- Aptos’s NFT trading volume plunged, with a substantial decrease in the number of transactions as well.

- Development activity showed clear signs of a rebound at the time of writing.

On 24 February, Aptos [APT] provided key updates on some of its most popular projects. One of the main highlights was Martian Wallet’s partnership with Jujube Finance, which would allow Martian users to access features of the latter.

Realistic or not, here’s APT’s market cap in BTC’s terms

Another important update was for the Web3 gaming ecosystem, as METAPIXEL announced the dates for the community test of Gran Saga Unlimited.

#APTOS ECOSYSTEM 24H UPDATE

1/ @BloctoApp A Multichain wallet support #Aptos blockchain has closed a Series A funding round at $80M

2/ @Mises001 just announced a new partnership with @kanalabsAnd some great news

Like &

to support us!#Aptos #AptosEcosystem #Web3 pic.twitter.com/n37CE4NCYc

— Aptos Insiders (@Aptos_insiders) February 24, 2023

Aptos started 2023 with a bang, and much of this meteoric rise was powered by its growing list of partnerships and product launches.

However, the juggernaut has come to a halt. Since the start of February, the ‘Solana Killer’ lost over 30% in its value, wiping out nearly $780 million of its market cap.

Lull in DeFi, NFT activity

One of the primary drivers of APT’s pump in January was the growth of DeFi protocols on the network. However, the activity has significantly tapered down. According to data from DeFiLlana, Aptos’s total value locked (TVL) declined 15% since the start of February.

Source: DeFiLlama

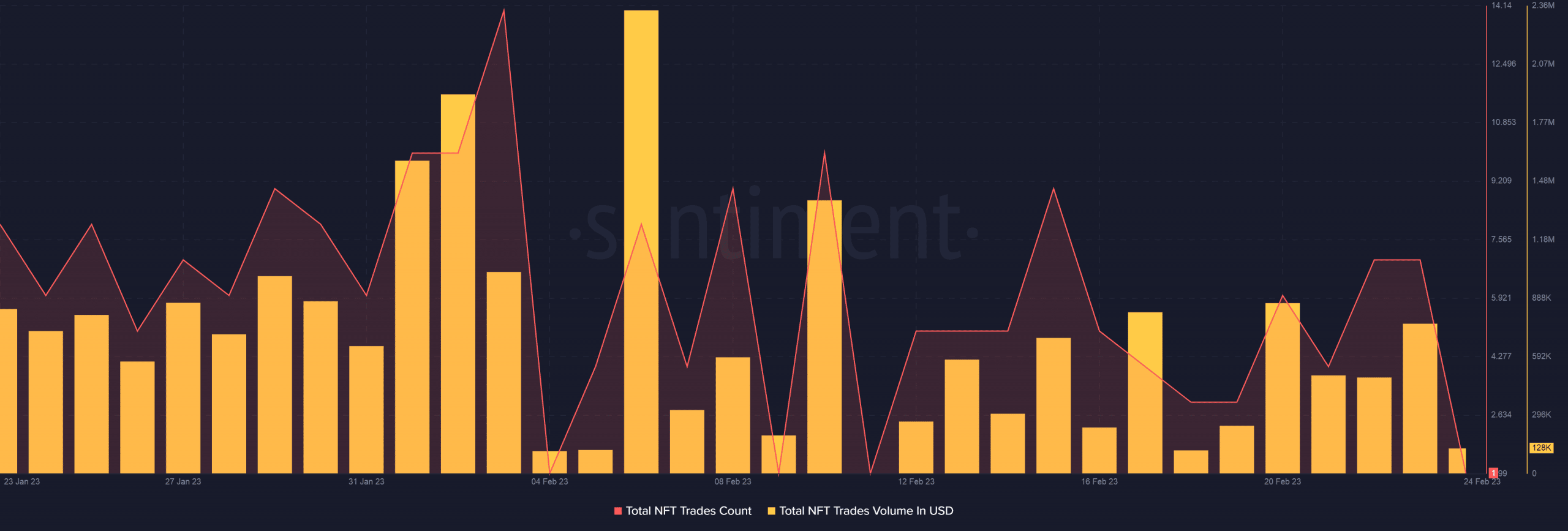

Another reason behind the drag could be the dwindling NFT momentum. Since hitting a three-month high on 6 February, the trading volume has plunged while there was a substantial decrease in the number of NFT transactions as well.

This is significant as a lot of NFT collections were launched on the Aptos network, which helped in improving the overall appeal of the network.

Source: Santiment

No respite in sight for APT?

Additionally, APT’s overall trading activity dipped over the last week, as its transaction volume plummeted by nearly 66%.

