DeFi

MakerDAO and Aave saw notable gains, while Curve and Uniswap declined in terms of TVL in March. This article will discover how these and other DeFi protocols behaved in March.

The DeFi landscape is currently exhibiting a combination of favorable and unfavorable trends in the Total Value Locked (TVL) of its leading five protocols. Notably, Lido, MakerDAO, and Aave have observed significant increments in their TVLs over the course of the month, whereas Curve and Uniswap have suffered considerable declines.

The uncertainties began with the collapse of three high-profile banks in the United States and the more recent regulatory effort against Binance.

You might also like: Circle partners with Cross River as other banks collapsed

DeFi TVL on March 30 | Source: DeFi Llama

The TVL of the DeFi ecosystem was $49.64 billion at the start of March. It decreased to a low of $42.97 billion on March 12, but rebounded to $50.33 billion 12 days later. Currently, the value stands at $49.94 billion at the time of writing.

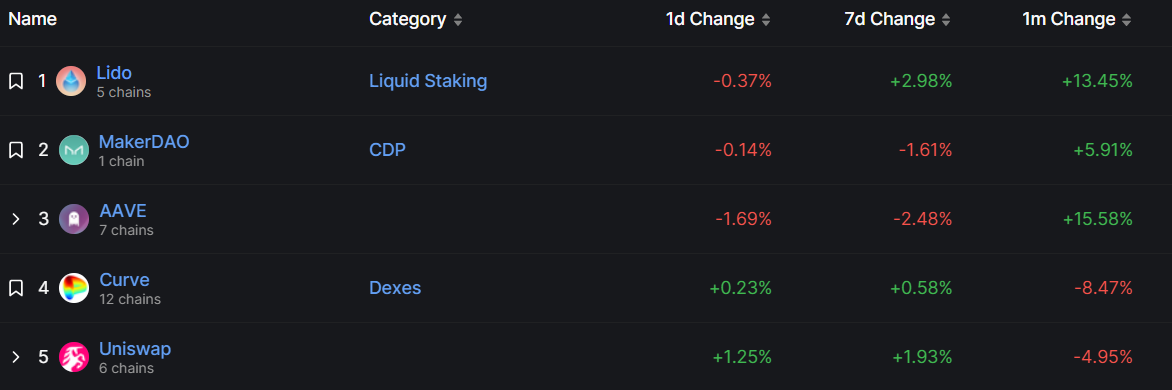

Lido’s value increased by 13.45% in March, resulting in a current TVL of $10.8 billion. Lido is currently the biggest DeFi protocol, constituting 21.6% of the entire DeFi ecosystem’s TVL. Moreover, Lido has observed a 2.98% increase in TVL in the past week.

Top 5 DeFi protocols on March 30 | Source: DeFi Llama

While MakerDAO’s TVL has decreased by 1.61% in the past week, the protocol has witnessed a 5.91% surge in value this month. Consequently, the protocol’s total value locked is $7.63 billion at the time of writing.

Aave, the Ethereum-based lending platform, has observed the most substantial increase this month among the top five DeFi protocols. Since the beginning of March, Aave’s TVL has risen by 15.58%, reaching the $5.5 billion mark.

Curve and Uniswap, the last two protocols on the top five list, have experienced a decline in their TVLs over the past month. Curve’s TVL has dropped by 8.47%, whereas Uniswap has faced a 4.95% decline. Furthermore, Curve’s value currently stands at $4.68 billion, with Uniswap’s dipping to $3.95 billion.

Read more: Binance may have hidden its presence in China for years