A leading crypto market analytics firm says Ethereum (ETH) is flashing a couple of bullish on-chain readings as the top altcoin bounces.

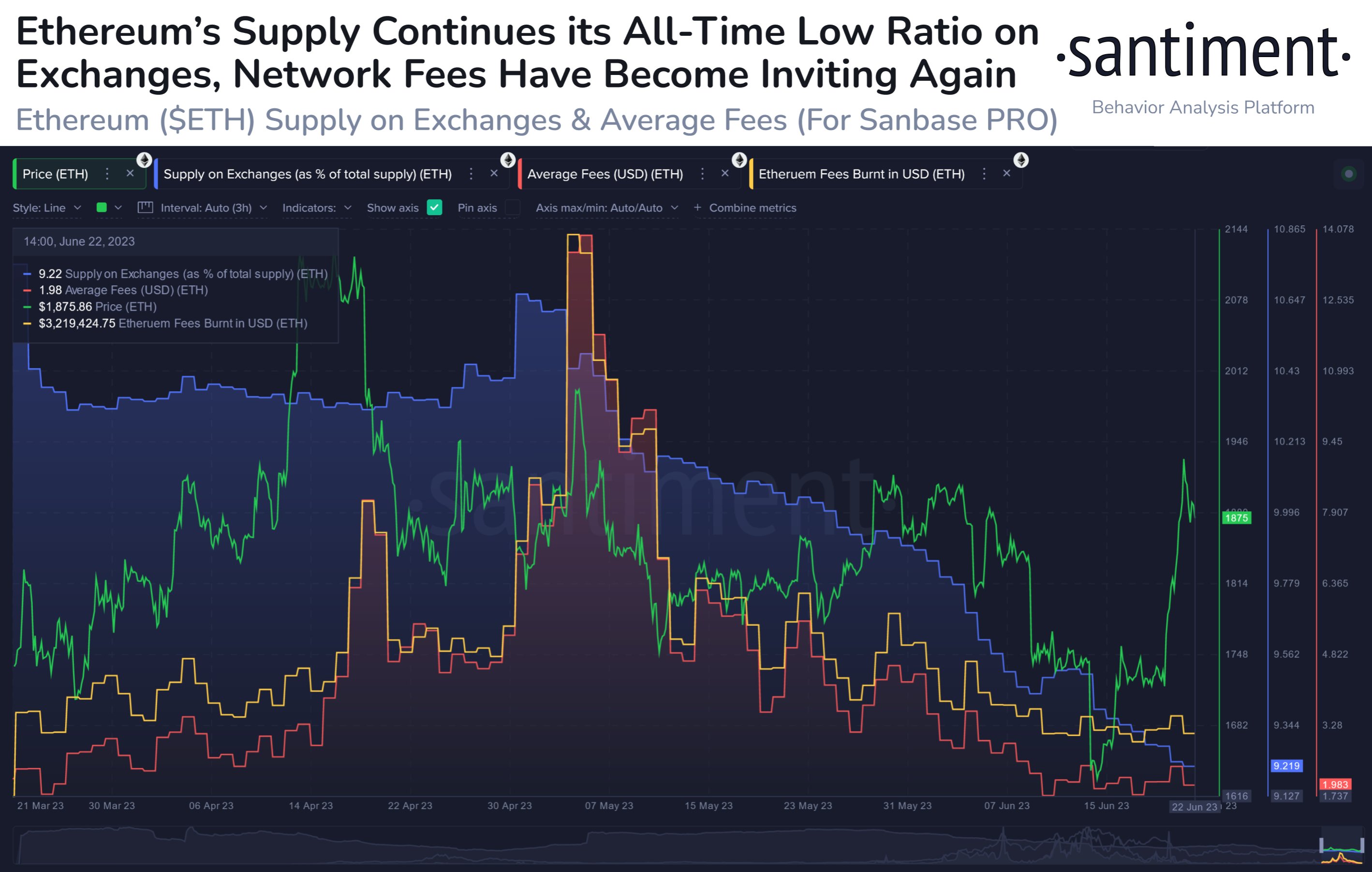

Santiment notes that Ethereum’s supply on crypto exchanges as a percentage of its total supply just hit a fresh all-time low, indicating that sell-off pressure on the leading altcoin may be limited as market participants move their ETH stacks away from the open market.

The analytics firm also says that ETH’s average transaction fees now look attractive after falling to a level last witnessed before Ethereum’s ascent to its 2023 highs.

“Even though Ethereum has been unable to maintain the $1,900 level for now, the level of supply continues moving away from exchanges. Additionally, average fees are back to levels last seen in March just prior to the ETH price ascension to $2,100.”

At time of writing, ETH is trading for $1,880, a nearly 15% increase from its June low of $1,637.

