- The STX price remained in the bullish region since the Bitcoin Ordinals hype.

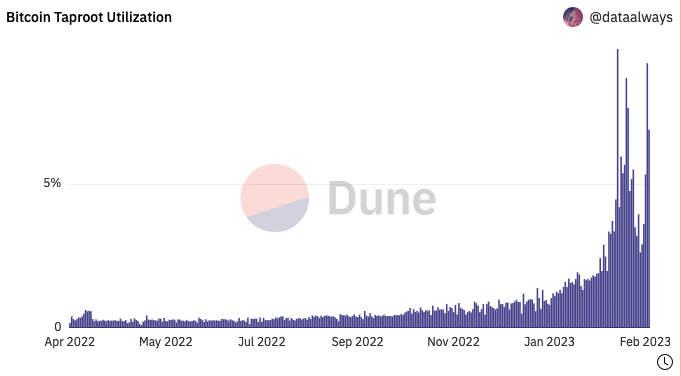

- The Bitcoin taproot utilization increased as Stacks develops hyperchain.

The value of Stacks [STX], a token related to the Bitcoin [BTC] ordinals NFT, surged 27.40%, according to data from CoinMarketCap.

This was in contrast to the sentiment displayed by the broader crypto market, which was largely red.

For context, Stack adds more functionality to Bitcoin by bringing smart contracts and decentralized Applications (dApps) to the original Bitcoin blockchain. Since this was the case, it was totally unavoidable not to connect the Bitcoin Ordinals’ rise to the STX gains.

How many are 1,10,100 STXs worth today?

Taking the ordinals ride since…

Information from the price tracking platform showed that the STX uptick did not begin recently. At press time, the token had been increasing monumentally since January, piling up over 200%.

Ordinals, during its massive adoption and hype in January, made it possible for NFTs to be stored, bought, and sold on the Bitcoin blockchain. So, how have the Inscription Ordinals performed over the last few days?

According to Dune Analytics, there has been increased storage of the NFT collection. On 26 February, the cumulative storage was 3.48 GigaBytes (GB)— this was the highest the collection hit in over seven days. However, there was a notable decline in the same activity the next day.

But on the Bitcoin taproot share, Dune revealed that Ordinals hit as high as 9.25%. While the taproot makes transactions on the network lighter and faster, it also opens doors for eliminating intermediaries via smart contracts.

Source: Dune Analytics

So, the hike means that more transactions adopted smart contracts on the Bitcoin blockchain. In addition, the STX market capitalization has been able to beat the $1 billion mark while maintaining the stance. But can the STX token sustain the month-long performance?

STX: Outperform Bitcoin for how long?

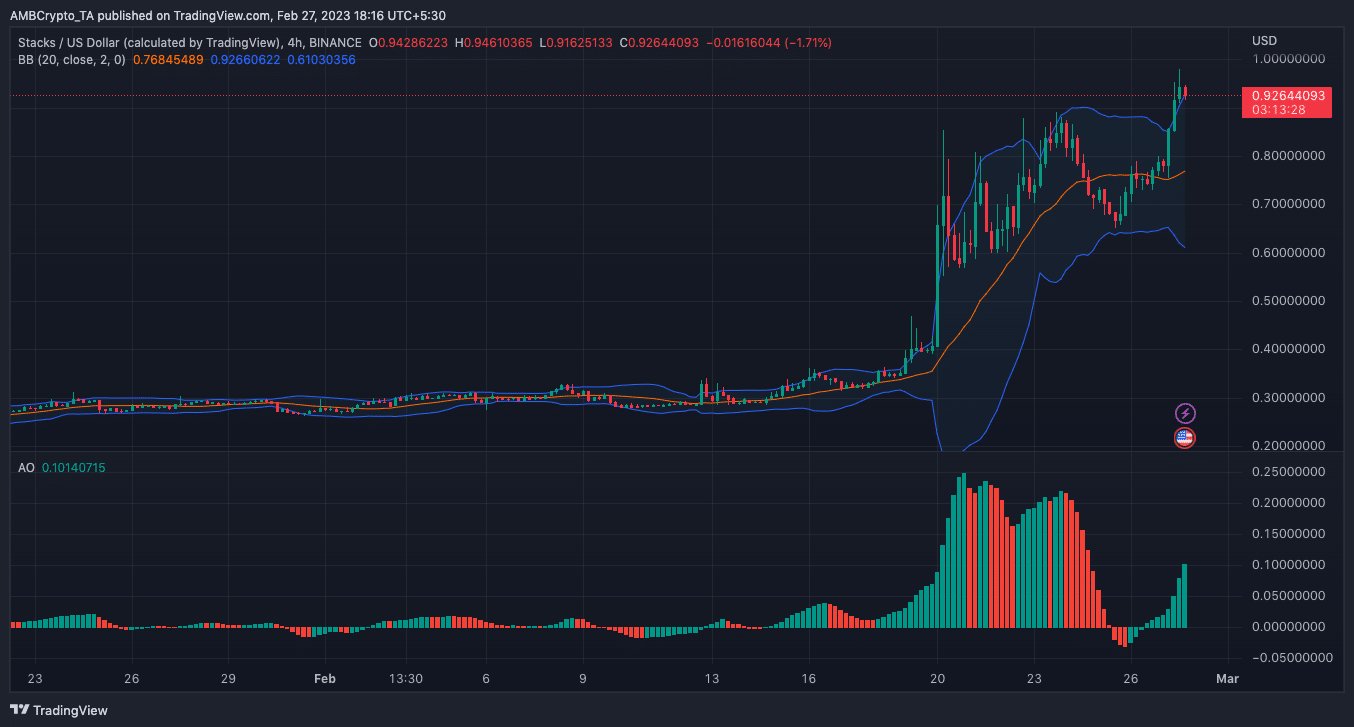

As per the Bollinger Bands (BB), the STX volatility was extreme. Moreso, the token price touched the upper band and also crossed it at press time. The position implied that STX was overbought and could be at risk of a reversal.

However, indications from the Awesome Oscillator (AO) signified that the token was solidly bullish still. Hence, there is a chance of maintaining the greens despite the volatility condition.

Source: TradingView

Realistic or not, here’s STX’s market cap in BTC’s terms

Interestingly, Stacks had been actively involved in developing hyperchain on the Bitcoin Layer-two (L2) network. Besides, Chris Burniske who formerly led crypto investment at ARKInvest seemed to have foreseen the Ordinals-STX shift. On 26 February, he said,

“Ordinals have catalyzed a cultural shift in Bitcoin that will work to STX’s benefit. For those that want more programmable uses of BTC, applications built on top of Stacks will provide what they seek.”

![How Bitcoin Ordinals boost drove up the Stacks [STX] price](https://cryptoinvestornewsnetwork.com/wp-content/uploads/2023/02/Screenshot-2023-02-27-at-13.29.47.png)