beginner

In the world of finance, cryptocurrency trading has emerged as a dynamic, lucrative sector. Despite the cryptocurrency space’s volatility, the potential for high returns has drawn investors from around the globe. However, just like any form of investment, trading cryptocurrencies comes with its own set of challenges.

In this article, I’ll talk about how to trade cryptocurrency and make profit. But first, let’s take a look at some of the most popular strategies for profiting from crypto assets like Bitcoin and Ethereum.

Investing in Blockchain Projects

Investment in blockchain projects is one of the easiest ways to profit from the growth of the cryptocurrency industry. Many successful blockchain networks offer their own tokens, which can appreciate in value as the network grows.

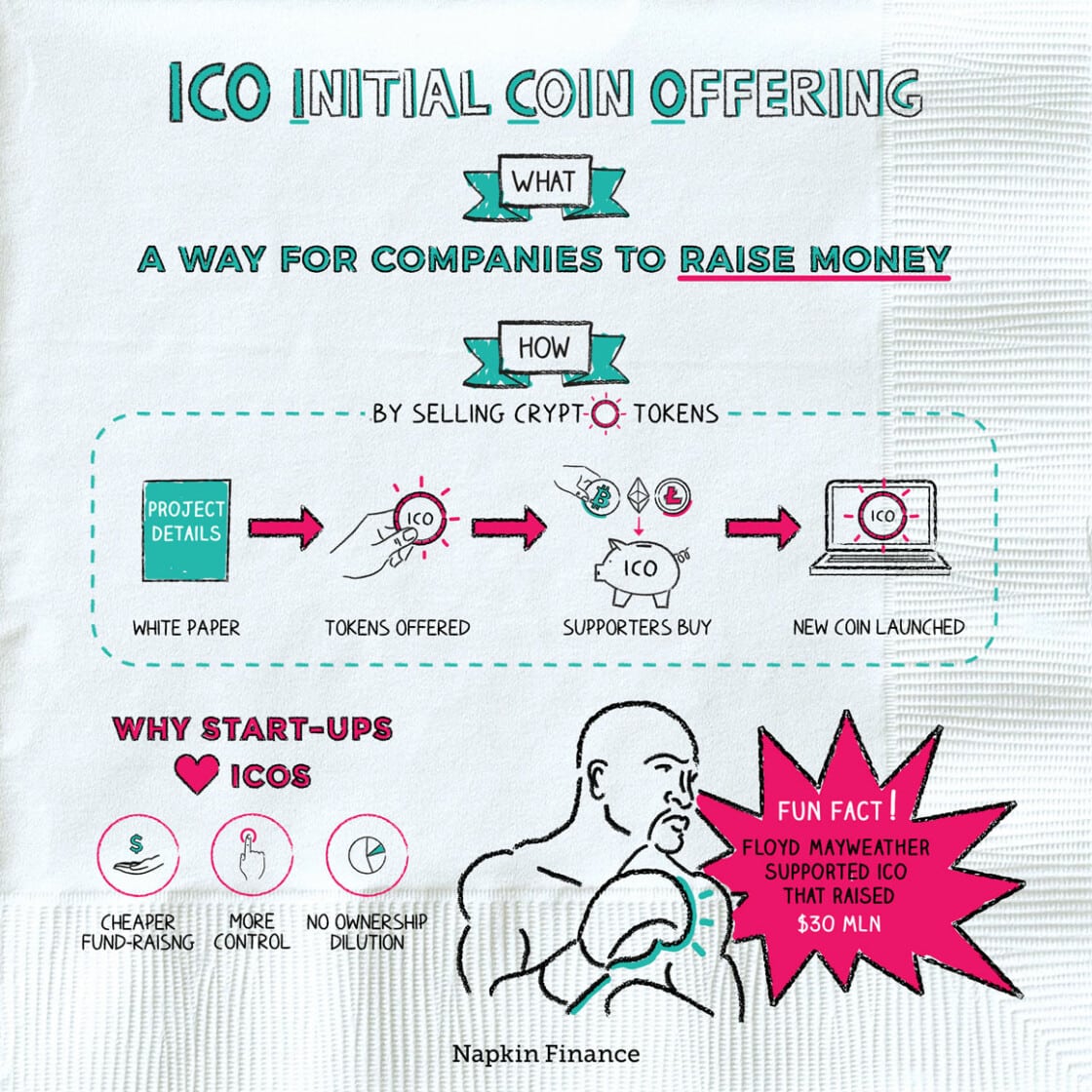

One approach to this strategy involves researching to identify promising projects, then buying their tokens through a crypto exchange or during an Initial Coin Offering (ICO). Fundamental analysis and understanding of the project’s vision, team, competitive landscape, and market potential are essential for this method.

