DeFi

After a chaotic 2022, the cryptocurrency industry started out this year full of hope for a better turnout. Users’ and investors’ confidence in the market was battered by the various events that marked the industry last year. However, Bitcoin (BTC), the largest digital currency, gained significant traction last month. At the start of the year, the price of BTC stood at $16,500. However, by January 30, the price surged by 45% to about $23,955, giving investors hope for better days ahead for the industry. This price rally is also reflected in the decentralized finance (DeFi) industry.

Finance Magnates reports that the DeFi market saw its tokens, minus stablecoins and wrapped tokens, collapse by 72.9% in 2022 “with various governance and utility tokens losing over $48.4 billion in value.” The stablecoin market, for its part, decreased by 16.6% to $27.3 billion by year-end.

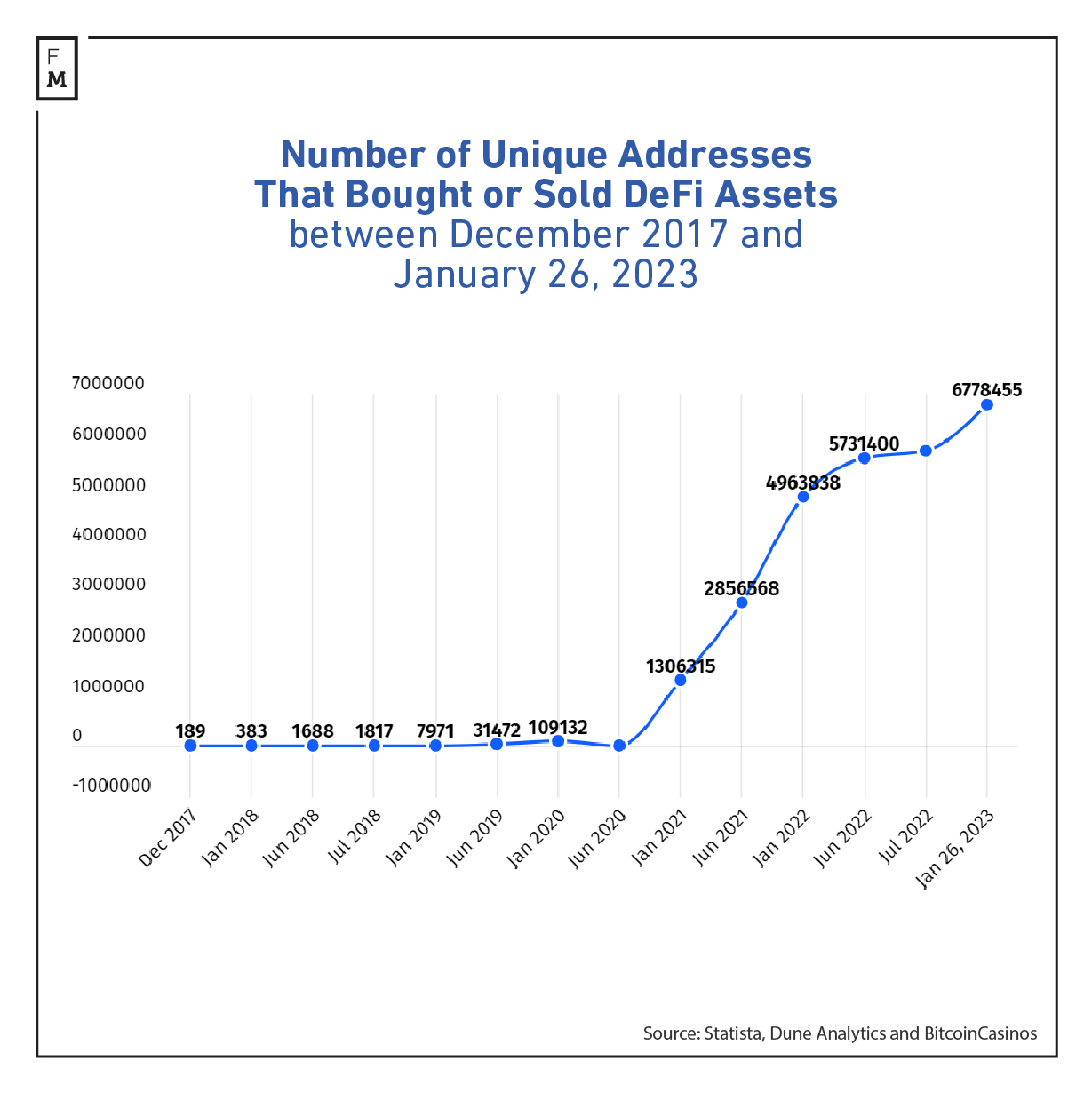

However, a new dataset collated by BitcoinCasinos.com shows that the total number of DeFi users increased by 35% year-over-year to 6.7 million in January 2023. Furthermore, analysis by Dune Analytics reveals that the total number of users engaging in DeFi projects skyrocketed from about 110,000 users three years ago to 4.96 million users in January 2022. In fact, by the end of last year, over 1.8 million new users had joined the DeFi industry. The data also shows that this number increased to 6.77 million users in January 2023.

The no of unique addresses engaging in DeFi activities has been increasing steadily over the years.

Andrew Thurman, the Head of Content at Nansen, a blockchain analytics platform, explained that the collapse of FTX inspired a double-digit growth in users and activities for many DeFi protocols “despite Total Value Locked (TVL) plummeting as Alameda and other major funds withdrew.”

“I think DeFi was a major beneficiary of the ‘not your keys, not your coins’ narrative. While DeFi has its own risk profile, with threats such as smart contract exploits looming, a growing number of users want to leverage on-chain financial services rather than centralized alternatives,” Thurman told Finance Magnates.

