Demand for yield is growing as central bank interest rates remain at stubbornly high levels. In the United States, the Federal Reserve has left interest rates at a 23-year high of between 5.25% and 5.50%.

While rates in most countries have started falling, they remain at an elevated level compared to where we were in the pandemic. All this means that investors can allocate cash to risk-free assets like government bonds to generate a return.

Financial services companies have also created active funds that focus on yields. We have written about covered call ETFs like the JPMorgan Premium Equity (JEPI), and JPMorgan Nasdaq Equity Premium Income Fund that provide substantial returns.

Cryptocurrencies are also generating some of the biggest yields in the industry. Solana has a staking yield of 7% while Celestia, Cosmos Hub, and Injective yield over 10%. For an asset yielding 10%, it means that a $10,000 investment will yield $1000 annually.

Ondo Finance yields

Ondo Finance is one of the top players that is changing the crypto yield industry. It is one of the biggest companies in the Real World Tokenization (RWA) sector.

The developers launched two funds: US Dollar Yield (USDY) and US Treasuries (OUSG), which have accumulated over $500 million in assets.

USDY and OUSG are better alternatives than popular altcoins like Tether, USD Coin, and Dai. Unlike these stablecoins, USDY and OUSG pay you for holding them. USDY, which is available for individuals and institutions, invests in bank deposits and short-term US Treasuries and then distributes these returns to investors.

USDY’s best use case is in cash management, yielding collateral, and as an alternative to Tether. USDY has a 5.7% yield, which is slightly higher than the 10-year bond yield of 5.35%.

On the other hand, the OUSG is a tokenized asset that gives users access to short-term US Treasuries. Most of these funds are invested in the Blackrock USD Institutional Digital Liquidity Fund (BUIDL), a fund that has grown to $500 million in the past few months.

OUSG is a more complicated fund than USDY since it has a minimum mint limit of $100k and a minimum redemption of $50,000. It is also a more expensive fund that will start charging up to 0.35% in January next year. Also, OUSG is only available to qualified investors.

Therefore, the USDY is a better yield asset to invest in. However, it is unclear whether this performance will continue when the Fed starts to cut interest rates. When this happens, most assets that it invests in will start to generate lower yields.

Ethena provides a risky-yield approach

Ondo Finance’s assets are less risky because they are backed by real assets. Ethena, on the other hand, provides a riskier approach to generate yields.

Ethena runs the USDe stablecoin, which has grown into a $3.3 billion juggernaut and the 4th-biggest stablecoin in the world. USDe, its synthetic dollar, has a 7.4% yield, one of the biggest in the crypto industry. It has over 250k holders.

The platform uses relatively complicated approaches to generate this yield. It generates its yield in two ways: staked asset consensus and funding and basis spread.

A staked asset is a situation where the developers invest in liquid staked Ethereum tokens and generate a return. Ether has a yield of over 3.7%.

The funding and basis spread happens when the developers enter complex derivatives trades to generate yield. In this case, when people mint USDe stablecoin, the company opens a corresponding short position to hedge the delta of the received assets. Historically, this spread has generated positive returns.

USDe often has a higher yield than Ondo Finance’s USDY token. However, I believe that it is a riskier asset to invest in because it has a similarity to Terra USD, a stablecoin that collapsed in 2022.

Also, there are signs that regulators will pass laws against stablecoins like USDe. In the United States, a Senate bill has sought to ban stablecoins not backed with fiat currencies. The same is happening in Europe.

