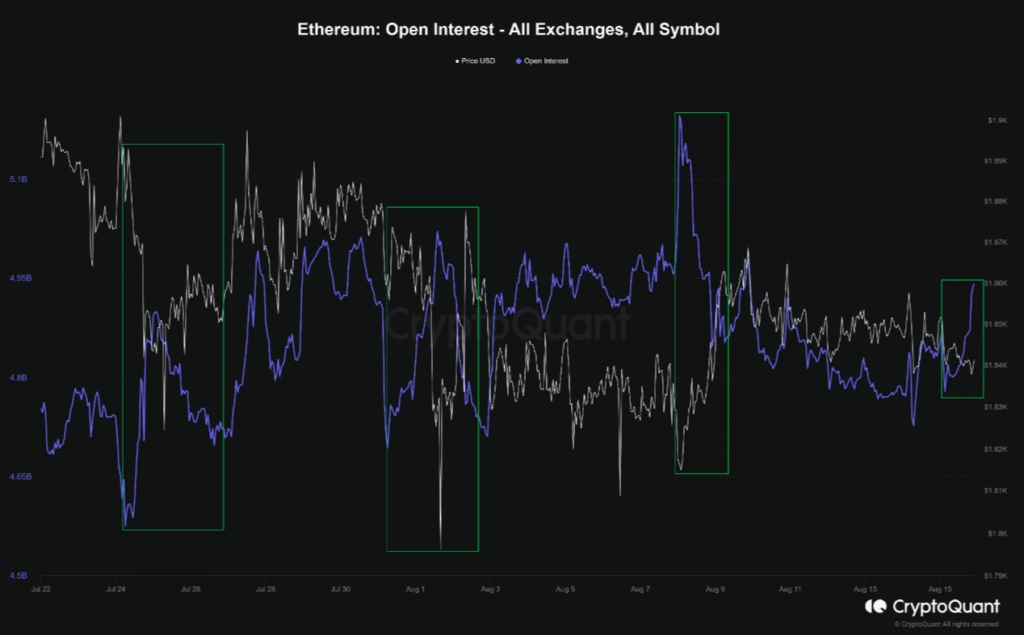

- ETH could recover if the open interest continues to decrease.

- However, the potential rebound to $2,000 depends on the average market behavior.

After enduring a period of low volatility and price retracement, Ethereum [ETH] was now standing at a crucial juncture, presenting a potential scenario for a rebound. This was the opinion of Korean on-chain analyst crypto sunmoon.

How much are 1,10,100 ETHs worth today?

According to sunmoon, ETH’s price decrease is usually followed by a rise in open interest. As an indicator to determine market sentiment and price strength, the open considers the open contract held by participants at the end of a trading day.

Repeating patterns

Sunmoon, in his analysis, published on CryptoQuant, noted that a follow-up of an open interest decrease leads to ETH’s price recovery historically. And this was the current state of things. Furthermore, the analyst opined,

“If Ethereum’s price movement continues to be limited, a short-term bounce is possible.”

Source: CryptoQuant

With the ETH price hovering around the $1,825 mark, this observation could be necessary to gauge whether the altcoin is poised for a resurgence beyond the $2,000 level and into higher territory.

One metric that provides more insight into this is the Short Term Holder NUPL. This metric takes into account the behavior of short-term investors around a 155-day period. Using the Net Unrealized Profit/Loss (NUPL), the metric can identify if market participants are in a state of hope, denial, optimism, or euphoria.

At press time, the Short Term Holder NUPL indicated that the broader market was in a state of hope (orange).

This means that the average ETH holder desires a price rise. However, most were not involved in intense buying to bring their wish to reality. Unless buying pressure increases, ETH may continue to consolidate.

Source:Glassnode

Bullish traders should be careful

How about traders? Well, indications from the funding rate suggested that traders are bullish on the ETH price action.

Funding rates are periodic amounts paid between traders that hold perpetual contract positions. When the funding rate is positive, it implies that traders are bullish. Furthermore, this also implies that longs pay short a funding fee to keep their positions open.

Conversely, a negative funding rate implies that short positions are dominant. Therefore, at 0.009%, the funding rate suggests that traders have a similar sentiment to short-term holders.

However, the exchange inflow could be a stumbling block to ETH’s potential rise to $2,000. Additionally, the exchange inflow measures the number of assets moving from non-exchange wallets to exchange wallets.

An increase in the metric tends to support a potential to sell off. While a decrease implies a possible decision to keep for the long term.

Is your portfolio green? Check the Ethereum Profit Calculator

![Ethereum [ETH] funding rate and exchange inflow](https://statics.ambcrypto.com/wp-content/uploads/2023/08/Ethereum-ETH-11.29.23-16-Aug-2023.png)

Source: Santiment

At press time, ETH’s exchange inflow spiked to 57,700. If the exchange inflow continues to outpace the outflow, then ETH’s potential rise to $2,000 might be difficult.