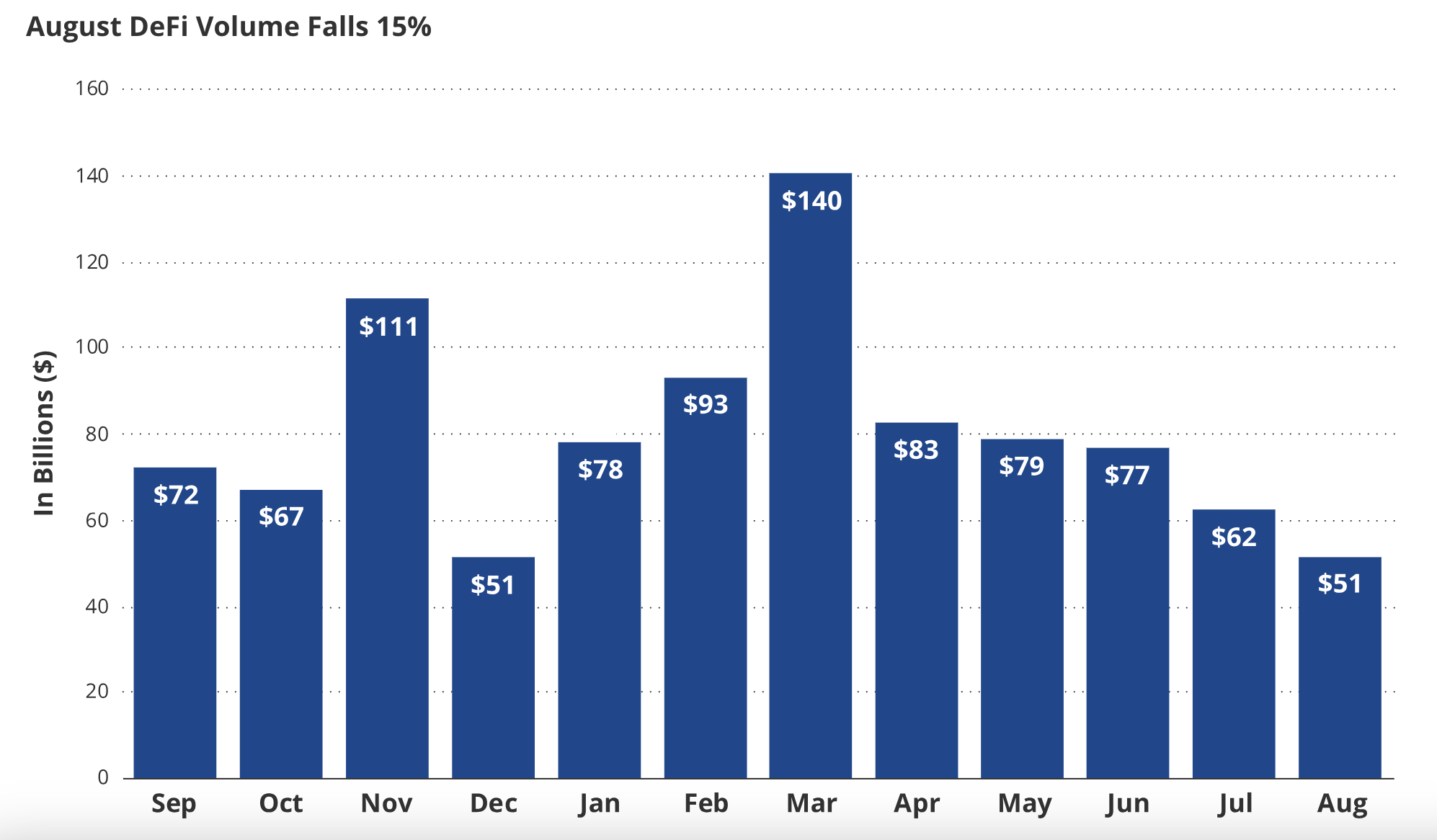

The decentralized finance (DeFi) ecosystem has suffered more setbacks in August as on-chain economic activity dwindled. According to an analysis from investment manager firm VanEck, exchange volume declined to $52.8 billion in August, 15.5% lower than in July.

The findings are based on VanEck’s MarketVector Decentralized Finance Leaders Index (MVDFLE), which tracks the performance of the largest and most liquid tokens on DeFi protocols, including Unisawp (UNI), Lido DAO (LDO), Maker (MKR), Aave (AAVE), THORchain (RUNE), and Curve DAO (CRV).

The DeFi Index underperformed Bitcoin (BTC) and Ether (ETH) in August, falling 21% in the month, notes the report. The results were exacerbated by UNI token negative performance of 33.5%, as investors sold off tokens to capture gains from July.

Another key metric for the ecosystem, the total value locked (TVL) declined 8% in August, from $40.8 billion to $37.5 billion, slightly outperforming Ethereum’s 10% slump in the month.

Decentralized exchange volume in August. Source: VanEck / DefiLlama

Even though DeFi tokens had poor performance in August, the ecosystem witnessed positive developments throughout the month, argues the analysis. These developments include Uniswap Labs’ dismissal of a class action lawsuit, and Maker and Curve’s stablecoin growth.

Recovering from a major exploit in late July, Curve Finance’s stablecoin crvUSD saw a significant growth in August, achieving a new all-time high of $114 million borrowed. CrvUSD is pegged to the U.S. dollar and relies on a collateralized-debt-position (CDP) model. Meaning users deposit collateral, such as ETH, to borrow crvUSD.

“The growth of crvUSD has allowed it to become a significant contributor of revenue for the platform, with crvUSD fees exceeding fees collected from all non-mainnet liquidity pools in 3 of the 4 last weeks,” reads the report. Curve Finance’s governance token, however, has not shown promising signs of recovery since the exploit, with its price falling 24% in August to $0.45.

VanEck analysis notes about CRV token performance:

“Due to the price decline, investors who bought CRV OTC from Michael Egorov last month are now only 12.5% above the water on their investment, with 5 months left until they can sell. If crvUSD can continue to grow to the point that it offsets the drop in exchange revenue caused by decreasing DeFi volume, CRV price may see some relief. Still, until then, declining DeFi volume remains a solid headwind for CRV appreciation.”

Curve Finance’s founder Michael Egorov had around $100 million in loans backed by 47% of the circulating supply of the protocol’s native token, CRV. As the CRV price dropped nearly 30% following the hack, fears of Egorov’s collateralized loans liquidation sparked concerns of contagious effect across the DeFi ecosystem. To reduce his debt position, Egorov sold 39.25 million CRV tokens to several notable DeFi investors during the crisis.

Additionally, VanEck pointed out that current levels of global interest rates, in particular in the United States, continue to put pressure on stablecoins. The aggregate market capitalization of stablecoins fell 2% in August to $119.5 billion. “This is mainly a result of elevated interest rates in traditional finance, which have incentivized investors to dump their stablecoins and move into money market funds where they can receive ~5% risk-free yield,” wrote the firm.

Magazine: How to protect your crypto in a volatile market — Bitcoin OGs and experts weigh in