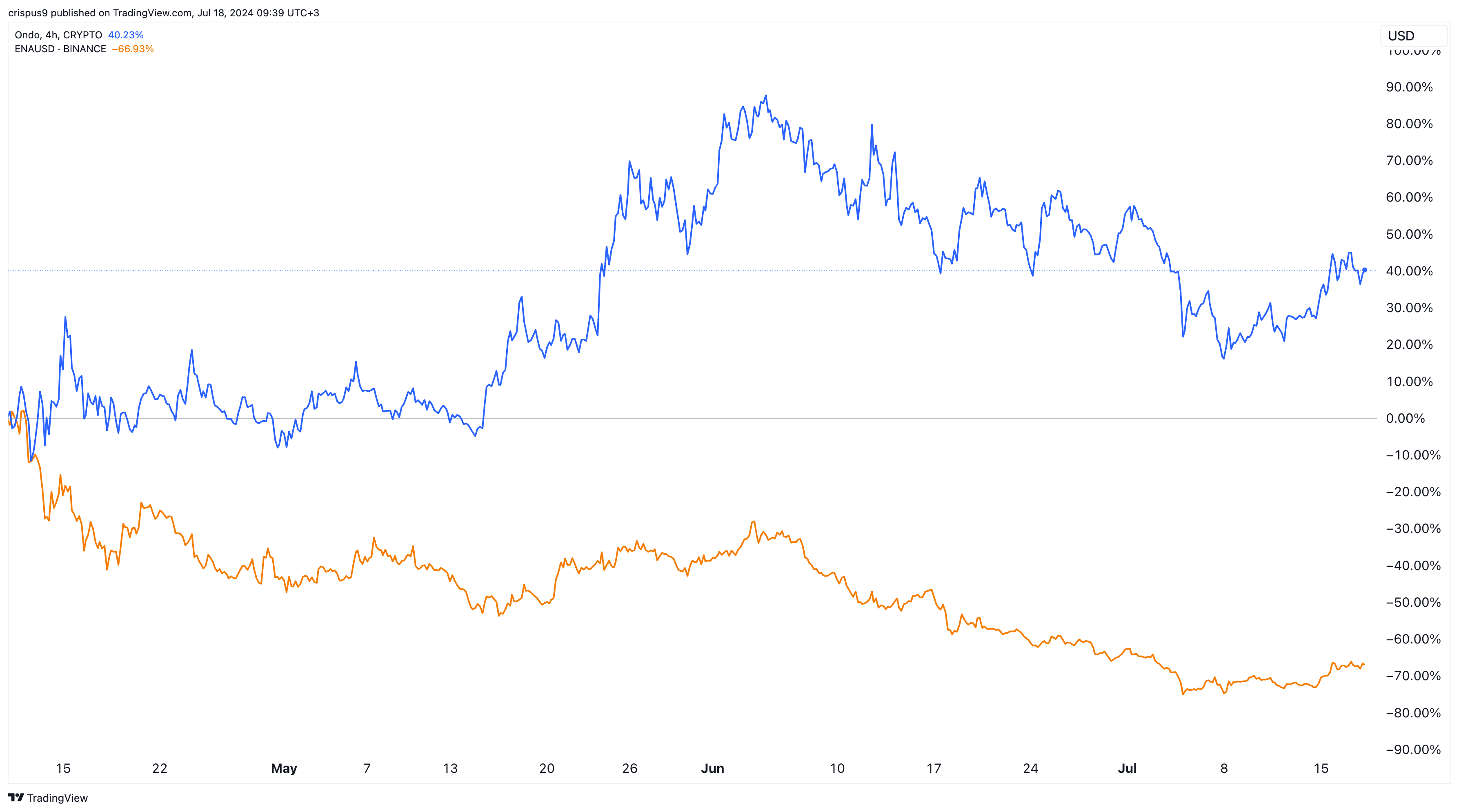

ONDO and ENA tokens have diverged

$ONDO vs $ENA tokens

These risks explain why the ONDO and Ethena (ENA) tokens have diverged in the past few months. Ondo Finance token has risen by over 40% since April this year. Ethena’s ENA token has crashed by over 70% as investors remain concerned about its future.

Therefore, if you are interested in just generating yields, I believe that investing purely in government bonds or related ETFs is a better alternative than investing in USDY and USDe.

However, if your goal is to substitute your stablecoins like Tether and USD Coin, I believe that USDY is a better asset to invest in because of its stability. USDe, on the other hand, is relatively risky and could lose its peg, especially in periods of high volatility.

The post How Ethena, Ondo Finance are changing the crypto yield industry appeared first on Invezz