- A portion of Bitcoins backing the existing fund would be used to seed the new ETF.

- The move comes amidst unrelenting outflows from GBTC since its conversion to ETF.

Digital asset manager Grayscale Investments plans to launch a miniature version of its flagship spot Bitcoin [BTC] exchange-traded fund (ETF).

This was revealed via a filing submitted with the U.S. Securities and Exchange Commission (SEC).

GBTC’s spin-off

The so-called Grayscale Bitcoin Mini Trust would operate under the ticker “BTC” upon regulatory approval.

It was expected to have a “materially lower” fee than the larger Grayscale Bitcoin Trust (GBTC), currently the world’s largest digital asset fund.

The mini fund would be a GBTC “spin-off”, meaning that a portion of Bitcoins backing the existing fund would be used to seed the new ETF.

Grayscale stated that the move would benefit existing GBTC shareholders by allowing them to enjoy a portion of the new fund at a lower blended fee.

The other major advantage was that GBTC holders could buy shares of the mini fund without having any tax liability.

GBTC bleeds with outflows

The motivation to launch a more affordable Bitcoin investment vehicle comes amidst massive outflows from GBTC, with the 1.5% fee cited as the primary factor.

The management fee charged by Grayscale was the highest among all ETF issuers. Most other players were charging between 0.2% and 0.4%.

Grayscale defended the high fees, citing its track record and status in the market.

However, the high fees appeared to be impacting the fund’s performance.

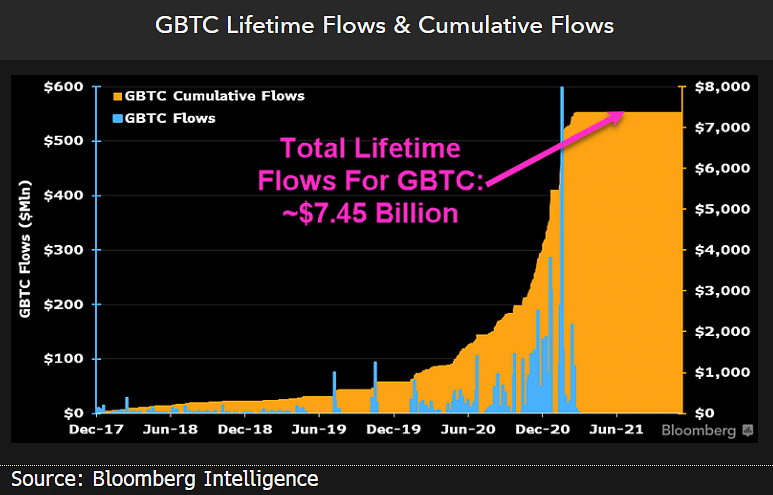

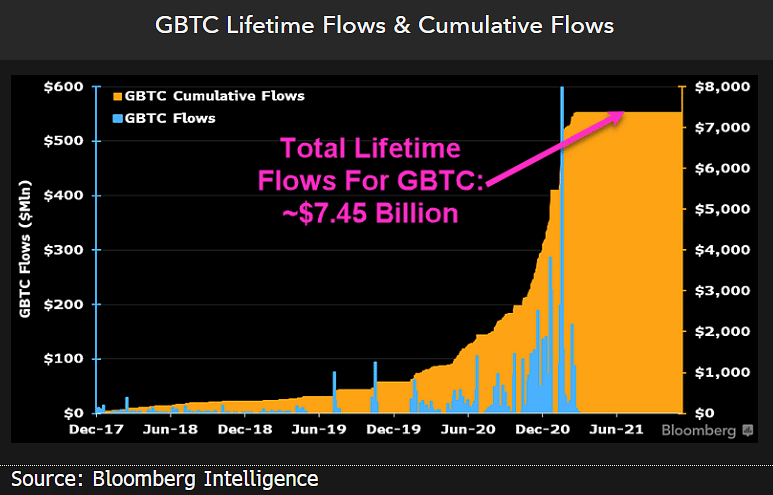

According to Bloomberg analyst James Seyffart, GBTC experienced $11 billion in outflows since transitioning to a spot ETF, as compared to $7.45 billion inflows before the conversion.

Moreover, as per ETF analyst Eric Balchunas, GBTC saw the 2nd-highest outflows of any ETF in the last 15 years.

Source: Bloomberg Intelligence

Read Bitcoin’s [BTC] Price Prediction 2024-25

Many of these redeemed Bitcoins were likely getting reallocated to cheaper spot ETFs. Blackrock’s IBIT, for example, has seen more than $11 billion in net inflows since listing.

As a result, its assets under management (AuM) have ballooned past $15 billion, as per AMBCrypto’s analysis of SoSo Value data.