With the Bitcoin price hovering above $50,000, the focus of the crypto community has shifted towards the DeFi sector, which has been witnessing a significant surge, marking an end to the crypto winter. This pivot is largely attributed to the mainstream attention DeFi has garnered amidst the ongoing AI craze.

Platforms enabling users to lend, borrow, or exchange crypto without the intermediation of a central authority, such as Uniswap and others, have seen a spike in value following various innovative proposals.

Therefore, it appears that the DeFi tokens may make a huge noise in the upcoming bull run and mark new highs.

Maven11 Capital’s Strategic DeFi Gains

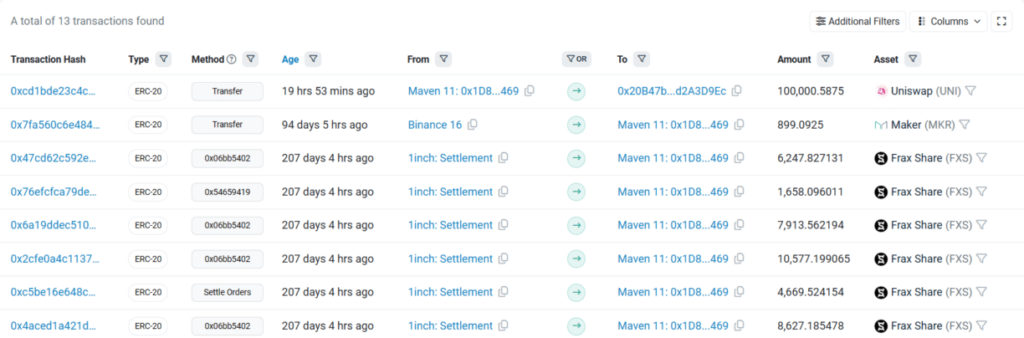

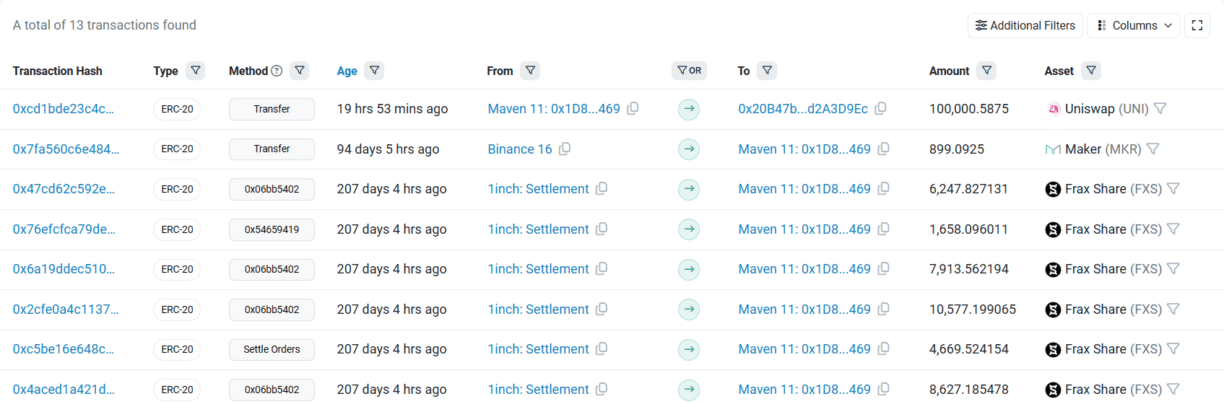

Amidst this DeFi boom, Maven11 Capital has exemplified the potential for astute gains in the crypto venture space. With a strategic investment in DeFi tokens, Maven11 Capital has reported a remarkable return of 54%, amounting to $1.43 million.

Source: Etherscan

This success story began with the purchase of 100,000 UNI tokens at $5.74 each from Binance, later sold at $11.2, resulting in a 95% gain of $546K.

Similarly, investments in other tokens like MKR, AAVE, and FXS have yielded significant returns of 38%, 58%, and 43%, respectively, highlighting the lucrative opportunities within the DeFi sector.

Uniswap’s Governance Proposal Fuels DeFi Rally

A noteworthy development fueling this surge is the recent proposal by Uniswap to reward its token holders. The proposal suggests distributing protocol fees among UNI holders who stake and delegate their tokens, thereby enhancing the protocol’s governance.

This initiative, spearheaded by Eric Koen, the governance lead of the Uniswap Foundation, led to a 70% hike in UNI tokens and promises to revitalize the network’s decision-making process.

Other than Uniswap, COTI (COTI) has marked a notable jump of over 38%, while SushiSwap (SUSHI) soared above 36%.