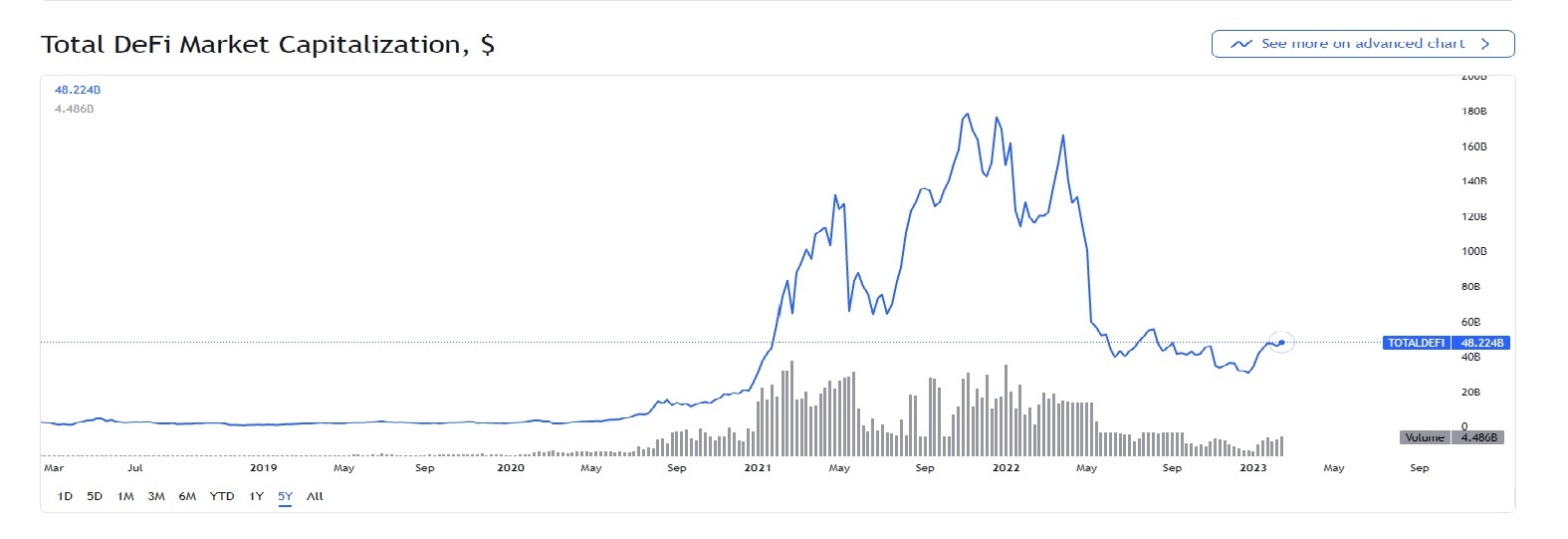

However, while the total number of DeFi users increased year-over-year in 2022, there was no commensurate growth in the sector’s market capitalization, which was struggling to rise above the levels last seen in 2021. Although the market cap increased from $113.4 billion in January 2022 to $166.4 billion in April, the figure declined to $51.8 billion in May and is yet to recover.

Brandon Tucker, Growth Lead at Marinade Finance, the creator of the mSOL token, noted that “a lot of the market cap of 2021 was due to over-leveraged large actors like Three Arrows Capital or FTX.”

As of December 2022, the DeFi market cap stood at $29.9 billion, showing further declines in the industry. However, this number recovered to $44.8 billion in January 2023, which is a growth of 50% month-over-month. Regardless, compared to the market cap achieved in January 2022, the number is still 60% down.

Andrew Thurman, Head of Content at Nansen

Houston Morgan, the Marketing Director of ShapeShift, a Switzerland-based crypto exchange, believes that users are possibly being more cautious with their investments in the DeFi space due to the market downturn and volatility. Nansen’s Thurman also holds the same view.

“During 2022, DeFi had to compete with declining crypto asset prices and US treasury yields often in excess of 4%. Few investors wanted their funds in assets like ETH, and while they could earn yield with stablecoins, off-chain yields were more attractive,” Thurman explained.

Furthermore, Thurman believes that once the total amount of stablecoins on chain begins to rise again, and withdrawals appear to have flattened, investors are likely to want their dollars on chain and in DeFi rather than in traditional asset alternatives.

What Does the Future Hold for DeFi?

In recent years, non-fungible tokens (NFTs) have come to play an important role in the DeFi industry with new use cases. However, in recent months, NFT trading volumes have been declining significantly, except in December last year when the market experienced a short-lived spike after ex-President Donald Trump launched an NFT collection.

