Curve DAO token (CRV) has observed a 7% bounce during the last 24 hours as mass liquidations of short traders have occurred in the market.

Curve Funding Rates Turned Extremely Negative Following Price Decline

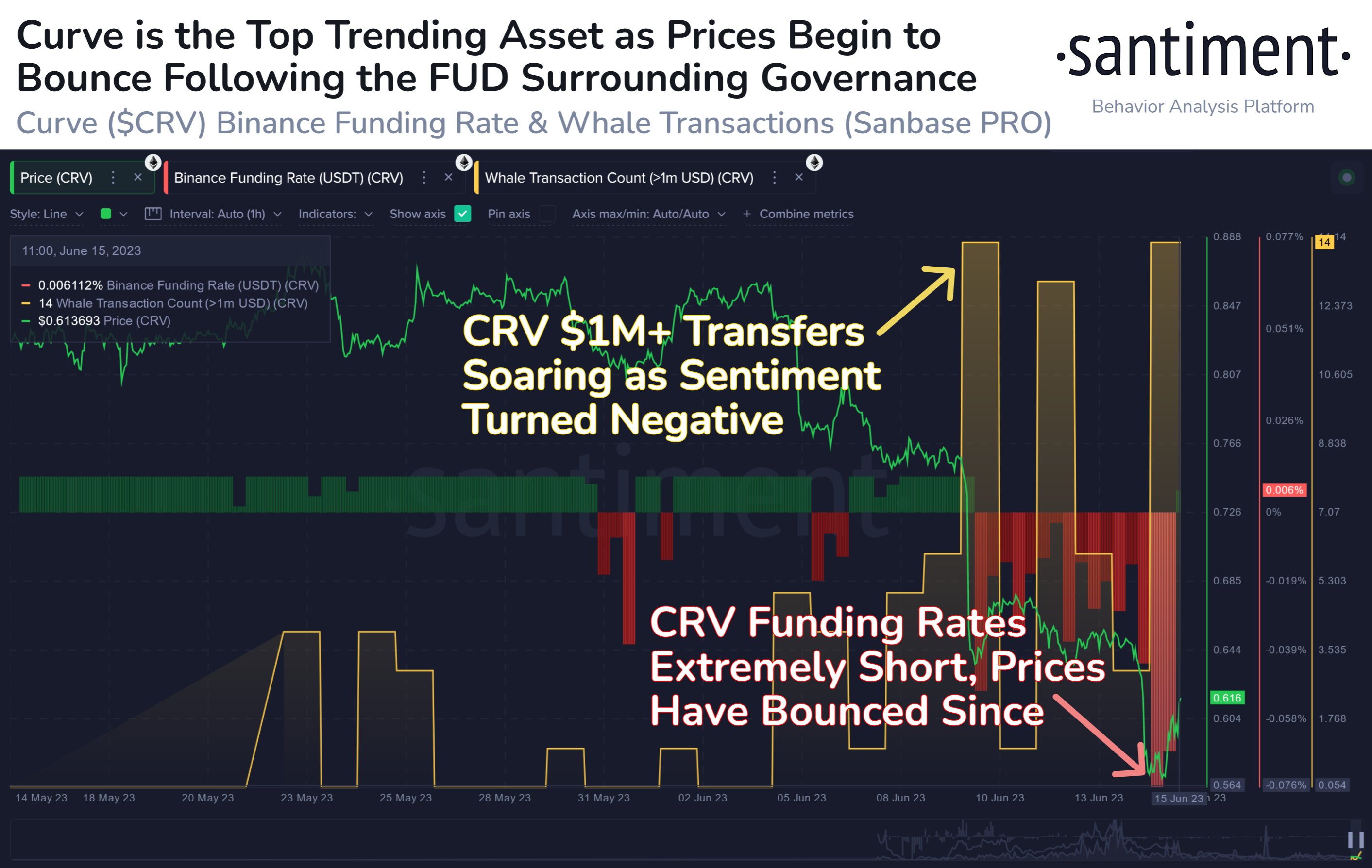

According to data from the on-chain analytics firm Santiment, an extreme amount of shorts had accumulated on the cryptocurrency exchange Binance recently. The relevant indicator here is the “funding rate,” which keeps track of the periodic fee that Curve perpetual contract traders on a specific exchange are paying each other right now.

When the value of this metric is positive, it means that the long contract holders are willing to pay a premium to the short contract holders in order to keep their position currently. Such a trend implies that bullish sentiment is held by the majority of investors.

On the other hand, negative values suggest that a bearish mentality is the dominant force in the market at the moment as the shorts are paying a fee to the longs.

Now, here is a chart that shows the trend in the Curve funding rates on the cryptocurrency exchange Binance over the past month or so:

The value of the metric seems to have been quite red not too long ago | Source: Santiment on Twitter

As displayed in the above graph, the Curve Binance funding rate had assumed negative values recently as the cryptocurrency’s price had continued to head downwards.

The decline in the asset’s price came in part because of all the FUD in the wider cryptocurrency sector, like the SEC charges against Binance and Coinbase, or the Fed interest rates decision, while the other factor was CRV-specific uncertainty.

The root cause of this FUD is the fact that the Curve Finance founder has taken up a large loan against a wallet that currently holds around 30% of the entire circulating supply of the token. As the price of the asset has taken a hit recently, concerns about this position getting liquidated have grown in the market.

Since the wallet holds such a significant part of the cryptocurrency’s supply (288.7 million tokens to be precise), a potential liquidation could have wide-reaching consequences for the project.

From the graph, it’s visible that the Binance funding rate had become extremely red as this FUD spread around. This means that the sentiment on the exchange had become quite bearish.

Historically, whenever the traders have leaned too hard into any particular direction, the market has tended to actually show a sharp move in the opposite direction.

The reason behind this is an event called a squeeze, which takes place whenever a sudden swing in the price occurs and causes a mass amount of liquidations to go off at once.

These liquidations only end up fueling said price swing further, leading to even more liquidations happening in the market. In this way, liquidations can sort of waterfall together during a squeeze.

In the graph, it’s visible that after the funding rate had turned very negative, the indicator suddenly started going the other way, and it has now already turned very slightly positive.

This suggests that a short squeeze has taken place in the market, as the shorts that had accumulated have all been washed away. The Curve price has jumped off this squeeze, registering a rise of about 7%.

CRV Price

At the time of writing, the Curve DAO token is trading around $0.61, down 20% in the last week.

Looks like the asset has seen some recovery | Source: CRVUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, Santiment.net