Charles Edwards, the founder of hedge fund Capriole Investments, offered an in-depth analysis of the Bitcoin market yesterday. His review offers a granular perspective on the aftermath of the historic ETF launches, the pivotal role of major players like Grayscale, and the interplay of market mechanics shaping Bitcoin’s trajectory.

Bitcoin Market Summary: ETF Launch

Edwards acknowledged the ETF launches as a pivotal moment, characterizing it as “ETF Mania.” He emphasized the hindsight realization that the ETF launch triggered a short-term “sell the news event.” Edwards elucidated, “A portion of this can be attributed to the Grayscale outflows of over $4B, approximately half of which was forced selling by the FTX bankruptcy estate and another couple billion likely to cover Grayscale’s debt obligations.”

However, he projects a shift in the outflow rate from Grayscale, stating, “I expect the current rate of outflow will drop to a more sustainable trickle over the next few weeks (after another few billion out).” Edwards also highlighted the end of Grayscale’s multi-year lock-up period, allowing long-term investors to finally close their GBTC positions at market prices.

Regarding Blackrock and Fidelity ETFs, Edwards noted their significance, saying, “The brand names of these two behemoths in the traditional asset management space means every billion they bring in, adds an order of magnitude more credibility (and therefore flows) into Bitcoin and crypto as a whole.”

BTC Technical Analysis

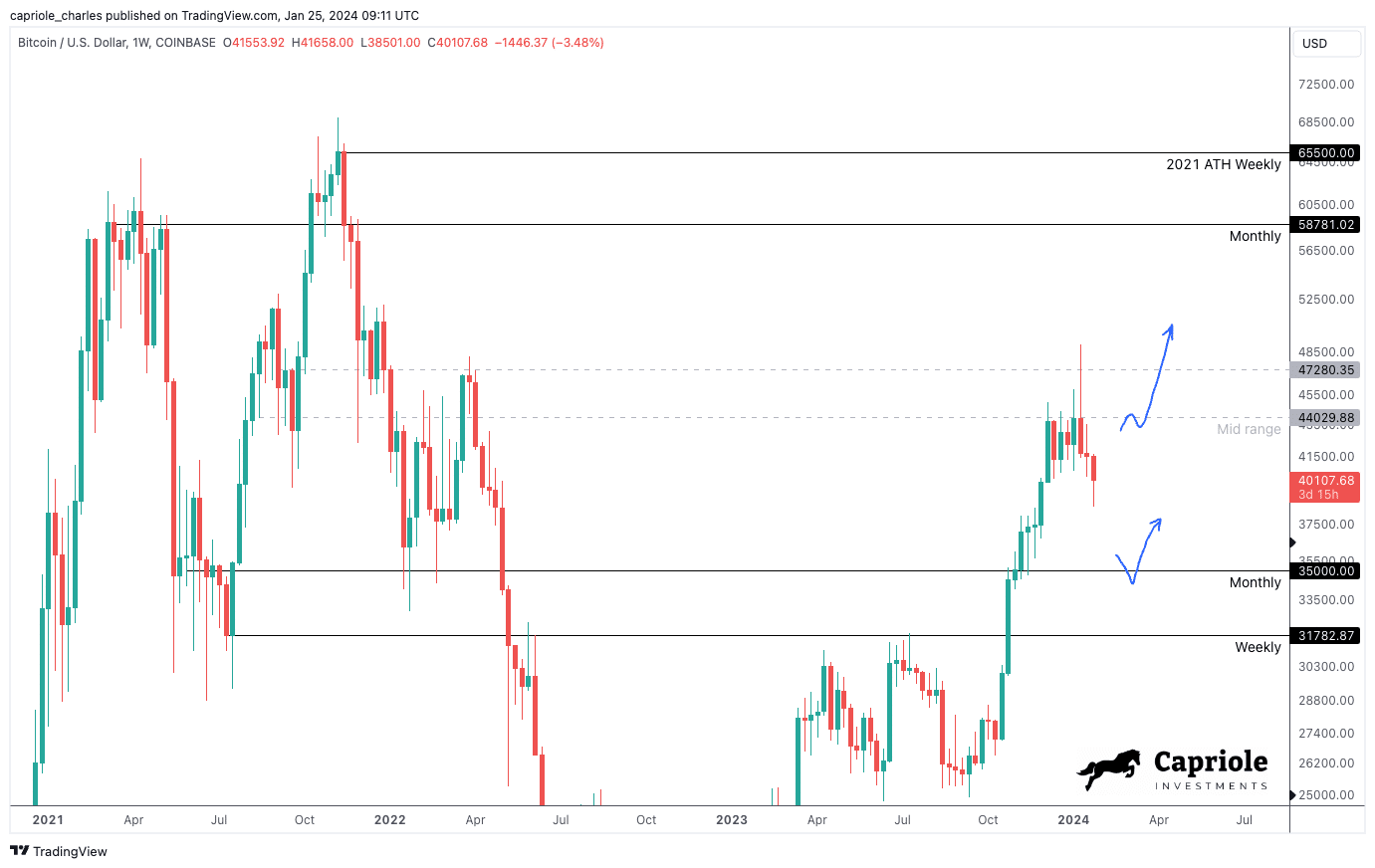

In his high timeframe technicals (HTF) analysis, Edwards observed a strong rejection at mid-range resistance during the ETF launch. He pointed out, “The nearest HTF support at $35K would likely represent a great opportunity to get long for the 2024 Halving year (if we are lucky enough to get there).” Edwards also mentioned, “Alternatively, a strong close above $44K will likely see the trend continue to range highs ($60K).”

