Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Decentralized finance (defi) is no longer confined to the digital world. As we look around at some of the most important present-day issues, from buying a house to fighting climate change, defi is increasingly playing a crucial role.

You might also like: Cryptocurrency awareness vs knowledge: To educate to empower | Opinion

Some may be skeptical, given how overhyped defi has been in the past. This is understandable. But it only takes a simple look around to see defi making a real impact on our lives in the real world.

And there’s good reason to believe this impact will only be amplified in the coming years. Innovators are implementing decentralized finance in ways that benefit many people’s lives. As these innovations proceed, more will be built on top of them.

Using cryptocurrency tokens, investors can now purchase shares of existing homes and homes under construction. This improves access to the real estate market, as a wider range of people can now participate in transactions by investing small amounts.

Companies such as RealT, Propy, and Homebase are experimenting with the best ways to tokenize real estate so that it works for the broadest range of people. It’s already catching on.

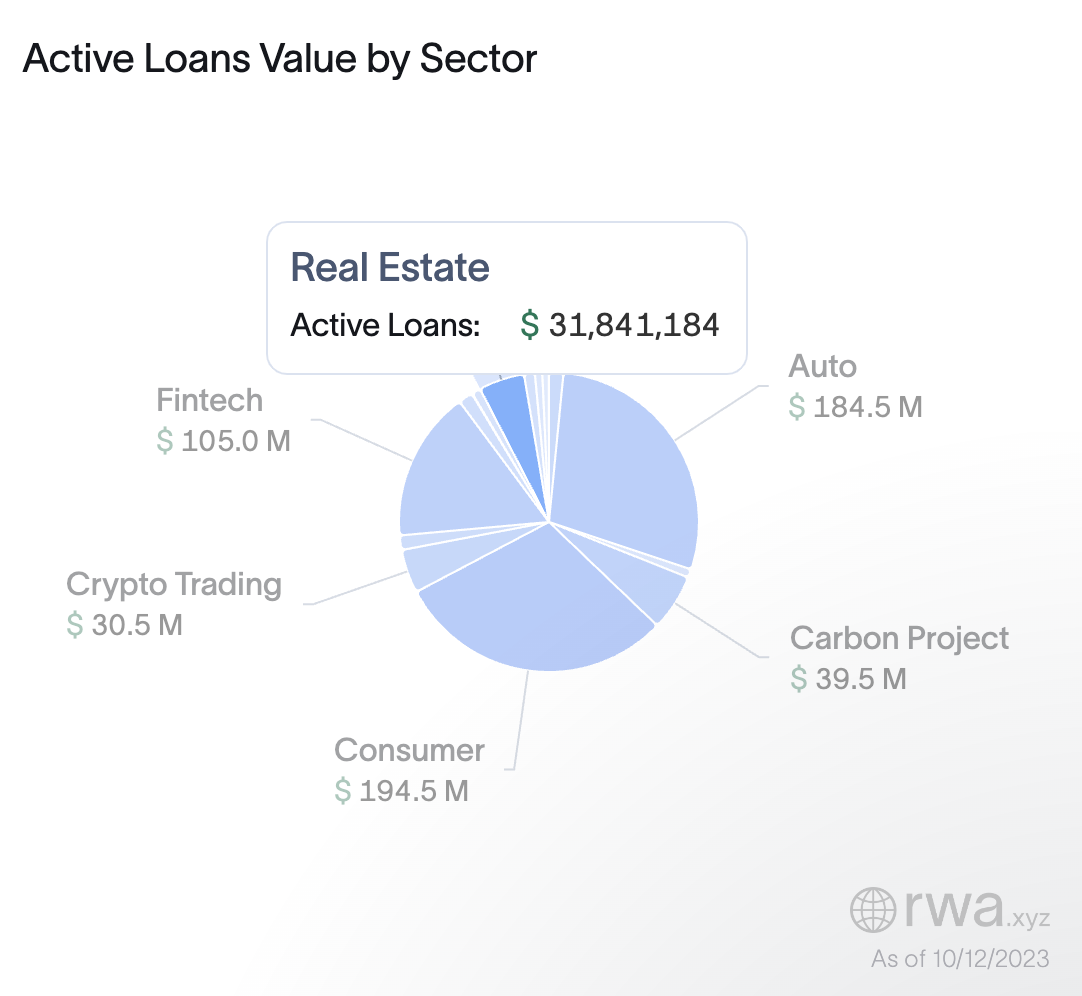

According to RWA, an analytics company for tokenized real-world assets, there are currently $31 million in active real estate loans — a huge market for tokenization. RealT was launched in 2019 with the promise of making real estate accessible for investments as low as $50. Three and a half years later, more than 390 houses worth over $92 million have been tokenized. In addition, Propy has processed over $4 billion in transactions in the U.S.

