As a result of the breach, Curve Finance’s native token, CRV, took a major hit in the market. On Coinbase, CRV was trading down 12% over the past 24 hours. However, in a curious twist, the token experienced a surprising surge of 500% on the South Korea-based digital assets exchange, Bithumb.

The incident also had a broader impact on mainstream DeFi tokens, with many experiencing sharp declines. The top largest decentralized exchanges’ native tokens fell after Curve announced the platform had been “exploited” due to a programming language flaw. COMP fell by 18.5% in 24 hours, CVX dropped by 14.3%, FXS declined by 13.02%, and AAVE experienced a 13.2% decrease in value.

AAVE price chart. Source: TradingView

Despite the exploit’s impact on CRV, the token’s role as collateral on Aave, a decentralized lending service, did not appear to lead to any “bad loans” on the Aave platform, according to Gauntlet’s Chitra.

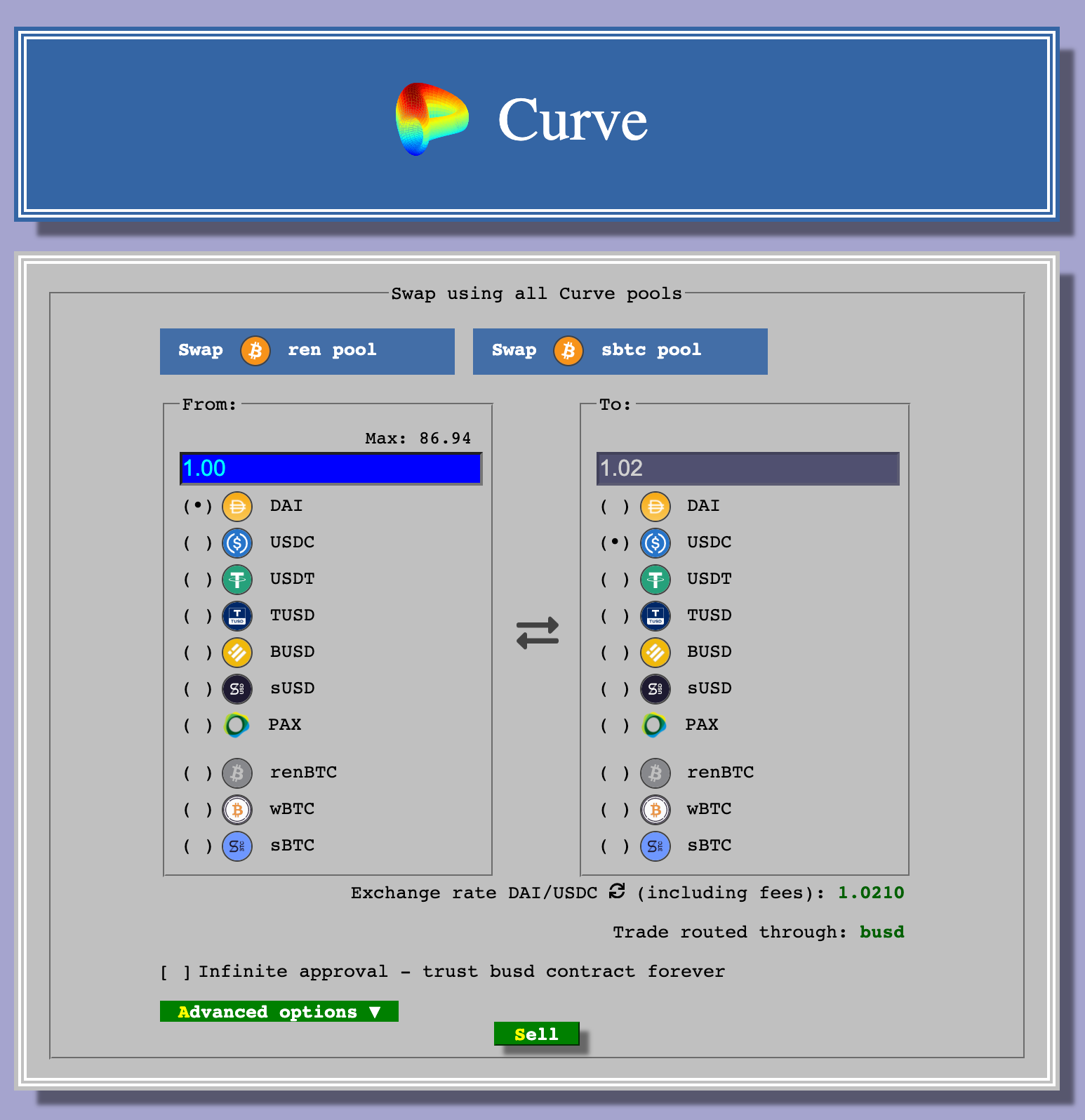

Curve Finance is well-known for allowing users to exchange like-assets, such as Ethereum for Staked Ethereum or Tether’s USDT for Circle’s USDC, providing a valuable arbitrage tool for traders seeking to capitalize on price disparities between assets.

According to initial reports, hackers exploited the platform on Sunday, making away with over $24 million in cryptocurrency. However, blockchain security firm PeckShield later updated the stolen amount to a staggering $52 million as the attack continued to unfold in real-time.

The vulnerability that led to the exploit was traced back to a programming language called Vyper, which is commonly used in DeFi applications like Curve Finance. The flaw in a specific version of Vyper allowed attackers to perform a “re-entrancy” attack, affecting multiple stablecoin pools used for pricing and liquidity across various DeFi services.

Curve Finance relies on smart contracts to provide various financial services, including stablecoin borrowing, trading, and lending, to its users. While decentralized finance projects offer many benefits, this incident highlights the potential risks and vulnerabilities associated with the technology.

As the investigation into the breach continues, the DeFi community will undoubtedly be keeping a close eye on developments and seeking ways to enhance security measures across the ecosystem.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.