- ETH is winning on the staking side, but other metrics underline lower network activity.

- Demand slows down limiting ETH’s potential upside.

Investors keeping a close eye on Ethereum [ETH] may have noticed that investor interest was limited despite the hype surrounding the Shanghai upgrade. Meanwhile, at press time, some network developments underpinned substantial activity in its preparation.

Is your portfolio green? Check out the Ethereum Profit Calculator

According to 9 April’s Glassnode data, the amount of liquidity locked in ETH 2.0 deposit contracts has not only been rising but is at a new ATH. Such an observation would normally be associated with more confidence in the market, and also in line with a major development.

📈 #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 17,330,295 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/d5o6D7bFpX

— glassnode alerts (@glassnodealerts) April 9, 2023

The timing of the growth in ETH 2.0 deposit contracts suggests that it might be heavily influenced by the countdown to the Shanghai upgrade. One potential reason for this is that ETH holders are locking their ETH on staking facilities so that they can earn passive rewards. Is this is in anticipation of increasing trading activities near, during, and after the upgrade? Not really, according to these metrics.

Ethereum network activity slows down

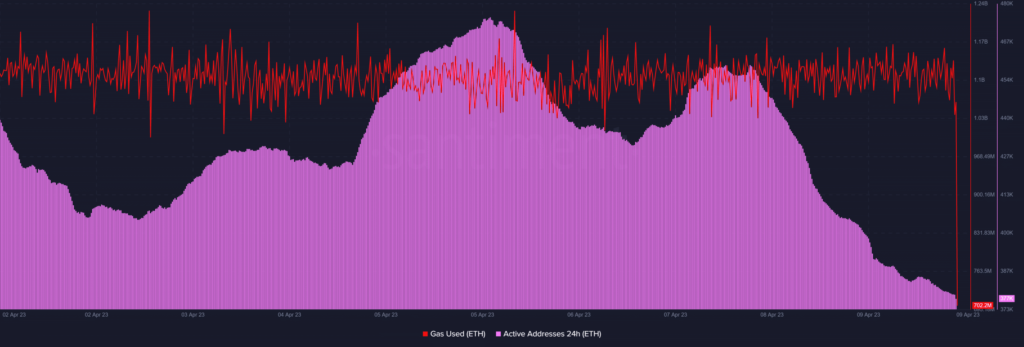

ETH’s daily active addresses have been declining, and at press time, were down to their lowest in the last seven days. This translates to lower transactions and thus, lower gas fees. It is therefore no surprise that ETH gas fees have also been at their lowest level in the last four weeks.

Source: TradingView

Lower gas fees, despite growing ETH 2.0 deposit contracts, may indicate a lack of organic growth underpinned by lower transactions. This meant that at press time, there was low demand for ETH. Higher gas fees are usually observed in times of strong network growth and usage, as network participants were willing to pay a premium under such conditions.

Active deposits have also slowed down in the last few days, in line with the above observations. Therefore, Ethereum experienced negative network growth, especially in the last seven days. Its network growth metric fell to the lowest weekly level in the last 24 hours at press time.

Source: TradingView

How much are 1,10,100 ETHs worth today?

ETH enthusiasm thwarted

The declining network activity, despite a surge in ETH 2.0 deposits, reflected ETH’s price action. It closed last week on a net gain thanks to a strong bullish performance in the first half of the week. However, a mid-week pivot followed by a 5.6% correction to its $1838 press time ensured that most of retail buyers during the week got trapped.

Source: TradingView

Despite the mid-week retracement, there was some excitement that fueled the rally at the start of the week. This was enough for a new YTD high as the price drew closer to the highly coveted $2000 price level. However, the second half ultimately revealed the state of low demand.