While this approach can yield high returns, it also carries risks. Not all blockchain projects succeed, and some may even turn out to be scams. As such, it’s crucial to conduct thorough research and consider this method as a part of a diversified investment strategy.

Staking

Staking is a process where you hold crypto coins in a cryptocurrency wallet to support the operations of a blockchain network. This process can earn you additional coins as a reward for participating in the network. Staking has become popular with cryptocurrencies that use a proof-of-stake (PoS) consensus mechanism.

To make money through crypto staking, you need to choose a coin that uses PoS or one of its variants, buy some of these coins, and hold them in a supported wallet. Over time, you’ll receive more coins, accruing your digital assets.

However, staking also comes with its own set of risks. The price of the staked coin might fall, diminishing the value of your returns. Furthermore, some networks require your coins to be “locked up” for a certain period, reducing your ability to sell them if needed.

Yield Farming

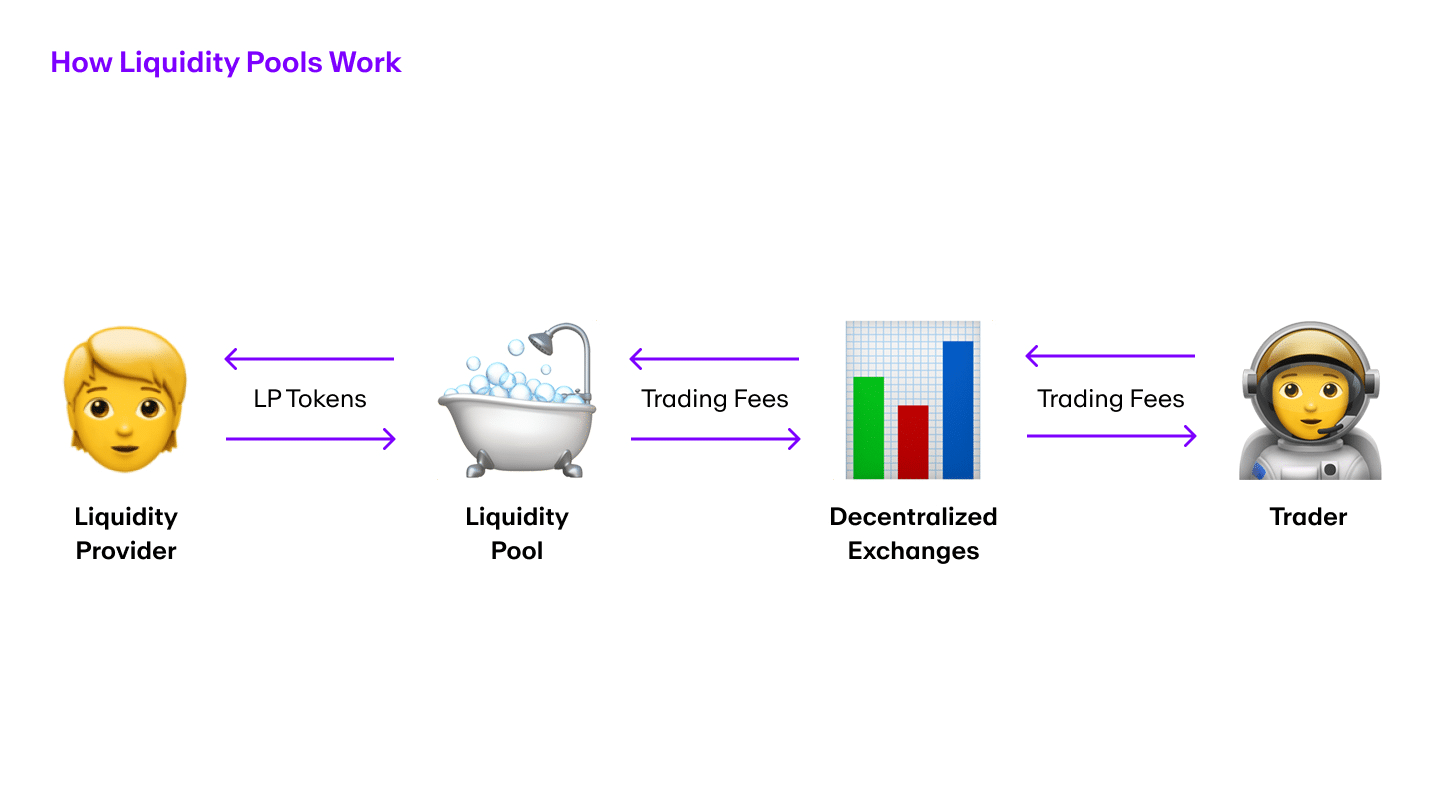

Yield farming, also known as liquidity mining, is a strategy employed in the decentralized finance (DeFi) sector. It allows cryptocurrency holders to generate returns by lending their assets. Essentially, users “farm” their crypto tokens by lending them out via smart contracts on DeFi platforms in return for yield in the form of more cryptocurrency. This is achieved by the users providing liquidity to a liquidity pool — they deposit tokens into a pool, which can then be borrowed by other users on the basis of a smart contract.

Yield farming differs from staking in that while staking involves participating in a network by holding and locking up a particular cryptocurrency in a wallet to support blockchain operations such as block validation, yield farming is more about maximizing return on capital by leveraging different DeFi protocols.

The benefits of yield farming include potentially high returns and the opportunity to earn additional tokens. However, there is a share of risks intrinsic to this method. These include smart contract bugs, impermanent loss, and market volatility. As such, it’s crucial to understand the underlying technology and risks involved before diving into yield farming.

Generate Passive Income with Cryptocurrency Lending

Lending is becoming increasingly popular as a method to earn money from cryptocurrencies and generate passive income. This approach involves lending your digital assets through a crypto exchange or a lending platform to earn interest. Some platforms offer returns as high as 8–12% per year, significantly bigger than traditional savings accounts.

Nonetheless, as lucrative as crypto lending can be, it carries inherent risks. The primary one is the risk of the platform defaulting or being hacked, which can lead to the loss of your digital assets. Hence, if you decide to lend your cryptocurrencies, make sure you use a reputable platform and consider diversifying your lending to limit potential losses.

The “Buy and Hold” Strategy

