The global market for NFTs has witnessed a downward trend in trading volumes, marking a consistent decline for the third week of January.

According to the latest figures from CryptoSlam.io, a prominent on-chain data aggregator, the trading sales volume in the NFT sector has fallen to $223 million over the last week. This represents a significant 22.5% drop compared to the previous week’s figures.

Contrastingly, the NFT market has observed an uptick in the number of active participants. Recent data shows that over 734,000 collectors engaged in NFT purchases across various platforms in the last week. This surge, amounting to a 34% increase, indicates a growing interest in non-fungible tokes despite the overall decrease in trading volume.

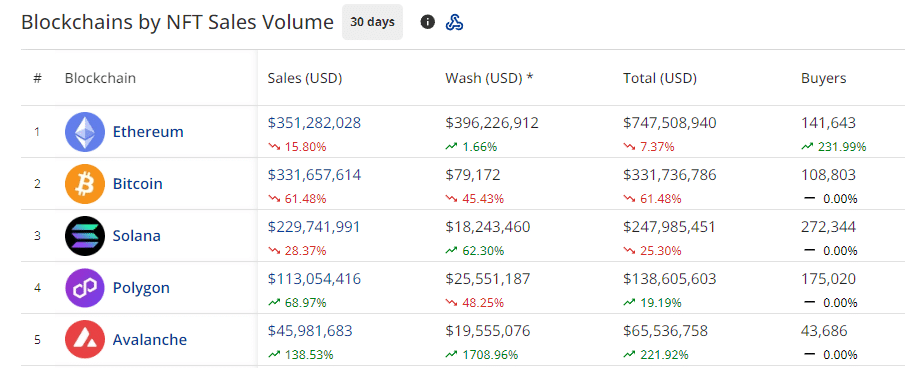

NFT montly sales volume across major blockchains | Source: CryptoSlam.io

You might also like: Google ends five-year ban on crypto ads as Bitcoin ETF becomes visible

However, wash trading has been notably high, speceially across Solana and Avalanche collections. Wash trading is a form of market manipulation where an investor simultaneously sells and buys the same NFT to create misleading, artificial activity in the marketplace. The notably high levels of wash trading on Solana and Avalanche suggest a significant portion of their NFT transactions may be artificial, potentially inflating the perceived market activity and skewing genuine economic indicators.

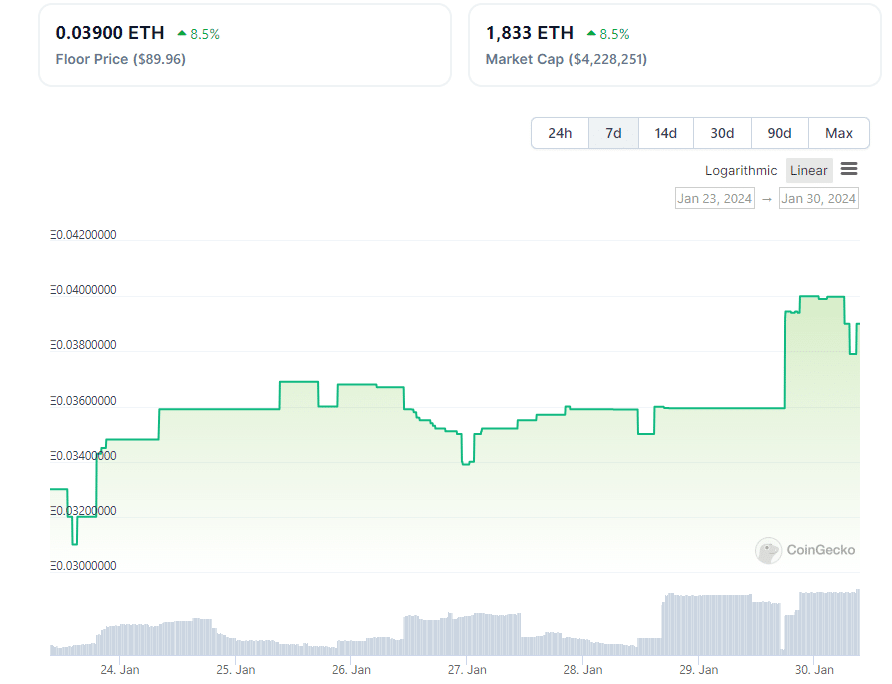

Bitcoin Ordinals collections took the hardest hit in January, as sales declined by nearly 35%. Ethereum and Solana-based NFTs also saw a significant decline. However, non-fungible tokens on Polygon experienced a massive 70% increase in sales this month. Polygon’s most popular collection, Trump Digital Trading Cards Series 2, saw a notable 25% increase in floor price. This is potentially due to the hype around the current election season in the U.S. and Trump’s campaign.

Weekly floor price movement of the TRUMP2 collection | Source: CoinGecko

On the other hand, popular Ethereum-based collections saw a notable decline in the past few weeks, with the floor price of CryptoPunks and BAYC both down nearly 8% in the past two weeks.

Although the market significantly recovered from its prolonged downtrend in Q4 2023, it’s again seemingly going through a bearish phase, perhaps an indication of user interest shifting to the less popular networks — like Polygon and Avalanche-based collections — which have both seen remarkable growth this month, it appears the NFT business may be shifting and diversifying, rather than strictly shrinking.

Read more: Bitcoin back at $43k, BlackRock’s BTC ETF volume closes in on GBTC