The growing interest in decentralized finance (DeFi) reflects a market striding towards rationality, efficiency, and increased awareness of risks, and all signs point to a forthcoming bullish summer, marked by renewed confidence and a shift towards safer investment strategies.

Once in love with nothing but high yields, investors are now prioritizing security over raw numbers.

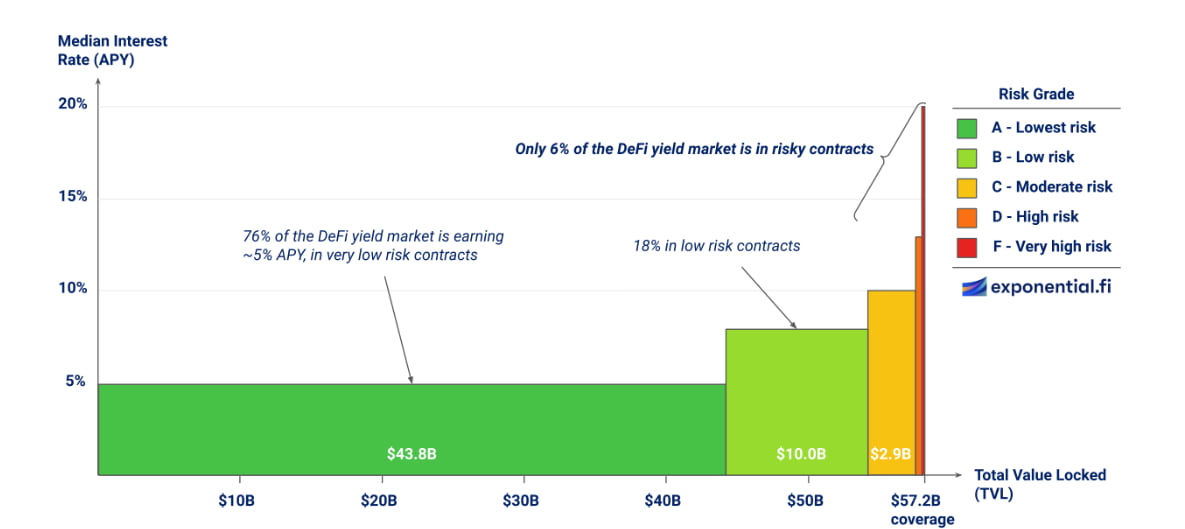

Data collected by Exponential and published in March, reveals a significant portion of DeFi funds, approximately 75%, are locked in pools offering conservative annual percentage yield (APYs) ranging from 0-5% (as seen below).

Such a cautious approach, particularly evident in Ethereum (ETH) staking pools, reflects a notable departure from the days of relentless yield chasing.

A new optimism in the market

A resurgence in Total Value Locked (TVL) within yield-generating DeFi protocols signals renewed optimism and market liquidity.

However, interest in sectors like insurance and derivatives has waned, highlighting the challenges of integrating certain financial activities into the DeFi framework.

Staking and secure lending

The landscape of DeFi job opportunities is also evolving, and we’re seeing a shift towards low-risk endeavors such as staking and secured lending.

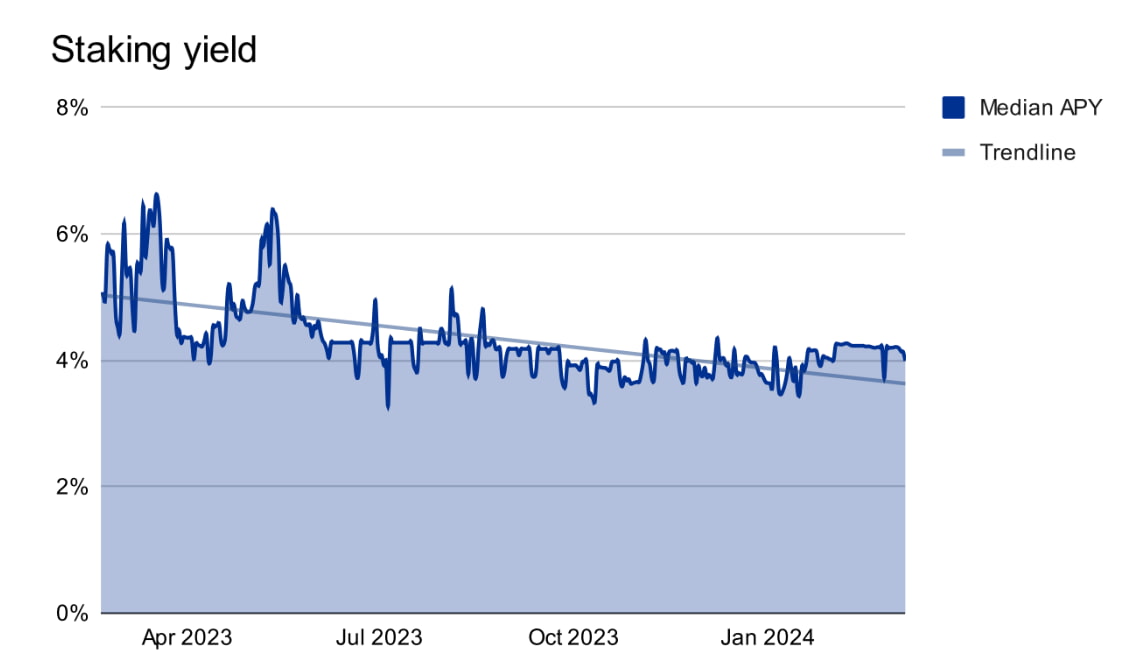

Staking emerges as a cornerstone of DeFi’s growth, fueled by Ethereum’s transition to a Proof-of-Stake (PoS) model.

Despite declining yields due to increased participation, staking now comprises around 80% of DeFi’s TVL.

Restaking options now available on platforms like EigenLayer further enhance demand for Ethereum staking, promising higher yields (although with increased risk).

The lending sector experiences a revival, driven by a collective risk-on attitude and a desire for increased yields.

Stablecoin borrowing rates on platforms like Aave (AAAVE) and Compound are now in the double-digit ballpark, incentivizing traders to leverage stablecoins for higher returns.

Decentralized exchanges

Decentralized exchanges (DEXs) face moderated growth due to concerns about impermanent loss.

However, advances in capital efficiency offer higher yields with reduced capital, mitigating some of the risks.

The bridging sector witnesses a significant TVL increase, propelled by the emergence of Layer-2 rollups, with trustless bridging models promising a more integrated and efficient DeFi ecosystem.

A shift away from rewards-based yields towards activity-driven yields indicates a maturing DeFi market sustained by real on-chain activity.

Despite the shift, however, incentives remain a viable strategy for attracting new users and raising capital.