- This market analysis explains why Bitcoin might have a hard time securing liquidity.

- Whales and institutions demonstrated outflows as the market showed a bleak outlook.

It was observed that Bitcoin [BTC] and altcoins were on a slippery slope for the last few days. A consequence of wavering investor sentiment. But will things improve or is there more pain to come?

Is your portfolio green? Check out the Bitcoin Profit Calculator

Let’s shift gears a bit and assess the market from a different angle that has to do with Bitcoin’s correlation with traditional finance. There is no doubt that the U.S. is one of the largest markets for crypto and it contributes substantially to the liquidity for Bitcoin and altcoins.

This is a double-edged sword because it also underscores some risks if the U.S. is to face a liquidity crunch.

A 25 April assessment suggested that a Bitcoin liquidity crunch might just be in the cards if the U.S. defaults on its debt obligations.

The analysis by Twitter user under the pseudonym Tedtalksmacro looks into various factors behind the liquidity that fueled the YTD gains. He noted that the U.S. treasury started drawing down on cash reserves due as its debt ceiling narrowed.

2/ The recent surge in global liquidity has been owed to:

– US debt ceiling situation –> Treasury drawing down on their cash reserves,

– Banking crisis –> Fed balance sheet expansion to backstop failing banks,

– China restarting their economy post-COVID –> stimulate with $$ pic.twitter.com/7NVjHeC8v6— tedtalksmacro (@tedtalksmacro) April 25, 2023

The recent banking crisis also forced the U.S. Federal Reserve to pause quantitative tightening (QT), in favor of liquidity injections. While this outcome stimulated the bulls, it will likely be a temporary move once the FED has limited cash reserves to tap into.

Will the liquidity taps run dry?

Tedtalksmacro’s assessment highlighted the risk of a liquidity crunch if U.S. runs out of cash reserves. When that happens, the U.S. will have to raise its debt ceiling. This is to raise funds through debt instruments such as treasury bills.

Doing so will lead to more quantitative tightening, which will in turn have a negative impact on higher-risk investments such as Bitcoin.

2/ The recent surge in global liquidity has been owed to:

– US debt ceiling situation –> Treasury drawing down on their cash reserves,

– Banking crisis –> Fed balance sheet expansion to backstop failing banks,

– China restarting their economy post-COVID –> stimulate with $$ pic.twitter.com/7NVjHeC8v6— tedtalksmacro (@tedtalksmacro) April 25, 2023

The above analysis may explain why the market is experiencing a slowdown in the level of liquidity coming into it. The analysis also noted that the FED may slow down the rate of QT, which may not necessarily lead to heavy outflows but a lot of sideways activity instead.

How many are 1,10,100 BTCs worth today

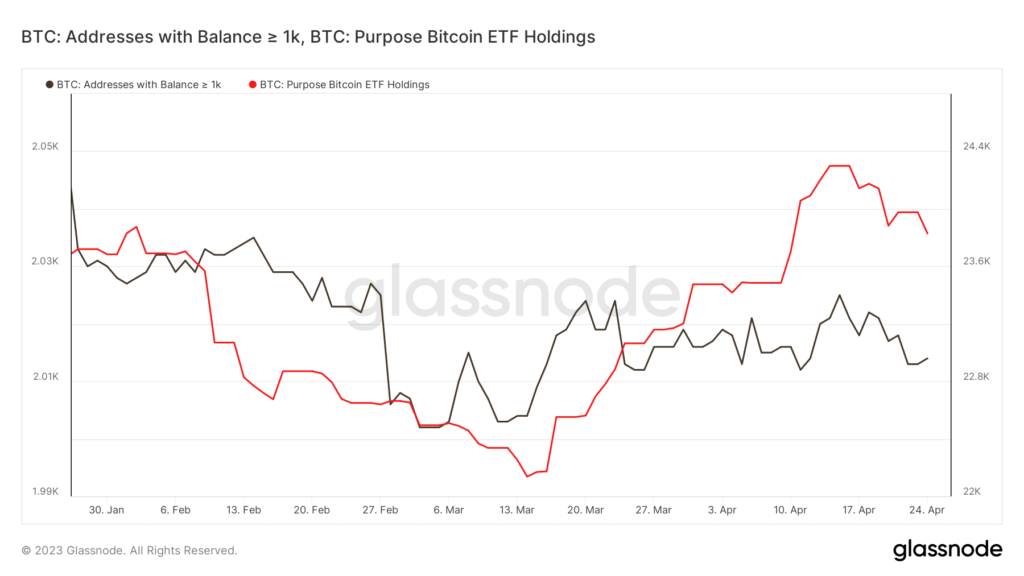

So, how are whales and institutions responding to this scenario? They contributed significant liquidity to BTC from the second week of March to mid-April. However, post-mid-April results indicated some liquidity outflows.

Source: Glasnode

This analysis underscores a strong reason for investors to keep tabs on FED activity as it may offer insights into the next market move.