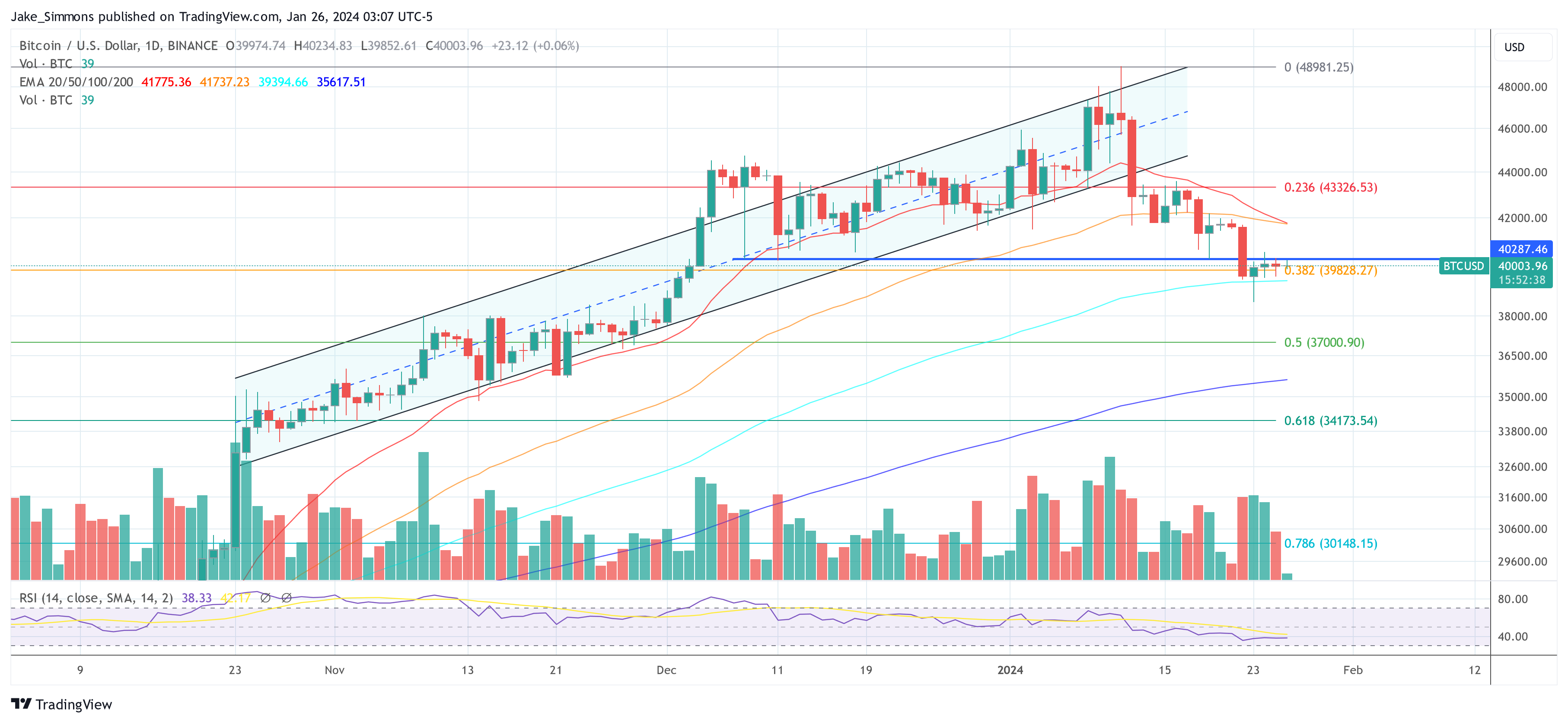

For low timeframe technicals (LTF), he dissected the December/January consolidation and the $44K “fakeout” during the ETF launch. Edwards explained, “Fakeouts often resolve in price movements to the other side of the range, as we saw.” He added:

Therefore, the most interesting price point locally is $41K. A daily close above $41K would likely represent a downtrend fakeout and a swift return to range high at $44K (+). If we simply wick into $41K and start trending back down, that would be a great risk-off trigger for a potential move lower toward $35K HTF support.

Fundamentals: The Role Of On-Chain Data

Edwards underscored the importance of fundamentals and on-chain data in understanding market dynamics. He introduced Capriole’s Bitcoin Macro Index, stating, “This Index includes over 50 of the most powerful Bitcoin on-chain, macro market and equities metrics combined into a single machine learning model. This is a pure fundamentals-only value investing approach to Bitcoin. Price isn’t an input.”

According to him, fundamentals have entered a period of slowdown which aligned with the near top at the ETF launch. “That fundamental slowdown continues today with price down -20% from the highs in January so far,” Edwards remarked.

Chart Of The Week

The hedge fund manager also introduced the Advance-Decline (AD) Line as a chart of the week. He explained, “The AD Line is calculated as the cumulative sum through time of each day’s count of advances less declines.” Edwards highlighted its relevance, stating, “Today we are seeing the first such breakout since 2016.”

He drew parallels between the AD Line’s breakout and Bitcoin’s historical performance, noting, “During these periods in 2013 and 2016, Bitcoin was also in a drawdown from all-time-highs (like today) and began two of its largest cyclical rallies in history.”

The Opportunity Of The Year

In conclusion, Edwards offered a nuanced outlook. He cautioned, “Bitcoin at $39-40K is not a screaming buy today.” However, he projected, “The opportunity of the year likely awaits in the $32-35K region, which if we are lucky enough to see, will probably be the last time we ever see it.”

Edwards concluded with a forward-looking perspective, stating, “Pending that, we await patiently for a momentum breakout of $41K (aggressive) and $44K (conservative) for resumption of the meat of the primary 2024 trend. Up.”

At press time, BTC traded at $40,003.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.