“Their books and records are incomplete and, in many cases, totally absent,” said current FTX CEO John J. Ray III, during a presentation of the company’s current assets and liabilities on Mar. 2.

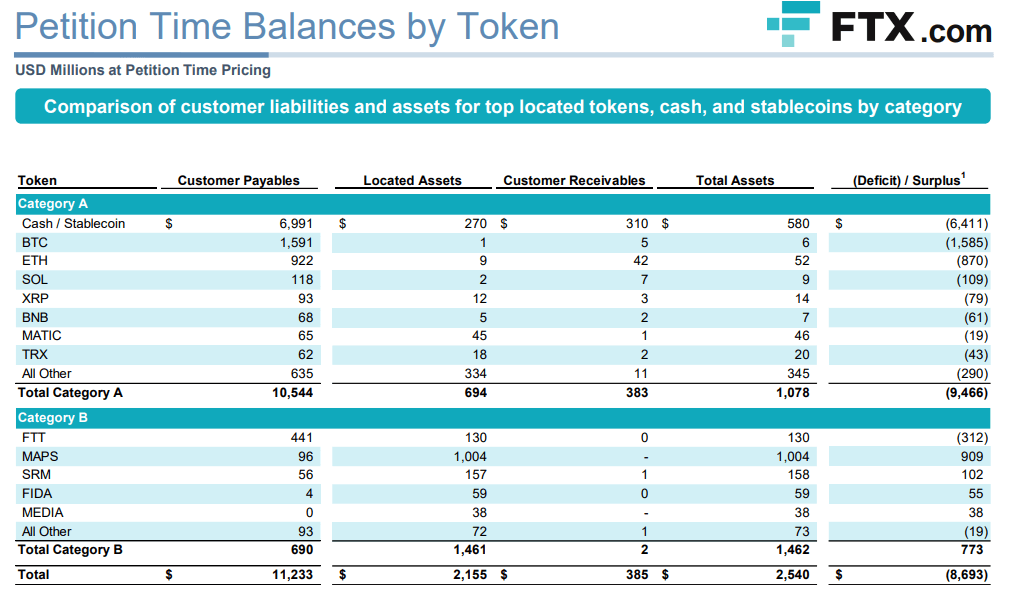

Remarkably, the latest presentation shows that the now-defunct exchange holds only 1 Bitcoin against the 1,591 it owes to customers. In total, it was revealed that the exchange owes $8.7 billion in total to customers, mainly spread across cash and stablecoin assets, but also Ethereum, Solana and hundreds of other tokens users were previously allowed to trade on FTX.com and FTX US.

In a presentation filed on Thursday by FTX Debtors in the company’s Chapter 11 bankruptcy cases, it was reported that a collaborative attempt to locate and catalog the remaining assets of the defunct cryptocurrency exchange FTX has uncovered the extent of the deficiencies found in the fiat bank accounts and digital asset wallets linked to the FTX.com and FTX.US exchanges.

$2.2 billion in assets secured – still no details on preferred creditors, bankruptcy proceeding expected to take years

The presentation states that $2.2 billion worth of assets have been identified, with only $694 million in highly liquid currencies like fiat, stablecoin, BTC, or ETH. Along with $385 million in customer receivables, these holdings are offset by Alameda Research’s net borrowings of $9.3 billion.

As per the filing, “Today, a total of $191 million in assets has been discovered in the accounts linked to the FTX.US exchange, in addition to $28 million in customer receivables and $155 million in related party receivables.” They further state that this is in contrast to the $335 million in customer claims and $283 million in related party claims payable.

