The crypto-market has evolved into a dynamic landscape with various trading opportunities. One area that has gained significant traction is the Crypto Futures and derivatives market. With cryptocurrencies like Bitcoin and Ethereum taking center stage, investors and traders are delving into Futures contracts tied to these digital assets in pursuit of potential profits.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Traders’ behavior for the king coin

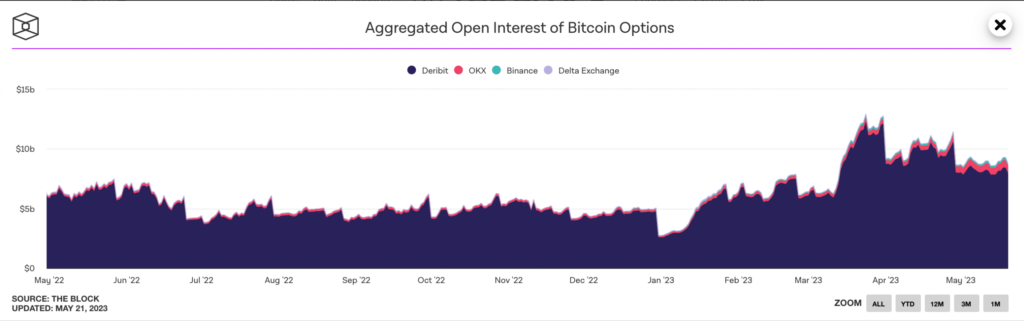

According to Glassnode’s data, the Open interest for BTC Futures contracts hit a one-month high on the Huobi exchange. However, the interest in trading Bitcoin Options wasn’t limited to just the Huobi exchange. Data provided by TheBlock suggested that Open Interest across the majority of exchanges in Bitcoin had surged.

For context, Open Interest in the context of cryptocurrencies refers to the aggregate number of active Futures contracts that have not yet been settled or closed. It serves as a crucial metric for assessing market participation and the potential liquidity within the crypto futures market.

At press time, a total of $8.72 billion BTC Options were being traded on various exchanges.

Source: TheBlock

A vast majority of most of these trades were happening on Deribit. At the time of writing, Deribit accounted for 90.91% of all Open Interest coming from centralized exchanges.

Even though the Open Interest in Bitcoin was rising, the volume of Bitcoin Options across exchanges started to fall. In the last 3 months, the volume for these Options fell from $32.17 billion to $13.56 billion.

Source: TheBlock

Traders see green, but optimists face the heat

In terms of liquidations of these positions, it was observed that the number of liquidations for BTC Options had started to decline over the last few days. Liquidations typically occur when traders are unable to meet margin requirements or maintain sufficient collateral to support their leveraged positions.

Lower exchange liquidations can also be seen as a positive sign for market participants. Especially as it suggests that traders are better managing their positions and avoiding significant losses.

Despite the relatively low number of liquidations, there was significant disparity between long liquidations and short liquidations, with the former outnumbering the latter by a considerable margin. This indicated that the traders who were betting on BTC’s price to rise suffered more losses compared to traders holding short positions at press time.

Source: Coinglass

What are Ethereum traders up to?

Not only did BTC see a surge in Open Interest, but Coinglass’ data also indicated a hike in Open Interest for Ethereum Futures in recent months. At the time of writing, the Open Interest for ETH across all exchanges stood at $5.60 billion.

Source: coinglass

Additionally, the Put to Call ratio for Ethereum declined during this period. A declining put-to-call ratio suggests that traders are much more optimistic about the future of ETH’s price and are expecting it to move in a positive trajectory.

Coupled with that, the ATM 7 Implied Volatility for Ethereum Options declined to 36.72%. This means that the implied volatility of Ethereum options with a strike price at-the-money (ATM) and an expiration period of 7 days has fallen.

A decline in implied volatility suggests that the market perceives a decrease in the expected magnitude of price fluctuations for Ethereum over the specified time frame. This fall in implied volatility could be interpreted as a decrease in uncertainty or a perception of a more stable market environment for Ethereum Options.

Source: TheBlock

Another indicator of a potential decline in volatility for Ethereum Options is the falling variance premium for Ethereum. Over the last few weeks, the variance premium for Ethereum has fallen from 17 to 14.

Realistic or not, here’s ETH’s market cap in BTC’s terms

This showcased that the difference between the implied volatility (expected future price volatility) and the actual realized volatility of Ethereum fell. A decline in the variance premium suggests that market expectations of future price fluctuations have become more aligned with the historical levels of volatility.

Source: TheBlock

HODLers’ outlook

However, things could take a turn for the worse soon. BTC and ETH saw a surge in their MVRV ratios over the last few weeks. The rise in MVRV ratios suggested that most of these addresses’ holdings were profitable. The profitability of their holdings could incentivize the addresses to sell.

If the holders respond to this incentive by selling, it could drive down the prices of both of these cryptos in the future.

Source:Santiment