A simple yet effective strategy for making money with cryptocurrencies is the buy-and-hold strategy, often referred to as “HODLing” in the crypto community. This approach involves buying popular cryptocurrencies like Bitcoin, Ethereum, or other promising digital assets and holding onto them for an extended period, irrespective of short-term market fluctuations.

via GIPHY

Don’t break into your crypto vault too early.

Investors who bought Bitcoin or Ethereum early and held onto their assets have seen significant returns on their investments due to the meteoric rise of these cryptocurrencies. That said, while this strategy can yield substantial profits, it’s not without risk. The crypto market is known for its volatility, and a crypto coin’s price can decrease as dramatically as it can increase. Therefore, the buy-and-hold strategy requires patience, belief in the value of your chosen digital asset, and the nerve to withstand potential downturns.

Mining

Mining is another potential way to make money in the cryptocurrency world. This process involves validating transactions and adding them to the blockchain. Traditionally, mining required high-powered computer systems and a lot of electricity, making it inaccessible to many people. However, there are more accessible alternatives to traditional mining, like cloud or pool mining.

Bitcoin is the most well-known cryptocurrency that can be mined, but other notable digital assets include Litecoin, Dogecoin, and many more. However, the profitability of mining depends on several factors, including the cost of electricity, the price of the mined cryptocurrency, and the network’s mining difficulty.

Please note that mining often involves upfront investment in hardware and running costs for electricity and cooling systems. While cloud and pool mining can help you to offset these costs, they usually have lower profitability. Also, with many cryptocurrencies transitioning to more energy-efficient consensus mechanisms, the future of traditional mining is uncertain.

Trading Cryptocurrencies

Trading cryptocurrencies is one of the most common ways to make money in the cryptocurrency market. This approach involves buying and selling crypto coins via cryptocurrency exchanges, much like trading financial markets.

Successful trading often relies on fundamental or technical analysis to predict price movements. This involves studying the overall health of the market, news events, and the project’s fundamentals. Besides, one can use chart patterns and indicators.

Trading offers the potential for substantial profits, especially given the crypto market’s volatility. However, it also carries significant risks. Prices can fluctuate rapidly, and without careful management, it’s possible to suffer severe losses. Moreover, just like with any other investment, it’s crucial to secure your cryptocurrency wallet to protect your digital assets from potential security breaches.

In my opinion, this is the best way to make money with cryptocurrency. It’s not the best for beginners — it has a high skill ceiling — but it can be incredibly engaging and fun… as long as you can manage risk and know your basics.

