How does Arbitrum work?

Offchain Labs’ Arbitrum One is a scalability 2 (L2) solution for Ethereum, introduced in 2021. This Layer 2 aims to reduce transaction fees and increase commodity processing that computes transactions per second, just like as Any Regulatory Scaling Solution. It moves computation and contract storage from the Ethereum main chain, allowing for significantly better parameters. Transactions on Arbitrum only need to pay a few cents to complete.

Arbitrum is a project that uses Optimistic Aggregation technology to enable Ethereum smart contracts to scale by processing transactions on a separate Aggregate layer before grouping them into a single block. for transmission to Layer 2 for certification. Validator nodes monitor the state of the chain, while full nodes support aggregation of layer 1 transactions.

Arbitrum adds a challenge phase to total blocks, allowing other validators to assess the accuracy of a block and issue a challenge if the block is incorrect.

The Arbitrum Virtual Machine (AVM) is the platform’s only virtual machine, and smart contracts written in Ethereum are instantly translated to work on top of the AVM.

Transaction speed upgrade

An advanced Optimistic Rollup

There are different scaling solutions: stateful, valid, segmented, and total channels. Rollups are extension systems that bundle some transactions from the main Ethereum network, process them off-chain, and integrate them back into the Ethereum state. There are different architectures for building rollup systems, and the two most prominent are the optimistic approach and the ZK method. The ZK method uses cryptographic proof to determine the validity of transactions without displaying detailed data about these transactions.

Arbitrum uses optimistic aggregation as a scaling solution, assuming that transactions are valid until proven to the contrary. It uses sequences to monitor the order transactions go into the primary inbox. Sequencer is a full node linking Arbitrum and the Ethereum network.

Optimistic Rollup helps to store very little data on-chain for optimal scalability. Arbitrum is built on the Ethereum network and allows up to 4,500 transactions per second (TPS). This exceeds Ethereum 2.0 (Consensus Layer) expectations of around 3,000 TPS. Meanwhile, Ethereum can only do about 10 TPS.

This layer 2 integrates with all Ethereum development tools, including the smart contract EVM (Ethereum Virtual Machine). Multiple integration options provide the standard Ethereum front-end engine for Arbitrum, making it easy for anyone to work with and very simple to build and deploy DApps.

Ethereum Virtual Machine (EVM) Compatibility

Arbitrum is the most EVM-compatible solution out of all the Layer 2 solutions, making it an easy choice for those who know about Arbitrum. It’s easy to use, easy to understand for developers, and powerful enough to scale on the Ethereum blockchain.

It is EVM compatible and uses Solidity code without compilers or version restrictions. There is also no gas limit, so smart contract developers can take their projects to the next level.

While Ethereum 2.0 proponents believe that rollups will be obsolete once the deployment is complete, Arbitrum rollups are linked to achieving unprecedented scalability. Some layer 2 blockchains plan to issue their coins, but Arbitrum pointed out that it is a transaction-focused institution.

Reduced transaction fees

ArbGas – the unit of account for Arbitrum

The problem with paying at layer 2 is that in an economically designed system, you’re paying for two things simultaneously: the L1 native and the L2 native. Arbitrum One is a Rollup, the L1 resources you are paying for are just Ethereum calling data; i.e. you pay the size in your transaction’s raw data multiplied by L2’s view of the L1 contact data price.

The L2 resources you need to pay for are your transaction’s computation in the Arbitrum general-purpose virtual machine. This value is the price of L2 gas multiplied by the amount of ArbGas – your transaction uses. The total L2 fee that a transaction needs to pay to succeed is the sum of these two components.

The Arbitrum network makes the token exchange almost incredibly cheap at 0.60 cents.

It relies on ArbGas to track execution costs for various transactions on this network. It is also important to note that all AVM instructions require an ArbGas overhead.

The cost of a particular transaction is the total amount of ArbGas fees for instructions in the transaction compared to Ethereum’s gas limit. Therefore, it is clear that you do not have any specific predetermined limit on the cost of ArbGas. Most importantly, ArbGas is cheaper than ETH gas fees for a particular transaction.

