Decrypting DeFi is Decrypt’s DeFi email newsletter. (art: Grant Kempster).

For some reason, tokenization, one of the crypto industry’s original promises, is again making headlines.

“It’s so funny because people that had been around from 2018 have all these scars from pitching this stuff and believing it and nothing happened,” Polygon’s tokenization lead Colin Butler told Decrypt.

Tokenization basically refers to the transfer of more traditional financial assets like stocks and bonds onto a blockchain. The transition has promised lower overhead costs and increased efficiency. And these days it’s got everyone pretty excited.

Avalanche, for instance, has just rolled out a $50 million initiative to help builders in this area (so long as they’re doing it on Avalanche). Late last year, Blackrock CEO Larry Fink called it the “next generation of markets.”

But why the sudden change of heart?

“I think the short answer for me is culture,” Butler said. “There’s actually hardcore blockchain believers in all of these large TradFi firms now. It basically took that amount of years for them to advocate, for this to percolate to the top, and for the top to even consider it.”

During that time DeFi also found its legs: Decentralized lending kicked off, Uniswap launched, and, of course, yield farming in 2020.

In parallel with these developments, Centrifuge CEO Lucas Vogelsang told Decrypt, “TradFi started to understand what DeFi actually means: the idea of having trustless smart contracts that settle these transactions can lead to efficiency gains. It’s actually a better back-end infrastructure for what they’re doing.”

Centrifuge, like Polygon, has been at the center of the tokenization–or alternatively, the real-world asset–trend for some time. The project lets businesses of all types put up their real-world collateral to mint the decentralized stablecoin DAI. Today, it’s servicing over $235 million in assets.

Franklin Templeton, an asset manager with more than $1.4 trillion in assets under management, also launched one of its funds on Polygon earlier this year.

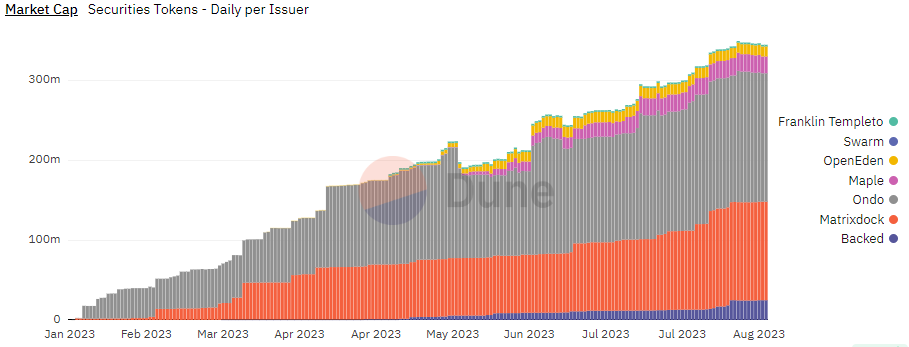

Across Polygon, Ethereum, and Gnosis Chain, there are more than $345 million in tokenized assets on-chain today.

Tokenized assets on Polygon, Ethereum, Gnosis. Source: Dune.

There’s clear momentum.

But that won’t be enough for the tokenization trend to really hit the mainstream.

“It’s going to require that everyone who’s working in this industry today is willing to take a certain amount of risk,” said Vogelsang. “And it’s going to require a couple more years to prove out that the risk is not actually there for regulation to catch up.”

That risk is much different than the food coins of yesteryear.

Onboarding the entire financial system, a behemoth representing hundreds of trillions of dollars, is a little more complicated than deploying a smart contract over the weekend.

“If you rewire your rails, you do something wrong and you’re BlackRock, you’re jeopardizing an $8.5 trillion business,” said Butler. “And everybody has the same challenge.”

But obviously, the money’s there.

And it may be more aggressive than employment concerns over AI.

“I had a digital head and a big infrastructure provider to Strathclyde model a 20,000 headcount reduction,” the Polygon exec said. “If tokenization actually worked, right, there’s like a quarter of their employees.”

With so much money knocking on the door, regulators are surely feeling the pressure.