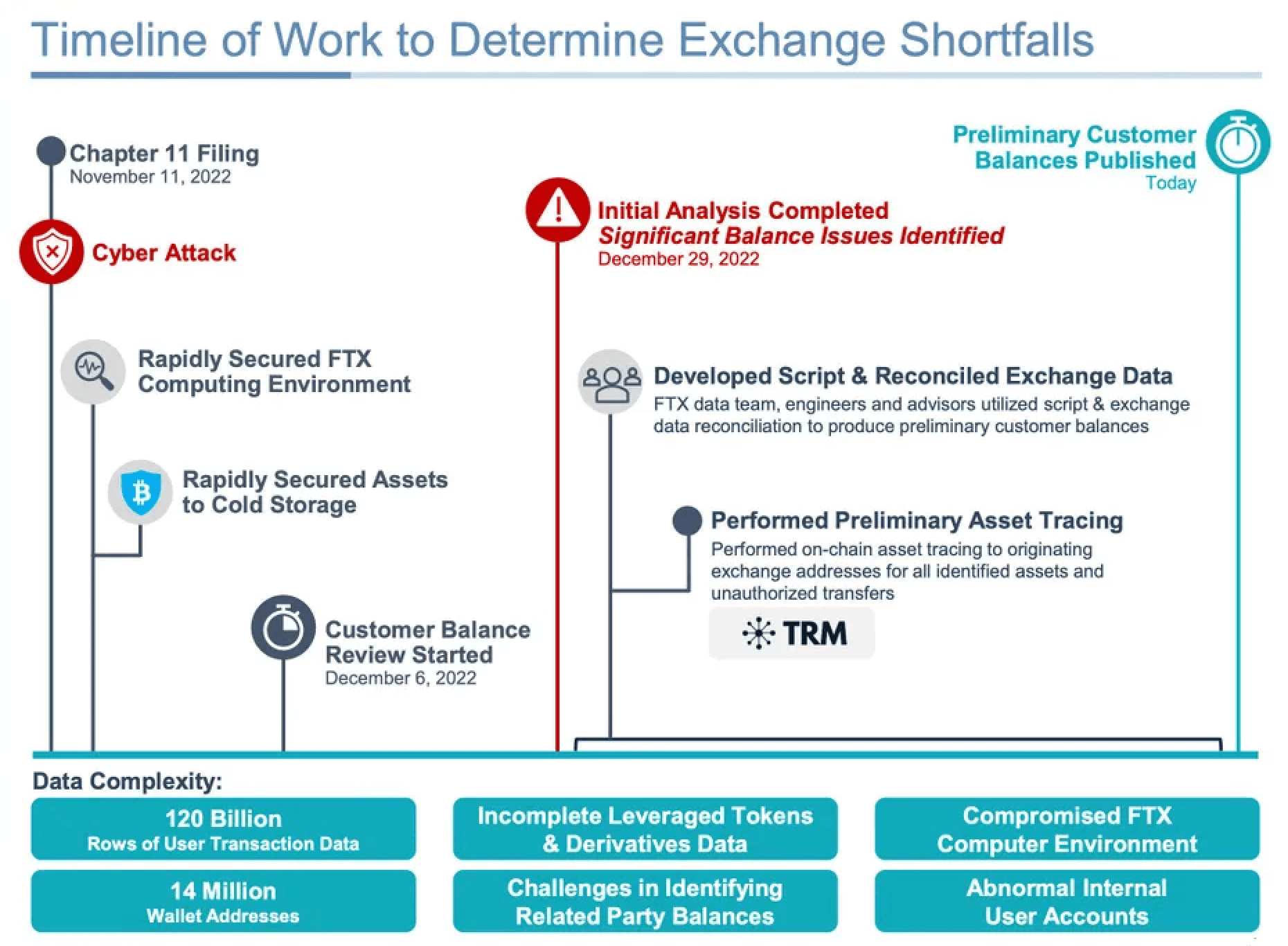

The presentation also revealed that “Unauthorized transfers have withdrawn an additional $293 million from wallets tentatively traced to the FTX.COM exchange and $139 million from wallets tentatively linked to the FTX.US exchange.”

FTX CEO promises to continue to disclose information publicly

Although the presentation highlights that the information presented is preliminary and should not be used for any purpose, Ray, who also holds the position of chief restructuring officer for the FTX debtors group, emphasized the importance of sharing the latest developments.

“It has taken a huge effort to get this far,” Ray added in a press release. “The exchanges’ assets were highly commingled, and their books and records are incomplete and, in many cases, totally absent.

According to Ray, “We believe that it is crucial to offer transparency to stakeholders by disclosing this information publicly at this time rather than waiting until we can confirm it with certainty.

The FTX debtors group’s presentation provided an update on the liquid assets held by the group, which has grown from $5.5 billion to $6.1 billion since its last report in January. The increase is mainly due to updated digital asset pricing, but the group has also recovered $202 million held at Alameda, $125 million in stablecoins, and $57 million in various cryptocurrencies held at subsidiaries.

Notably absent, however, were SBF’s Robinhood shares worth a reported $450 million, as well as FTX’s investment in Anthropic, worth a reported $530 million, as well as numerous properties SBF was alleged to have owned throughout the Bahamas.

DCA Live: Your

DCA Live: Your  Week-Ahead Alpha Drop

Week-Ahead Alpha Drop