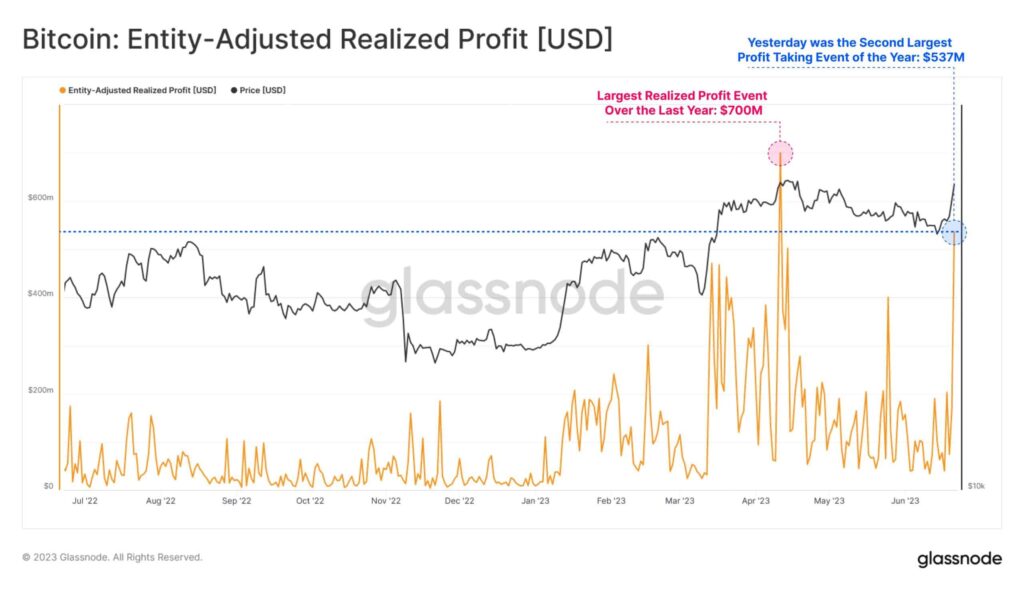

- Market participants locked in a non-trivial $537 million in profit following BTC price rise.

- BTC’s RSI was in an overbought position, which can cause trouble.

Bitcoin’s [BTC] price gained upward momentum last week, allowing it to once again cross the $30,000 mark. The uptrend gave investors hope for better days as BTC’s price had remained relatively dormant for weeks. Though the price action looked optimistic, things can also turn the other way round if history is to be believed.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Bitcoin finally reclaims the $30,000 spot

After several weeks of waiting, BTC finally managed to put smiles on investors’ faces by registering a promising uptick. According to CoinMarketCap, BTC’s price went up by more than 18% in the last seven days.

At the time of writing, it was trading at $30,150.42 with a market capitalization of over $587 billion.

A tweet from Glassnode pointed out that the recent Bitcoin breakout above the $30,000 price level has inspired an uptick in profit sent to exchanges, recording a profitable inflow of $62.8 million. However, BTC’s gains have halted, as evident from the marginal increment in its price over the last 24 hours.

This can cause trouble

Glassnode, in another tweet, pointed out a noteworthy development. As per the tweet, following the recent uptick in Bitcoin price action, market participants locked in a non-trivial $537 million in profit, the second largest profit taking event over the last year.

As is evident from the chart, the last time such an event happened, it was followed by a decline in BTC’s price.

A look at BTC’s daily chart did not provide a reason to be bearish on the coin. For instance, the Exponential Moving Average (EMA) Ribbon displayed a bullish crossover as the 20-day EMA flipped the 55-day EMA.

The MACD’s findings also complemented those of the EMA Ribbon, as it did reveal a clear bullish advantage in the market. Additionally, BTC’s Chaikin Money Flow (CMF) registered an uptick after a decline, which also looked bullish.

Source: TradingView

Is your portfolio green? Check the Bitcoin Profit Calculator

This is why caution is advised

Though the market indicators were bullish, Bitcoin’s on-chain metrics told a different story. As per CryptoQuant, BTC’s Relative Strength Index (RSI) was in an overbought position. This can increase selling pressure, resulting in a price correction in the coming days.

BTC’s net deposits on exchanges were high compared to the last seven days, suggesting that selling pressure has already increased. On top of that, BTC’s fear and greed index had a score of 65 at press time, which was also a bearish signal.