Liquidity Trends Signal Rising DeFi Optimism

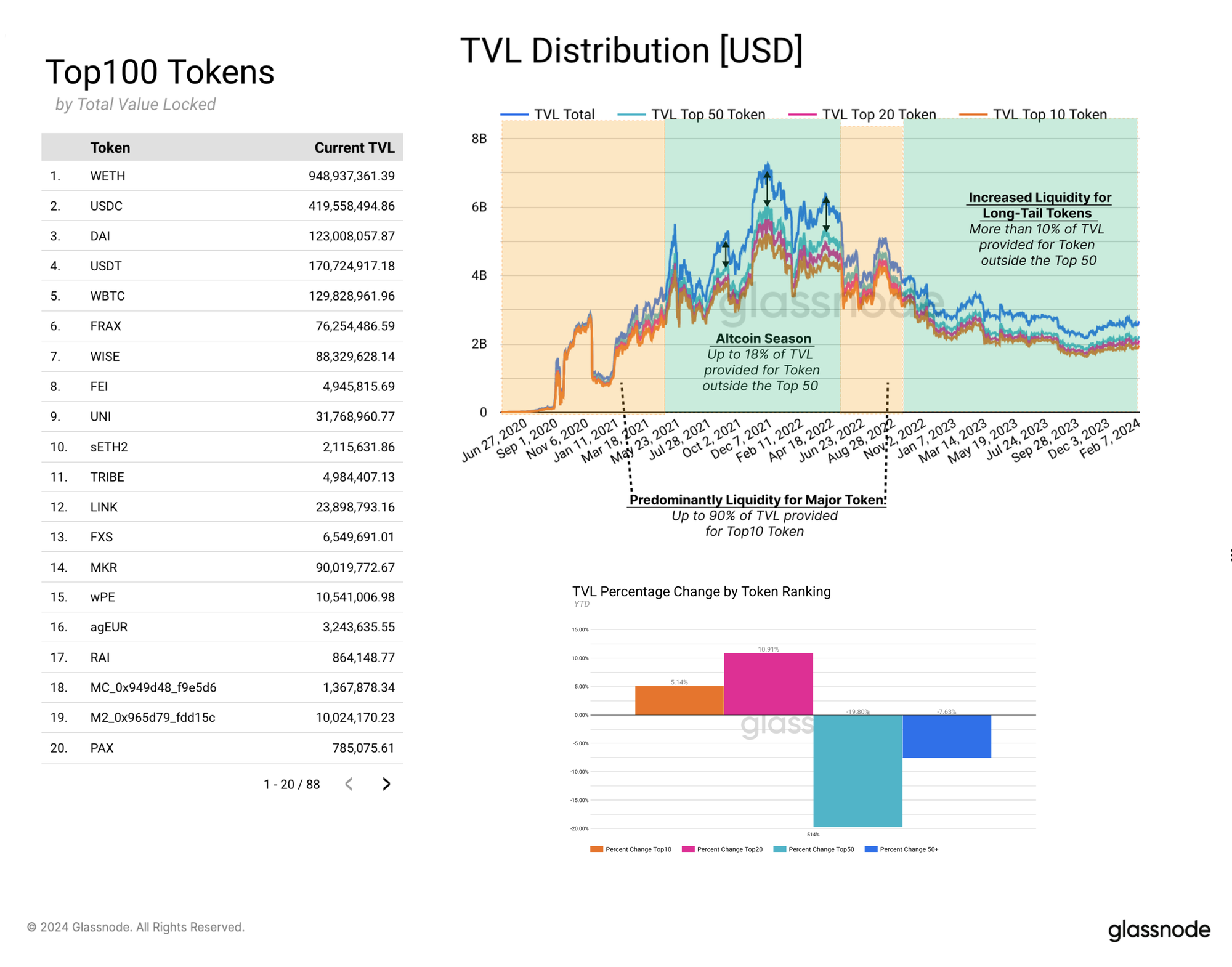

In a recent Glassnode report, a compelling trend was observed in the Total Value Locked (TVL) on Uniswap, signaling burgeoning optimism in the DeFi space. During the altcoin season, there’s a notable uptick in the liquidity profile for tokens outside the Top 50, reflecting a burgeoning investor interest in long-tail tokens.

Source: Glassnode

Even though bear markets typically see liquidity concentrating in the top 50 tokens, where the bulk of trade happens, the current landscape is changing. The Top 10 tokens, which consist mainly of WETH, WBTC, and stablecoins, have witnessed an increase in liquidity by 5.14%, and the Top 20 by 10.9%.

Meanwhile, the shift away from tokens ranked 20 to 50 indicates a strategic move by investors to potentially higher-yielding assets.

This liquidity redistribution hints at a growing confidence in the market, as investors seem to be warming up to the idea of diversifying their portfolios with a broader range of assets. It’s a potential sign that the investors might look out for long-tail assets.

In conclusion, the DeFi space promises significant growth in the upcoming bull run.