- GMX took a step towards enhancing the user experience on its V2 amid a decrease in development activity.

- Besides offering security, the integration would help create a fee structure on the derivatives exchange.

Decentralized margin trading platform GMX has secured the integration of Chainlink [LINK] low-latency oracles after its community approved the proposal.

The integration, hailed as a positive development, for the project would help in support of swaps and liquidity on the GMX V2.

Realistic of GMX’s market cap in LINK’s terms

A look at the voting results showed that 96.28 of those involved in the process agreed to the project to confirm the motion. 3.72% were not in support.

According to the press release published by PR Newswire, the collaboration has the potential to improve the experience of GMX users in the DeFi economy.

Of the discourse to supply safety

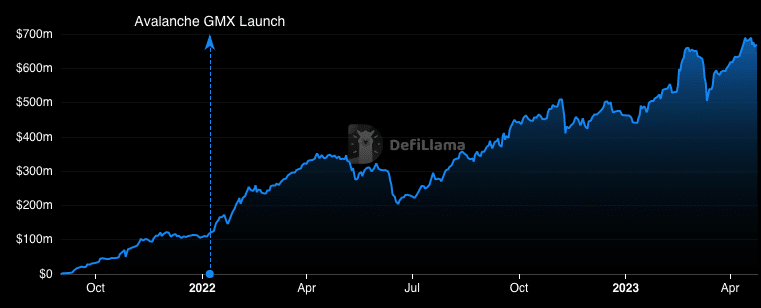

Recently, Chainlink released the new low-latency oracles to address the pain of DeFi applications, including derivatives exchange by providing data security. Following the disclosure, the Total Value Locked (TVL) continued its year-long increase.

The TVL measures the health of a protocol, as well as investors’ interest in smart contracts applications listed under the project. At $665.46 million, the hike implied that user confidence in GMX was high. Hence, the basis for the growth.

Source: DeFiLlama

However, the GMX ecosystem state was not an all-around cheer. According to Santiment, the project’s development activity took a sharp dip on 24 April. The development activity metric measures developers’ commitment to implementing upgrades within a project.

So, the decline means GMX was lagging in terms of public GitHub repositories. Another metric in a similar state as the development activity was the active addresses.

Extension is not adoption

Active addresses show the number of unique deposits and addresses that have participated in transactions within a network. At the time of writing, the seven-day active addresses were 11,000. This suggested that the speculation around the token did not have investors rushing in their droves.

Source: Santiment

Is your portfolio green? Check the GMX Profit Calculator

In addition, it remained uncertain how quickly the implications of the Chainlink integration will begin to reflect. But the GMX team confirmed that the partnership was for the long term.

GMX had gained the crypto community’s attention since it operated on the Arbitrum [ARB] network. However, besides Chainlink, it also expanded into Avalanche [AVAX]. Reacting to the development, a core contributor of GMX mentioned the community was elated about the endorsement.

Johann Eid, Chainlink Labs Vice President of integrations also commented, on the matter which could result in the establishment of a GMX V2 fee structure. Eid said,

“With this collaboration, we mark a new milestone for the space and its race towards mass adoption. The low-latency oracles will bring the industry one step closer to the performance level that currently exists outside of it”