The ArbGas Fee helps compensate the chain validators and verifies all the instructions of the AVM. Therefore, the user should always ensure that the EthBridge never exceeds the layer one gas limit through estimates of the amount of layer one gas required for the EthBridge. In addition, the simulation time estimation is also essential for the coil string throughput, as it helps to find out the speed limit of the chain.

Besides, the problem of improved transaction speed to prevent network congestion is also an essential factor in helping reduce transaction fees significantly.

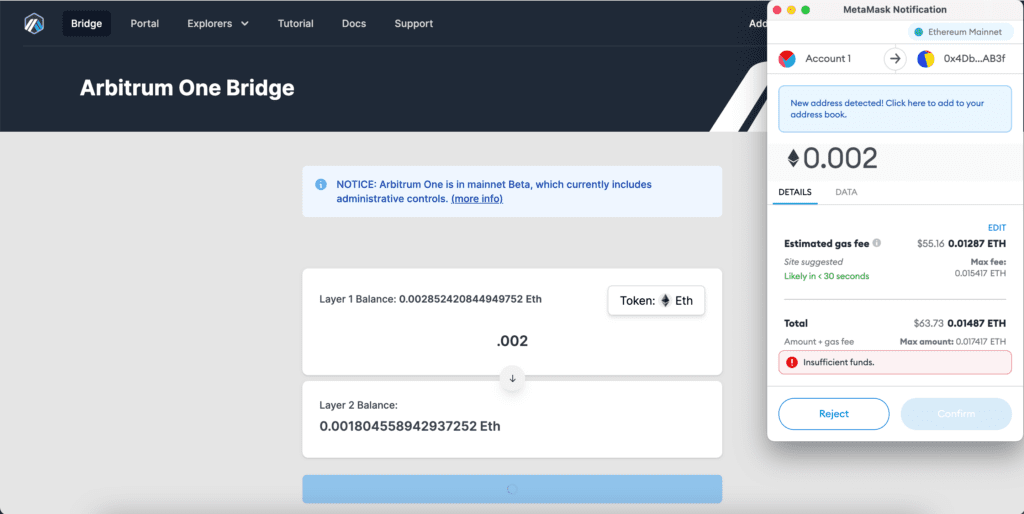

Arbitrum One Bridge

Arbitrum’s Layer 2 scaling solution is called Arbitrum One. On the other hand, a token bridge refers to a channel that transfers ETH and ERC-20 tokens to this bridge. Any user who wants to send a specific transaction using Arbitrum can send it to one of the contracts on the EthBridge Inbox.

Also, the Outbox contract will help accept data from this layer 2 as input. The Outbox contract then adds the data to the Ethereum blockchain for reverse interaction. Public verification of EthBridge inputs and outputs can help identify and verify off-chain activities.

Meanwhile, Arbitrum One has reduced fees by allowing smart contracts to be validated in batches while compensating validators for their efforts.

The AVM architecture ends with this network. With the Nitro upgrade, the new generation of Arbitrum One mainnets use WebAssembly.

As of the second half of 2022, the Arbitrum One network runs with a Nitro stack under the hood. The Nitro update introduced the geth virtual machine and WebAssembly. It’s a paradigm shift for the Arbitrum Bridge. No need for AVM anymore because WAVM can handle everything in a single instruction. The move to Geth has reduced average transaction fees because all interactions are done at a low level.

Conclusion

With unprecedented speed, important built-in security protocols, and low operating costs, DeFi adoption is coming into focus with its expansion potential as more and more users begin to understand Arbitrum.

It achieves the same by offloading the computation and data storage from the main network or layer 1 of the Ethereum blockchain. Arbitrum Bridge follows the mechanism of layer 2 scaling solutions by developing on the Ethereum blockchain with off-chain data storage facilities.

The Ethereum mainnet has made significant progress as the main chain for digital assets with lower gas fees. Off-chain transactions are the future of blockchain technology.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.