The Basics of Crypto Trading

Before embarking on your journey to making money with cryptocurrency, you must understand the basics of crypto trading, including choosing a crypto trading platform, getting a crypto wallet, and learning more about crypto in general.

Choosing a Crypto Exchange

Your first step is choosing a cryptocurrency exchange. The best crypto trading platform for you will depend on your needs, but factors to consider include security, trading volume, and the diversity of cryptocurrencies offered. Make sure the platform supports the digital currency you’re interested in.

Getting a Crypto Wallet

A crypto wallet is crucial for storing your digital assets securely. Crypto wallets can be hardware- or software-based, and each is packed with its own benefits and drawbacks. Hardware wallets are typically safer but can be more challenging to use, while software wallets are more user-friendly but less secure.

Learning Blockchain and Crypto Basics

Before you start trading, you need to understand blockchain technology and how cryptocurrency prices fluctuate. Start with the basics, such as what a blockchain is, how transactions work, and the meaning of terms like “block,” “mining,” and “proof of work.” Then, delve deeper into trading-related concepts, like reading candlestick charts, order books, and trading volumes.

How to Maximize Your Profit When Trading Crypto

Once you’ve got the basics down, the next step is to develop an investing strategy that can help you maximize your profits.

- Educate Yourself: Keep abreast of the latest trends in the cryptocurrency market. Understand how the largest cryptocurrency works and familiarize yourself with emerging ones. Staying informed will allow you to make better investment decisions.

- Diversify Your Portfolio: Just like with traditional investments, a diversified portfolio can help minimize risk. Investing all your money in one coin is risky. Instead, consider spreading your investment across several cryptocurrencies.

- Use a Safe Investment Strategy: While aggressive strategies can yield significant returns, they can also lead to substantial losses. A safer, long-term strategy might involve investing a fixed amount regularly, regardless of the market conditions.

- Consider the Use Cases: Consider the potential applications of the crypto assets you’re investing in. Cryptocurrencies that serve as a payment method or have other use cases are more likely to succeed.

- Keep Emotions in Check: Emotional decisions can lead to rash actions, such as selling at a loss out of fear or investing more than you can afford in a hype. Stick to your investing strategy and avoid making decisions based on emotions.

Conclusion

While trading cryptocurrencies can be profitable, it’s also fraught with risks. It’s worth remembering that the crypto space is known for its high volatility, which means prices can fluctuate dramatically in short periods.

Before diving into the cryptocurrency trading world, make sure you understand the basics and have a clear investment strategy. Stay informed about changes in the cryptocurrency market, learn how to analyze market charts, diversify your crypto investments, and always make decisions based on analysis, not emotions. Remember, while the potential rewards are extremely lucrative, digital currencies are not guaranteed or entirely safe investments. Your success in the world of crypto trading will largely depend on your understanding of the market, your chosen crypto trading strategies, and your ability to manage risks.

FAQ

Can you make money by investing in cryptocurrency?

Yes, you can make money by investing in cryptocurrency. There are several ways to do it: for example,

— you can try buying a cryptocurrency like Bitcoin when its market value is low and selling it when the price rises. It’s a similar concept to stock market investing, but instead of buying and selling shares, you’re buying and selling digital assets recorded as blockchain transactions.

Other ways to actively and passively earn crypto funds include staking, mining, play-to-earn games, and more.

How can I make money with Bitcoin?

Making money with Bitcoin specifically can be done in a few ways. One of them is through long-term investing, where you buy Bitcoin and hold it for several months or even years, hoping for an increase in its market value. Day trading is another strategy that involves buying and selling Bitcoin within the span of a day based on short-term price fluctuations. Other methods include Bitcoin mining, which requires greater technical understanding and additional resources.

It’s important to note that while some people have managed to make millions of dollars from Bitcoin, it’s not a guaranteed result. Cryptocurrencies are complex financial instruments, and their prices are affected by numerous factors.

How long does it take to start making money on Bitcoin?

Starting to make money on Bitcoin could take anywhere from a few days to several years, depending on your investing strategy. Short-term traders might see profits or losses within hours or days, while long-term investors might need to wait years to see substantial profits.

How can beginners make money with cryptocurrency?

There are several ways for beginners to make money from cryptocurrency. Start by learning about different cryptocurrencies and find out how the market works. Understand the basics of blockchain transactions, learn how to analyze market charts, and stay updated on the news in the crypto space. Consider starting with a small investment that you can afford to lose.

As you gain experience and confidence, you can explore more sophisticated strategies, such as day trading or participating in Initial Coin Offerings (ICOs).

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.