beginner

Cryptocurrency storage is a significant consideration for both seasoned crypto investors and newcomers. The two main options for storing crypto assets are wallets and exchanges. While crypto exchanges facilitate buying, selling, and trading digital currency like Bitcoin, wallets serve as a personal bank to store your crypto holdings securely.

When it comes to using traditional crypto wallets vs. exchange wallets, the choice mostly depends on your preferences and characteristics as an investor. If you need to store crypto in large amounts, there’s no better choice than a hardware wallet. However, I personally find hardware and paper wallets a bit awkward to use when making frequent transactions.

In this article, I’ll take a look at how a cryptocurrency exchange wallet is different from a regular crypto wallet and examine whether you should store crypto in a crypto wallet or an exchange.

What Is a Crypto Wallet?

A crypto wallet is essentially a digital wallet that allows users to store, manage, and transact digital currencies. Just like you use a physical wallet to keep your cash or credit cards, a crypto wallet keeps track of your digital assets. The main difference, however, is that instead of storing physical money, crypto wallets store digital codes or two types of keys — the public keys, which are your public address, and the private keys, which give you access to your digital assets.

These wallets can be used with a wide variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and many others. Importantly, while they are called “wallets,” they don’t actually store cryptocurrencies. Instead, they secure the keys associated with those currencies, giving you the ability to access your assets on the blockchain.

How Does a Crypto Wallet Work?

A crypto wallet operates using a technology known as public key cryptography. Each wallet has a pair of cryptographic keys: a public key and a private key.

The public key, also known as your wallet address, is shared publicly and is what others use to send funds to your wallet. Think of it as your bank account number.

The private key, on the other hand, acts as your digital signature: it is used to sign transactions, proving that they originated from the wallet owner. It’s comparable to your ATM PIN code and, therefore, should be kept secret and safe because whoever knows your private key has access to your funds.

When someone sends you cryptocurrencies, they are signing off ownership of the coins to your wallet address. To spend these coins and unlock the funds, your private key must match the public address to which the currency is assigned. If both keys match, the balance of your digital wallet will increase, while the sender’s balance will decrease correspondingly.

Types of Wallets

Crypto wallets come in different forms, each offering various features, levels of security, and accessibility. Here are the most common types:

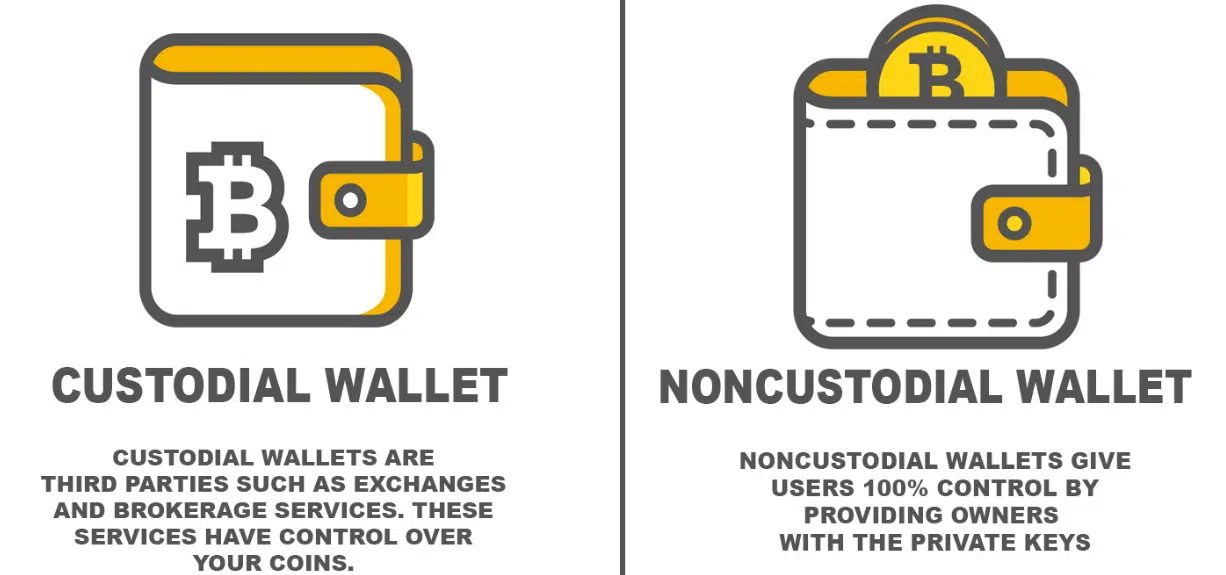

- Non-Custodial Wallets: Non-custodial wallets are a type of cryptocurrency wallet where only the user has control over the private keys and thus has full sovereignty over their funds. This contrasts with custodial wallets, where a third-party service retains control of the keys.

- Hot Wallets: These wallets are connected to the Internet.Typically easy to set up and use, they include web, desktop, and mobile wallets. They have a good balance between convenience and security, although they are more vulnerable to online threats than cold wallets.

- Cold Wallets: Also known as hardware or paper wallets, these wallets are not connected to the Internet, offering better protection against online threats. They are primarily used for the long-term storage of cryptocurrencies. Hardware wallets are physical devices that securely store your private keys offline. Paper wallets, meanwhile, involve printing out your public and private keys and storing them in a safe location.

- Paper Wallets: Apart from being easy to use, these wallets provide a very high level of security. The term “paper wallet” generally refers to a physical copy or a printout of your public and private keys. It can also refer to a piece of software used to securely generate a pair of keys which are then printed.

- Custodial Wallets: In these wallets, the private keys are managed by a third party, such as a cryptocurrency exchange. This makes them a convenient option for users who prefer not to manage their keys, but it also means the users have to trust the third party’s security measures.