Active loans value by sector | Source: RWA

Other momentous effects may be coming for the real estate industry. For example, smart contracts may eliminate the need for attorneys in real estate transactions. This means more people will be able to afford getting into real estate.

Defi is starting to play a role in reducing the impact of climate change, with the potential to hold major emitters accountable in a way hitherto impossible. Carbon reductions are notoriously difficult to track, given the possibility of data manipulation. But when immutable blockchains are involved, numbers can’t be shifted. Smart contracts can be written to govern monitoring mechanisms, offering rewards and punishments to those being tracked.

In a green defi marketplace, carbon tokens are used as proof of emissions reductions and even used as collateral for large transactions. Protocols for climate change – focused applications are still in the works and widespread adoption is on the way. But pilot programs and demonstrations exist.

In 2022, tokenized carbon credits began being traded on blockchain through the use of digital voluntary carbon markets. These credits were used as collateral to borrow against. As demand grew, it became apparent that tokenization of carbon credits on blockchain was a great way to scale up transparent governance of carbon markets.

Toucan Protocol, for example, provides the base infrastructure for projects which tokenize carbon credits using blockchain technology. According to Toucan, it has tokenized over 20 million carbon credits and influenced over 50 climate projects. Another example is KlimaDAO, a decentralized autonomous organization (DAO) and a defi protocol launched in October 2021. Its proprietary tool offers users “the option to selectively filter, choose and retire carbon credits from over 20 million tons of available digital carbon credits.”

Defi allows individuals in undercapitalized regions to access funds without relying on centralized banking institutions. We’ve heard this promise in the crypto space for many years; now it’s becoming a reality.

Defi enables crowdsourcing and other alternative financing methods for projects that traditional banks might not want to support. There’s no reason ambitious business ideas should wither because people lack access to capital.

An ecosystem is under development to allow people in countries with developing economies to grow alongside the defi sector. Goldfinch, for instance, enables outside investors to invest cryptocurrency funds in projects all over the world. Goldfinch utilizes facility agreements to allow for fund receipt and repayment, thereby connecting on-chain and off-chain operations.

Under the traditional insurance model, human adjusters decide payouts, requiring a time-consuming and costly process. Defi revolutionizes this, allowing for automatic payouts to beneficiaries through smart contracts once specific conditions are met.

This better protects consumers, as their payouts are not dependent on the decision of a single person but on an unalterable contract. Intermediate negotiations are no longer needed.

For instance, Ethrisc, as part of the Lemonade Crypto Climate Coalition, provided parametric crop protection to 7,000 Kenyan farmers during the growing season in late 2022 to safeguard their crops against drought and floods. These farmers used phones to register, with their premium being less than a dollar.

Direct and near-instantaneous cash transfers based on area yield data were automatically credited to their accounts with M-Pesa, Kenya’s most widely used payment system, without requiring any claims to be filed. Contrast this with traditional payouts, which can take several months or even years.

Regulatory hurdles, particularly from the SEC, could be a major obstacle in the integration of decentralized finance into the real world. The SEC has provided no roadmap forward at this point, and recent actions, such as its lawsuit against Coinbase, signal that things may be about to get worse.

In addition, smart contracts could have issues if bugs become prevalent. As of now, only scant legal frameworks exist to determine accountability and which jurisdictions certain cases fall under.

Given the incredible amount of innovation in this space, it would be a shame if solutions weren’t worked out. Defi is clearly demonstrating its ability to transform our world. As it continues to evolve, it’s crucial that regulators keep up — so that its potential can be fully realized.

Read more: 2050: CBDCs, AI, and the uncharted path ahead | Opinion

Pratik Wagh

Pratik Wagh is the head of research at Coinchange. Previously, Wagh worked for major oil and gas clients, performing advanced ultrasonic techniques and conducting NDT research. He ran an NDT training school called the Institute of Nondestructive Testing and Training. He holds a master’s in materials science and engineering from Iowa State University and a bachelor’s in mechanical engineering from Mumbai University.