MakerDAO, the governing body of the popular DAI stablecoin, is contemplating a substantial allocation of 600 million DAI to the fast-growing USDe synthetic dollar stablecoin via Morpho Labs. This strategic move comes as Ethena Protocol, the platform behind USDe, prepares to launch its native ENA token airdrop.

This decision reflects the organization’s confidence in USDe’s potential. Additionally, if the proposal comes to fruition, it might be a positive catalyst for Ethena, particularly its TVL growth.

USDe Pools Give More Benefits to Users

A comprehensive analysis by BA Labs, a member of MakerDAO’s advisory council, reveals strong user demand for USDe-backed lending pools within the MakerDAO ecosystem. This preference stems from USDe’s attractive yield-earning potential and the opportunity to earn ENA tokens.

Furthermore, the result of the analysis recommends focusing on higher leverage USDe pools (86% and 91.5% LLTV) with a proportionally larger allocation of DAI. Ethena’s revised rewards program reinforces this approach, favoring USDe over other collateral options.

Read more: What Is Ethena Protocol and its USDe Synthetic Dollar?

The strategic redirection of DAI towards USDe pools brings several advantages. Notably, it offers lower liquidity risk for the collateral, as USDe can be redeemed immediately via Ethena.

On the contrary, sUSDe requires a one-week unstaking period. Moreover, this shift allows Ethena to retain a larger revenue share for its insurance fund. Eventually, it will enhance the risk profile of Maker’s Ethena allocation over time.

While the allocation carries inherent risks associated with custody, exchange counterparties, and exposure to liquid staking tokens, BA Labs acknowledges steps Ethena took to mitigate these risks. MakerDAO’s rigorous due diligence further safeguards the process, ensuring a calculated approach to maximizing returns while minimizing potential losses.

Risk Mitigation and Transparency

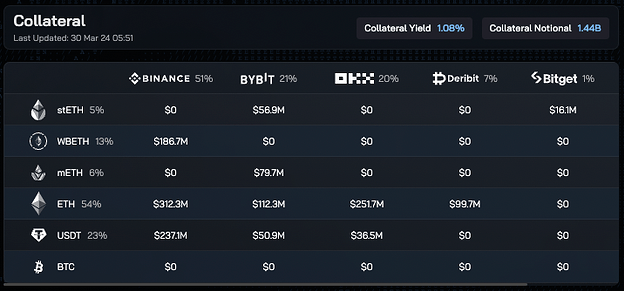

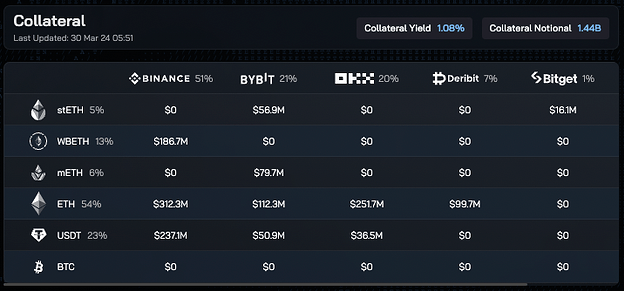

The analysis also notes the Ethena Protocol’s commitment to maintaining transparency by disclosing collateral breakdowns and deposit addresses.

However, to establish further trust and credibility, the BA Labs team recommends additional measures, such as improved visibility of futures hedging positions. This also includes product and exchange breakdowns, and periodic assertions from custodians to verify the assets under custody (AUC) that can be attributed to Ethena.

Read more: How To Use Ethena Finance To Stake USDe

Ethena’s Collateral Breakdown. Source: Ethena Dashboard

In response to this significant allocation from MakerDAO, Seraphim Czecker, Head of Growth at Ethena Labs, expressed his excitement and confidence.

“Not a joke: MakerDAO considering allocating up to $600m DAI into sUSDe and USDe via MorphoLabs with possibility to go up to $1 billion. Ethena TVL growth is on track with internal expectations,” Czeker wrote.

In parallel, Ethena Protocol announced that on April 2, 2024, it will airdrop its native token, ENA, to its community.

Based on CoinGecko data, USDe, with a market capitalization of $1.56 billion, has climbed to fifth in the global stablecoin rankings, following Tether, USDC, DAI, and FDUSD.