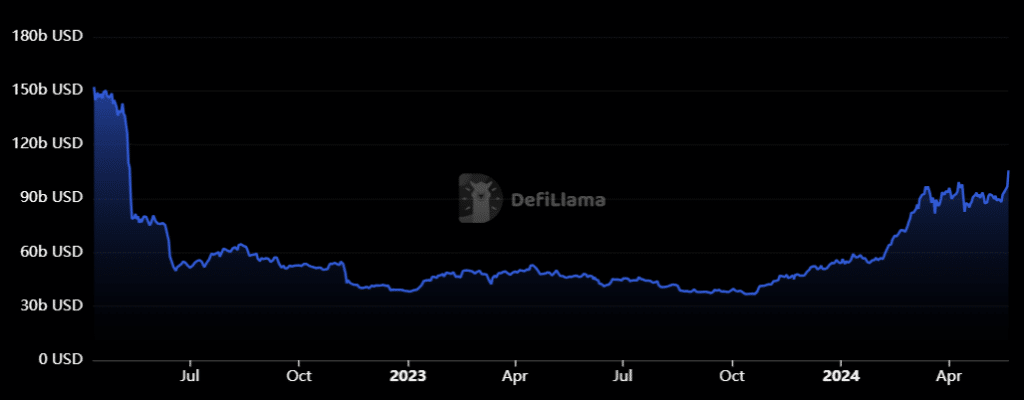

The total decentralized finance (defi) total value locked (TVL) is currently witnessing an impressive surge as the broader cryptocurrency market gains bullish momentum.

According to data provided by Defi Llama, the total defi TVL increased by 9.1% in the past 24 hours and is standing at $105.63 billion at the time of writing. Notably, this is the first time since May 11, 2022, that the defi market value surpasses the $100 billion mark.

Defi TVL | Source: Defi Llama

With the current rally, 51 of the total 52 defi protocols that have a TVL of over $500 million are roaming in the green zone.

You might also like: Eight altcoins rally 10+% as volatility swings market

Marinade is the only defi protocol among the leading 52 to record losses over the past day — with its TVL dropping by 5.4%, hovering at $1.66 billion, per Defi Llama.

The TVL of the leading defi protocol, Lido Finance, increased by 17.5% in the past 24 hours, reaching $34.22 billion for the first time over the past six weeks.

Similarly, Coinbase’s Wrapped Staked ETH emerged as the top gainer with a 21.6% rally over the past day. The protocol’s TVL reached $687 million for the first time over the past two months.

The rally in the defi TVL comes as the global cryptocurrency market gained upward momentum. According to data provided by CoinGecko, the total crypto market cap increased by 7.6% in the past 24 hours, reaching $2.74 trillion.

Per CoinGecko, the global crypto trading volume in 24 hours also increased by 130%, surpassing the $170 billion mark.

Usually, high price volatility is expected when the trading volume suddenly surges.

It’s important to note that the Bitcoin (BTC) price also surpassed the $70,000 mark after six weeks of consolidation between $60,000 and $67,000.

Read more: Grayscale CEO Michael Sonnenshein resigns as spot BTC ETF inflows rebound