Houston Morgan, Head of Marketing and Partnerships at ShapeShift DAO

Although market observers reported that trading prices in the NFT market have begun to pick up again, there are concerns about the slower pace at which new participants are joining the market.

Despite these, Thurman says DeFi will continue to be “a hotbed of innovation and growth in a new bull market” as DeFi provides an alternative to centralized financial institutions and positively impacts the average user.

“I expect the rise of staked ETH, in particular, to lead to a new class of products as developers experiment with yield-bearing liquid staking derivatives (LSDs),” the Nansen executive told Finance Magnates.

On the other hand, Morgan noted that it is impossible to predict the future of the DeFi industry “with certainty” as factors such as regulatory developments, technological advancements, and market sentiment “will likely play a role in determining its trajectory.” Regardless, the ShapeShift executive expects continued DeFi growth.

“DeFi is likely to continue growing in the larger cryptocurrency market, but its relative importance may vary based on market conditions and technological innovations. However, as DeFi continues to mature, it will become an increasingly significant part of the larger cryptocurrency market. I see the largest room for growth in the area of liquid staking and cross-chain decentralized application (DApp) aggregators like ShapeShift taking prevalence,” Morgan explained.

With the wider cryptocurrency industry yet to fully recover from the shock of 2022, most experts expect greater regulatory interference by government actors this year. This likely development, factored in with the increasing number of DeFi users spurred by the failure of centralized exchanges last year, means that it remains to be seen what turn the DeFi industry will take in 2023.