Digital asset management giant Grayscale’s institutional crypto products are soaring sky-high as spot markets continue a major bounce back.

Grayscale primarily provides institutional investors with trusts that aim to give exposure to digital assets in a compliant, simpler way than holding them directly.

The price of the trusts doesn’t directly track the price of the assets, creating discounts and premiums depending on demand.

Amid a return in institutional interest, Grayscale’s products have exploded, causing massive premiums between the price of the trusts and the spot market.

At time of writing, Coinglass data shows Grayscale’s Chainlink Trust (GLINK) is trading at $49, a 250% premium compared to the spot price of LINK.

The firm’s Solana Trust (GSOL) is priced at $202, an 869% premium on the price of SOL, while its Filecoin (FIL) product is trading at a 901% premium and its Decentraland (MANA) product is at a 308% premium.

The big premiums on Grayscale’s products come following several positive reports from Coinshares that suggest institutional demand for crypto assets is picking back up to levels that were last seen in the bull market of 2021.

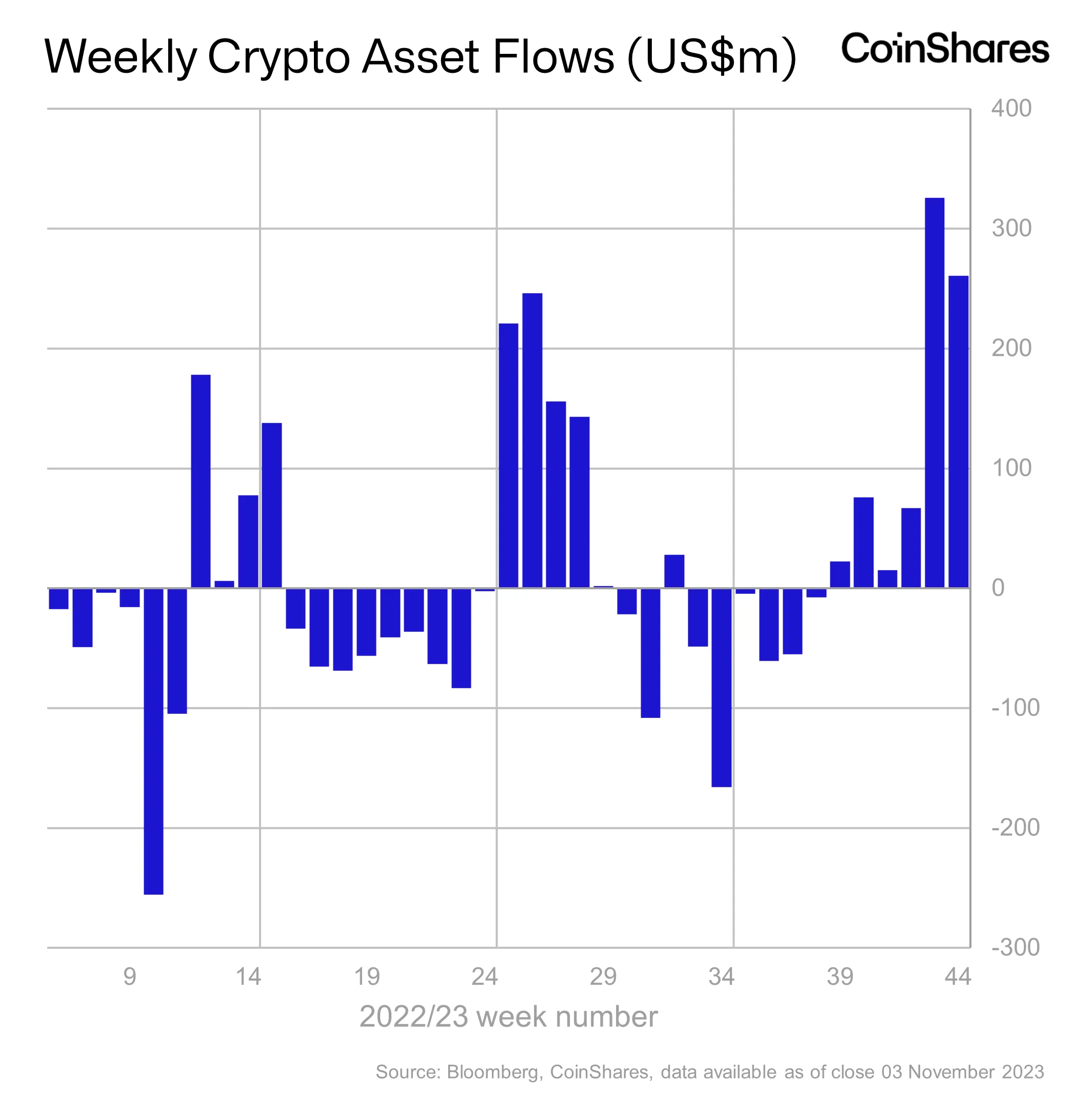

In its latest Digital Asset Fund Flows report, CoinShares found that institutional investors are continuing to allocate to crypto as the asset class enjoys its sixth consecutive week of institutional inflows.

“Digital asset investment products saw inflows totaling US $261 million, representing the sixth week of consecutive inflows that now totals US $767 million, surpassing the total inflows of US $736 million seen in 2022. This run of inflows now matches the July 2023 run of inflows and is the largest since the end of the bull market in December 2021.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/IM_VISUALS