What Is a Cryptocurrency Exchange Wallet?

A crypto exchange wallet is a type of digital wallet provided by cryptocurrency exchanges. These wallets allow users to store, receive, and send crypto assets directly within the exchange’s ecosystem. They are a part of the service portfolio designed for users who trade on the exchange platform.

The primary type of crypto exchange wallet is associated with centralized exchanges (CEXs). Centralized exchanges like Coinbase, Binance, or Kraken manage these wallets on behalf of the user. While decentralized exchanges (DEXs) are also a significant part of the cryptocurrency trading landscape, they typically do not offer in-built wallets. Instead, they allow users to connect their existing wallets (like MetaMask or Trust Wallet) to interact with the exchange.

How Does a Crypto Exchange Wallet Work?

In the context of a centralized exchange, when a user creates an account, the exchange generates a wallet associated with that account. This wallet operates under the control of the exchange that holds private keys, meaning the exchange is responsible for managing and safeguarding the assets held within.

When a user decides to trade, they transfer their crypto assets into their exchange wallet. These assets are managed by the exchange, which acts as a custodian, maintaining balances, facilitating transactions, and allowing users to buy, sell, or trade crypto assets. The exchange also handles all transaction verifications and security.

Nevertheless, it’s important to note that this level of convenience comes with a degree of risk. By holding user funds and private keys, centralized exchanges become attractive targets for potential hackers. If the exchange’s security is breached, users may lose their assets.

Storing Crypto on Exchanges vs. Wallets

Exchanges are platforms where you can convert fiat currency (like dollars, euros, etc.) into cryptocurrency and vice versa. They also enable crypto-to-crypto trading. These exchanges offer web-based wallets where you can store your digital assets. That said, exchanges control the private keys to these wallets, which means you’re not the only one with access to your cryptocurrency holdings.

On the other hand, crypto wallets can be software- or hardware-based. They allow users to store their private and public keys, thereby giving them full control over their funds. They offer the convenience of making transactions directly from the wallet and often include features for managing multiple cryptocurrencies.

Benefits of Non-Custodial Crypto Wallets

Non-custodial wallets, also known as self-custody wallets, boast several benefits over their exchange-based counterparts.

- Full Control. Non-custodial wallets give users exclusive access to their crypto coins. This means you have complete control over your digital assets, and no third party can freeze or lose your funds.

- Enhanced Security. These wallets generally offer enhanced security measures, including two-factor authentication (2FA), pin codes, and biometric scanning on mobile devices.

- Privacy. Since you have full control of your wallet, there’s no need to share your personal information with a third party, which helps preserve your privacy.

The Best Non-Custodial Crypto Wallets

Choosing a non-custodial wallet depends largely on your specific needs and the level of convenience and security you desire. Here are five notable non-custodial wallets you may consider:

- MetaMask. MetaMask is a software wallet that operates as a browser extension, allowing users to interact with decentralized applications (dApps) on the Ethereum blockchain directly from the browser. Thanks to its user-friendly approach, it is a popular choice for those new to the crypto world.

- Exodus. This is a software wallet that provides a robust platform for managing multiple cryptocurrencies. Exodus offers a user-friendly interface, live charts, and portfolio management tools. Besides, it integrates with Trezor hardware wallets for added security.

- Trust Wallet. Trust Wallet is a mobile wallet for storing a wide range of cryptocurrencies. It also provides a Web3 browser for interacting with dApps, making it a versatile choice for those invested in the wider blockchain ecosystem.

- Electrum. Electrum is one of the oldest software wallets in the crypto space. While its asset range is not that wide (it works only for Bitcoin), its security is actually high-level due to encryption and two-factor authentication. Its interface is less user-friendly than some others, so it is better suited for more tech-savvy users.

- Ledger. Ledger produces hardware wallets Ledger Nano S and Ledger Nano X. They store your private keys offline on the device, making them immune to online threats. Ledger wallets support a vast array of cryptocurrencies and integrate with various software wallets for easy management.

Each of these wallets has a unique set of features and security measures, catering to a range of user needs and levels of technical proficiency.

Is It Safe to Use an Exchange Wallet?

While exchange wallets lure users with a lot of conveniences, they come with security risks. Exchanges are attractive targets for hackers. If a hack occurs, your crypto holdings could be at risk. Additionally, the exchange has control of your assets, meaning they could freeze your account for various reasons.

Nonetheless, many exchanges implement security measures like two-factor authentication, withdrawal whitelists, and insurance against theft. That said, the old adage of “not your keys, not your coins” holds true. To keep your funds safe, it’s best to move your cryptocurrencies off the exchange and into a secure wallet unless you are actively trading.

How to Move Crypto off an Exchange

Transferring your crypto coins from an exchange to a wallet is a straightforward process.

- You first need to have a wallet. Depending on your preferences, this could be a software, a hardware, or a paper wallet.

- Once you’ve set up your wallet, you’ll have an address that can receive funds. Copy this address.

- Next, navigate to the withdrawal section of the exchange. Select the cryptocurrency you want to transfer and paste the copied address into the designated field.

- Confirm the transaction. You may have to pay transaction fees, which vary from exchange to exchange and also depend on network congestion.

- The exchange will process the withdrawal, and your assets will appear in your wallet.

Remember to double-check the wallet address before confirming the transaction as crypto transactions are irreversible.

Final Thoughts

Ultimately, whether you choose to store your crypto assets in a wallet or an exchange should depend on your individual needs and the level of risk you’re comfortable with. If security and control over your funds are paramount, a non-custodial wallet could be the best choice. Conversely, if you are an active trader who needs quick access to assets, keeping some funds in an exchange may be more convenient.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.