- Bots drove most tweets associated with FTX-listed tokens

- PEPE and PSYOP also followed similar patterns of using bots to influence their price trends.

FTX, Pepe [PEPE], and Psyop are seemingly unrelated projects at first glance. However, upon closer examination, it becomes apparent that they all share a connection with Twitter and Twitter bots.

FTX listings and bots interplay

The collapse of FTX had a profound impact on the entire crypto ecosystem, particularly because it occurred shortly after another major crypto project, Terra [LUNA], collapsed.

Both FTX and Luna are embroiled in ongoing legal battles. However, recent findings suggest that FTX’s suspicious activities extend beyond its financial operations.

According to a report from NCRI, Twitter significantly boosted the value of cryptocurrencies listed on FTX. The report revealed that whenever FTX listed new coins, there were immediate price surges, largely driven by Twitter activity.

The analysis conducted by NCRI indicated that a considerable portion (around 20%) of online discussions about FTX-listed coins involved bot-like accounts. Interestingly, these bot-like activities predicted the prices of many FTX coins examined in the data sample.

Although the bot activities were not directly linked to FTX itself, they became more prevalent and inauthentic following the promotion of these coins by FTX. This indicated potential market manipulation through social media channels, which raises concerns about the authenticity and transparency of FTX’s operations.

How do PEPE and PSYOP fit into the discussion?

Elon Musk, Twitter bots, PEPE and PSYOP in one sentence

In 2023, the crypto industry experienced a surge in meme coins. Pepe and Psyop stood out for their rapid ascent to $1 billion in market capitalization. Concerns arose when NCRI conducted a time-series analysis of account creations related to Pepe.

The analysis detected abnormal surges in new accounts being created, particularly before the token’s launch.

These surges occurred in September 2022 and, more notably, on 16 April 2023, a day before the launch of PEPE. This pattern suggested possible manipulative tactics, such as using bots to inflate the apparent popularity of these tokens artificially.

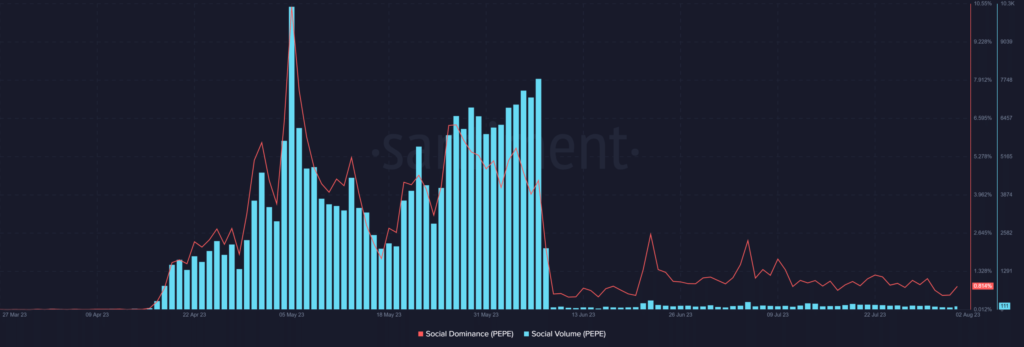

Santiment’s social metrics further highlighted suspicious activity. The social volume and dominance for Pepe saw significant spikes after 17 April. The social volume reached over 10,200 on 5 May, and dominance spiked above 10%.

Additionally, Elon Musk’s tweet on 13 May correlated with another spike in volume and dominance. Whether this was coincidental or not remains uncertain.

As of this writing, the dominance of Pepe had dropped to less than 1%. Also, the social volume had decreased to around 100.

Source: Santiment

As for Psyop, it was launched shortly after Elon Musk tweeted about a “Psyop” in response to a shooting incident in the US. The timing raised eyebrows and fueled speculation about potential connections between Musk’s tweet and the token’s launch.

Elon and Doge

Elon Musk has been known to engage with the Doge community through his tweets, often teasing and sparking excitement among its investors. But not all investors were pleased with his actions, and a group of them filed a $258 billion lawsuit against him.

They accused Musk of driving up the price of Dogecoin by an astonishing 36,000% over two years before allowing it to crash. The lawsuit alleged that he leveraged his status as the World’s Richest Man to operate and manipulate what they referred to as the Dogecoin Pyramid Scheme.

One key point in their case was Musk’s appearance on Saturday Night Live in May 2021, during which he played a “fictitious financial expert” and called Dogecoin “a hustle.”

The prevalence of inauthentic activity in crypto is a growing concern and poses risks for investors. Manipulating such activities creates a Fear of Missing Out (FOMO) effect, which can significantly impact the price of tokens or coins.

This phenomenon has led to instances of pumps and dumps in the crypto market, causing the industry to come under closer scrutiny.

As the crypto space becomes more mainstream, evidenced by the filing of Bitcoin [BTC] and Ethereum [ETH] ETFs, future regulatory policies will likely consider such manipulative practices.

As the industry evolves, investors must exercise caution and stay informed about potential risks and fraudulent activities in the crypto market.

Examining the state of PEPE and PSYOP

The daily time frame charts analysis for PSYOP and PEPE revealed interesting patterns in their trading activities. PSYOP experienced a lack of interaction and poor volume after its launch, leading to a significant decline in its price, falling by over 99% from its initial launch price.

However, around 17 July, there was a notable uptrend, with the price rising by over 697%. Despite this surge, PSYOP’s price did not reach the range it had witnessed at launch, indicating that it was still far from its previous levels.

Source: TradingView

On the other hand, PEPE showed more activities on its daily timeframe chart compared to PSYOP. However, like PSYOP, PEPE had also lost a considerable value of over 68% when its price range at launch was compared to press time levels.

This suggested that the Fear of Missing Out (FOMO) driven by bots had decreased, and normal trading activities had returned to a greater extent.

Source: TradingView