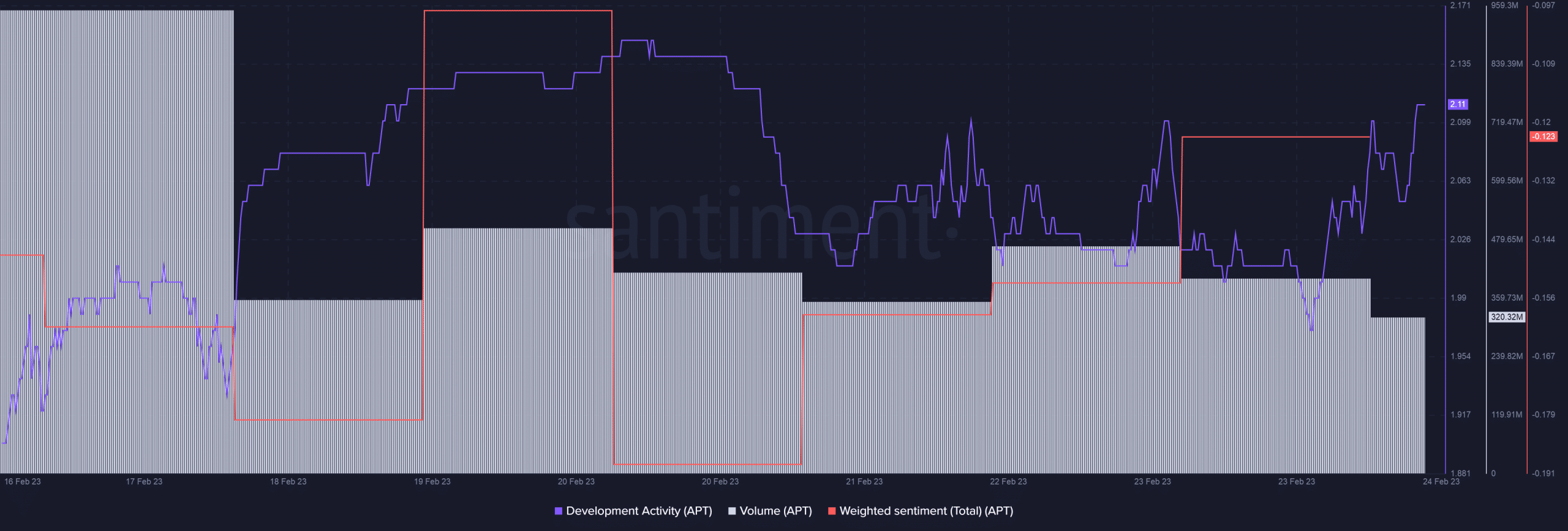

However, the development activity showed clear signs of a rebound at the time of writing. This implied that the network was steadfast towards its technical milestones and could meet its deadlines.

Source: Santiment

A jump in development activity caused investor’s sentiment to soar as well, as indicated by Aptos’s weighted sentiment. However, it should be noted that this metric was still in negative territory.

How much are 1,10,100 APTs worth today?

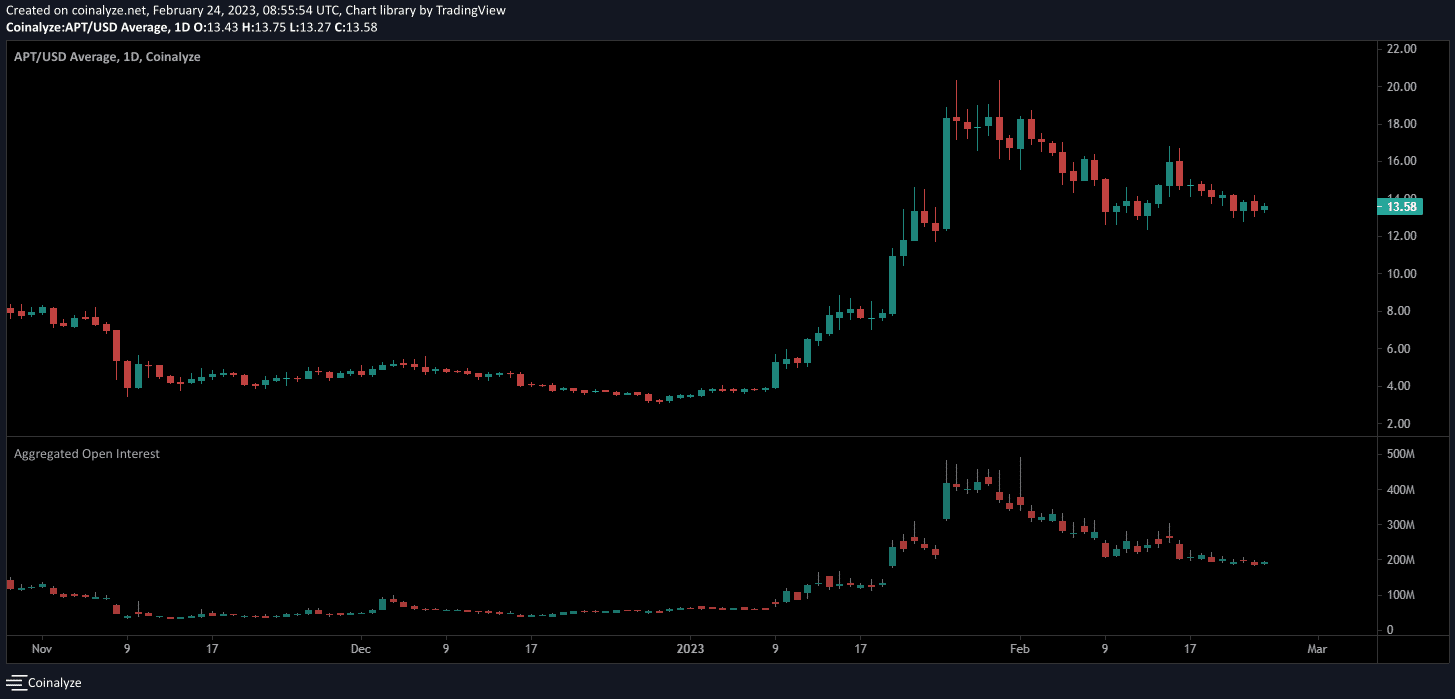

According to Coinalyze, APT’s Open Interest (OI) steadily declined over the past one month and matched the price action. This was a bearish signal and suggested that the prevailing trend could continue and APT could shed more value in the days to come.

At the time of writing, the token exchanged hands at $13.58, down 1.78% from the previous day, per CoinMarketCap.

Source: Coinalyze

![Cruising Aptos [APT] hits speed breaker – will it switch back to top gear?](https://cryptoinvestornewsnetwork.com/wp-content/uploads/2023/02/APTOS-1024x363.jpg)