DeFi

Over the weekend, a wallet tagged as belonging to Michael Egorov, the founder of Curve Finance, made a notable maneuver by depositing 38 million Curve DAO tokens — equivalent to $24 million — into the decentralized lending platform Aave.

This action, noted by on-chain analyst Lookonchain, was part of Egorov’s plan to increase his collateral and mitigate the risk of potential liquidation. The move is particularly noteworthy due to the sheer scale of the collateral he controls. He secured his Aave loan with an astonishing 277 million CRV tokens, which accounts for 32% of the total circulating supply of CRV.

According to DeBank’s data, Egorov’s initial loan from Aave was substantial — over $64 million in stablecoins. To collateralize this loan, he supplied nearly one-third of the total circulating supply of CRV tokens, which indicates the significant role that large token holders play in the DeFi landscape.

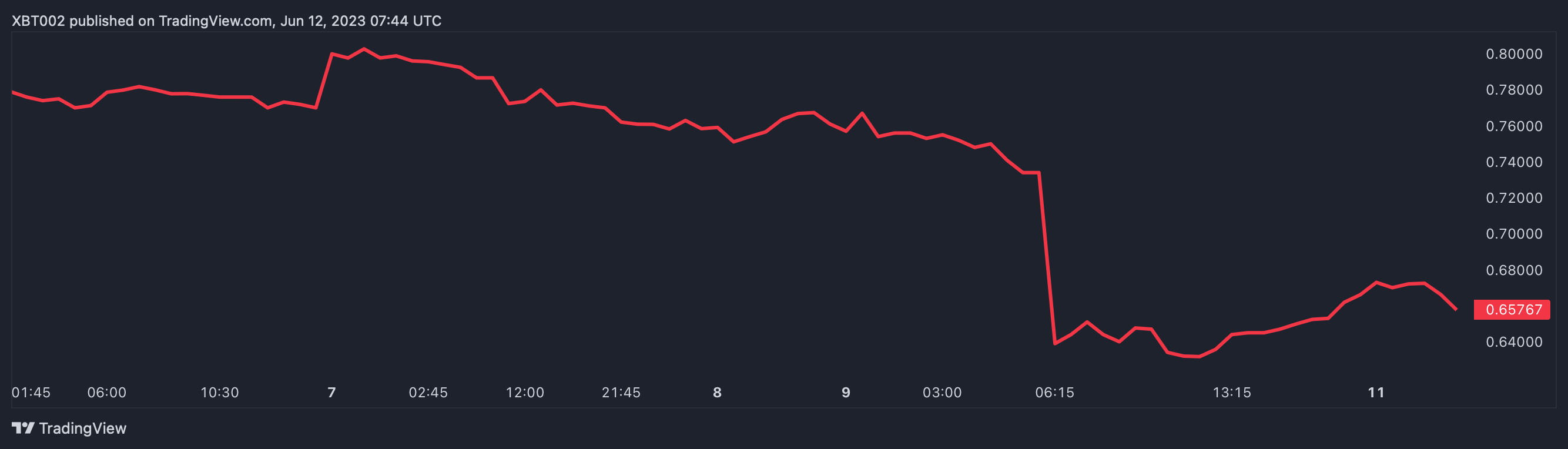

The price of CRV has declined by 21.71% on crypto exchange Bitstamp over the past week. Source: TradingView

More CRV, better health

Lookonchain reported that Egorov’s recent deposit improved the health rating of his position from 1.3 to 1.5. This is a crucial development, as a health rate of one usually triggers liquidation. Currently, the health rate of Egorov’s position stands at a safer 1.7.

Given the volume of Egorov’s CRV collateral, a mass liquidation could cause significant market disruption by precipitously dropping the token’s price. Automated liquidations are an inherent feature of the DeFi landscape. They can trigger a cascade effect, causing the price of the collateralized asset to plummet until the market stabilizes.