Defi Insurance market overview

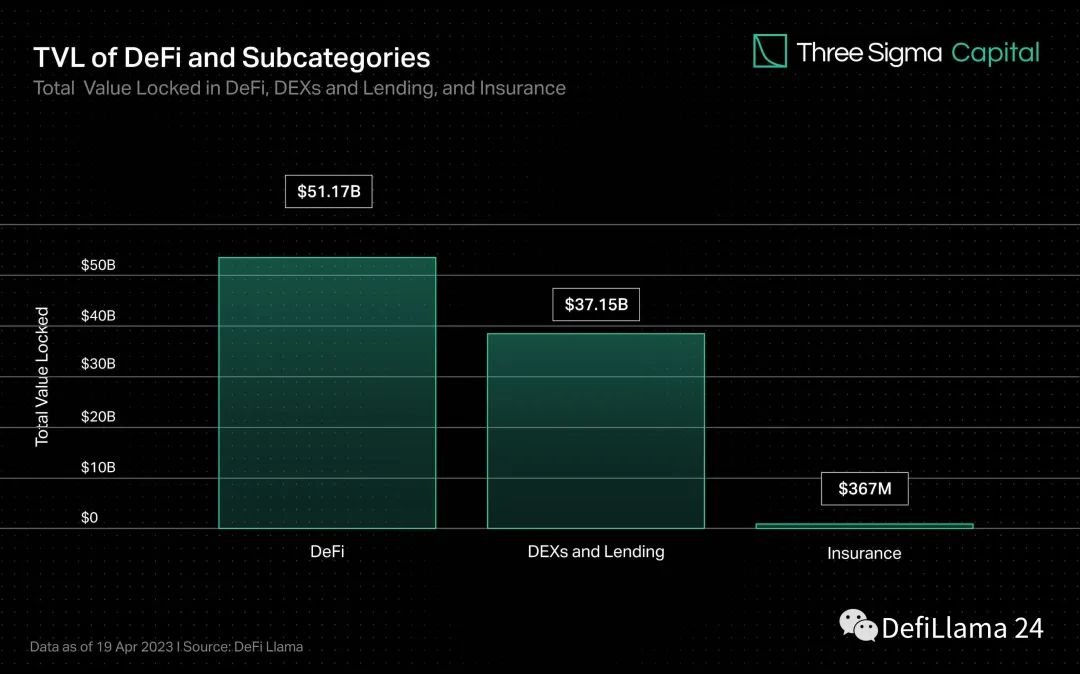

While DEXs and lending account for most of the value locked in DeFi, insurance accounts for less than 1% of the total value. However, as TVL grows, so does the possibility of smart contract vulnerabilities or other attack vectors. Insurance solutions are similar to safety nets in the traditional financial markets, and a thriving solution will encourage investors, individual users, and institutions to confidently enter the online market.

Industry pioneer Nexus Mutual has dominated the insurance market since its launch, accounting for over 78% of TVL but only 0.15% of DeFi’s total TVL. The rest of the insurance market is fragmented, with the three policies behind Nexus accounting for about 14% of TVL.

While the global traditional insurance market is vast and expected to grow significantly over the next few years, the DeFi insurance industry has become a small but promising offshoot of the blockchain industry. As the DeFi insurance industry matures and upgrades, we can expect more innovation, with new protocols emerging and existing protocols improving their products to meet the needs of DeFi users.

What is Defi Insurance?