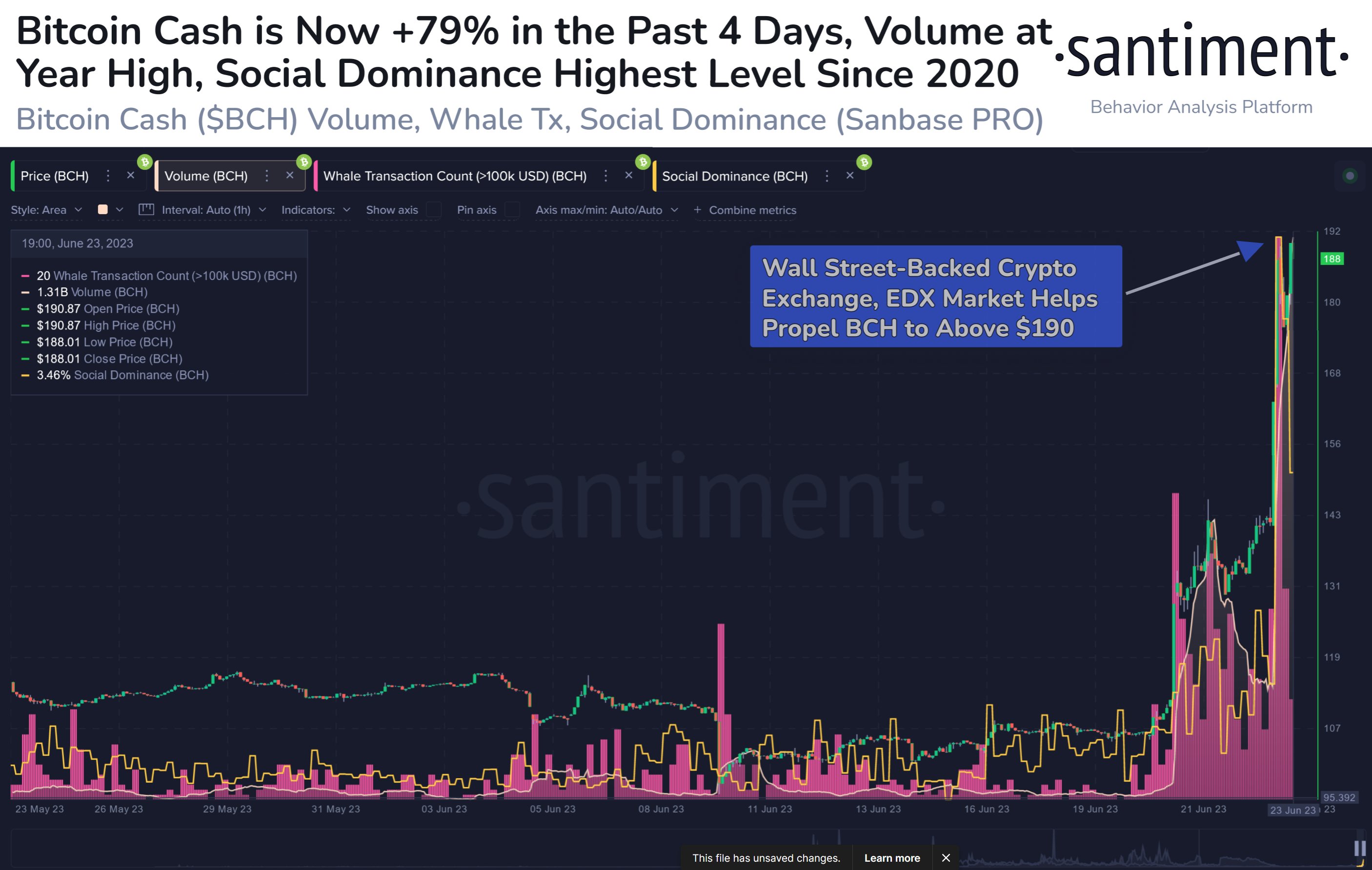

Looking at Bitcoin (BTC) hard fork Bitcoin Cash (BCH), Santiment says that the 20th-largest altcoin by market cap has been trending on social media after receiving support from the digital asset marketplace EDX Markets.

Traders are keeping a close watch on EDX Markets because it received a round of funding from financial heavyweights Charles Schwab, Citadel Securities, Fidelity Digital Assets, Paradigm, Sequoia Capital and Virtu Financial.

Says Santiment,

“With the assistance of EDX Markets, launched on June 20th, BitcoinCash has been the biggest beneficiary with a massive +79% price gain in four days. Notably, BCH has seen a three-year high in social discussion rates, and volume has easily eclipsed 2023 highs.”

At time of writing, BCH is worth $213.47, up nearly 120% from its June low of $97.87.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Featured Image: Shutterstock/Spyro the Dragon