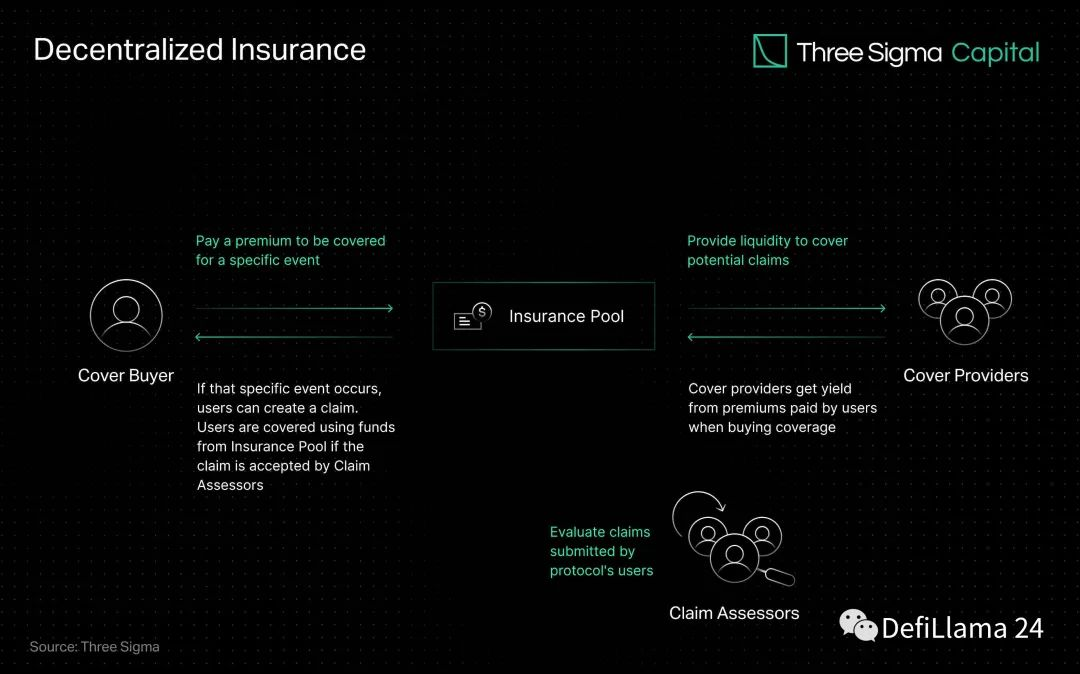

In DeFi terminology, these “Defi insurance providers” are liquidity providers (LPs) or, more appropriately, Insurance Liquidity Providers. These LPs can be any company or individual locking their capital into a decentralized risk pool with other similar providers.

DeFi insurance serves to protect you from unexpected losses like hacks, halted withdrawals, and stablecoin crashes. These insurance products are highly customizable, and your coverage (and premium) will depend on exactly what events you choose to get covered.

In true DeFi fashion, insurance pools are crowd-funded. The basic premise is that people put together insurance money for different events, and this amount of coverage is reserved for those who purchase insurance against that event.

If a covered event occurs, such as an exchange hack, the funds you pledge to pay for that event will be sent to the affected parties. If the event doesn’t happen, your money stays in the pool, earning a return over time.

The most prominent part of any discussion of DeFi coverage explained in detail will focus on its workings. Insurance works through the pooling of risks. People seek insurance to cover the risk of financial penalties due to potential events in their lives. Now, insurance companies work by pooling risk by requiring each user to pay a premium. Every customer’s premium is significantly lower than what is payable on claims.

How DeFi Insurance Works

Instead of receiving insurance from a centralized institution, DeFi insurance allows individuals and businesses to hedge their capital against risk through decentralized liquidity pools. In return, the insurance provider earns a return on locked-in capital generated from a percentage of the premium paid, creating a link between the compensation and the risk of the deal.

Overlay providers invest their funds in the protocol’s riskier and more rewarding pools. This means that individuals trade event outcomes based on their estimate of the probability of the potential risk occurring. Suppose a protocol underwritten by an insurance company experiences an adverse event, such as a hack. In that case, the funds in the fund that cover the protocol will compensate users who have purchased insurance against the possibility of that specific.

Pooling resources and spreading risk among multiple players is an effective strategy for dealing with unusual or extreme events with significant financial impact. A pool of mutual funds can offset many times the risk with less money, providing a collective mechanism for solving large-scale problems.

The popularity of parametric insurance in DeFi is due to its automated and transparent mechanism. A smart contract with preset parameters and real-time data from oracles can enable automatic claim settlement based on these parameters. This automation speeds up the claims process, increases efficiency, and reduces the possibility of bias or human error.

The ability for anyone to participate, and the transparency of on-chain operations, is often highlighted as the main advantage of a decentralized insurance system. As DeFi grows, the need for solutions that protect users’ funds becomes increasingly essential.

Pros and Cons

Pros

Cons

- It’s complicated: DeFi is a notoriously difficult area for beginners. There are so many smart contracts, exchanges, and covered events that even choosing the correct insurance option can get complicated.

- Issuer benefits: Insurers (and protocols, in this case) will only be in business if they make money. Like with casinos, whenever you buy insurance, you are betting on a risk model that says it will make money by providing you with an insurance policy. For some people, setting aside their money for a rainy day may be a better insurance strategy than buying insurance.

How do you buy DeFi insurance?

To purchase DeFi insurance, you must first find an insurance protocol that provides coverage for the event you want to be covered for — whether it’s a specific smart contract mining, a de stablecoin – peg, or anything else.

Looking at significant insurance providers like Nexus Mutual, Etherisc, InsurAce, and Bridge Mutual is a good starting point.

Is DeFi Insurance Worth It?

As DeFi continues to grow, it becomes more vulnerable to security attacks. To protect users from such risks, viable insurance protocols need to emerge. It’s not always clear whether DeFi coverage is worth it. If you are concerned about the safety of a particular smart contract, exchange, or stablecoin and are dealing with a lot of money, insurance can be a good investment.

On the other hand, if you are dealing with a small amount of cash or using large established platforms, DeFi insurance can be an unnecessary expense. Ultimately, the choice to use insurance depends on your personal risk tolerance.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.