In the ongoing legal confrontation between cryptocurrency exchange giant Coinbase and the U.S. Securities and Exchange Commission (SEC), District Judge Katherine Polka Failla has raised eyebrows in the crypto community with her probing questions and comments related to the SEC’s 2021 approval of Coinbase’s S-1 filing. The relevant courtroom exchanges unfolded during a pre-motion hearing on July 13 and centered on Coinbase’s initial public offering (IPO) in 2021.

Coinbase’s IPO, which required an effective S-1 filing with the SEC, allowed the company’s shares to be publicly traded for the first time. S-1 filings are the type of registration required by the SEC for new securities for public, U.S.-based companies. In June, the SEC filed a civil lawsuit against Coinbase alleging securities law violations, though it raised no concerns at the time of the IPO, a contrast Judge Failla called out in the case’s hearing held last week.

Moving the legal goalposts

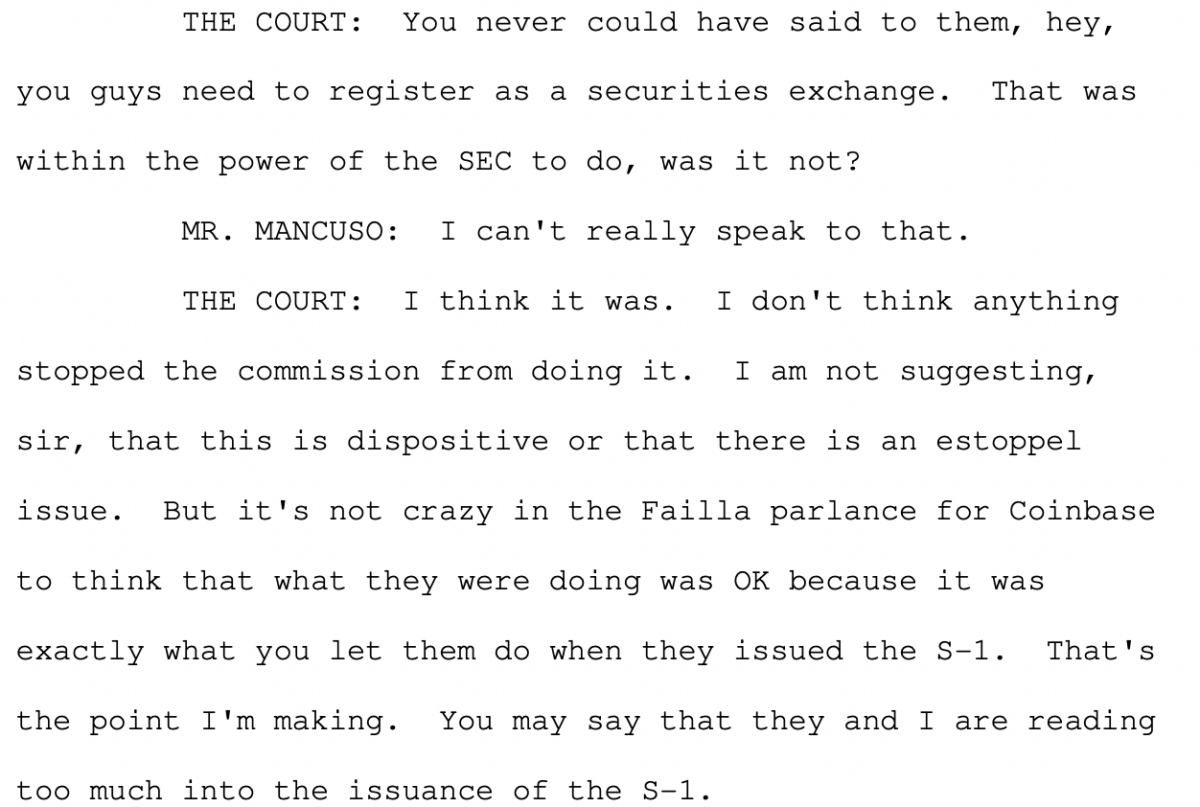

In court documents revealing the conversation that took place during the hearing, Judge Failla conjectured that Coinbase may have inferred their actions as permissible from the SEC’s lack of opposition during the S-1 filing process.

The SEC’s legal counsel was quick to clarify, arguing that the acceptance of the S-1 filing does not imply approval of the company’s underlying business model or operations:

“Simply because the SEC allows a company to go public does not mean that the SEC is blessing the underlying business, or the underlying business structure, or saying that the underlying business structure is not in violation of the law,” they said.

The SEC’s counsel could not provide evidence to confirm that the regulatory body had examined specific assets listed on Coinbase’s platform or assured the cryptocurrency exchange that they wouldn’t be deemed security later on. This discrepancy in the SEC’s actions during Coinbase’s IPO process attracted Judge Failla’s scrutiny, who further suggested that the SEC’s position on the S-1 filing required skepticism.

In the court’s view, the SEC may have done well to have conducted its due diligence into the company’s business practices during the evaluation of Coinbase’s S-1. This, Judge Failla believes, could have alerted Coinbase to potential future problems in their business operations. Even though she did not expect the SEC to be “omniscient,” she expressed a belief that they should have had some foresight into potential conflicts between Coinbase’s business and securities laws.

A change in the regulatory wind?

This distinction was one that Steven Peikin, part of Coinbase’s legal team and a former co-director of the SEC’s enforcement division, also pressed. Peikin pointed out the SEC’s historical practice of declining to review registrations from sectors like cannabis and betting. Reinforcing Judge Failla’s skepticism, Peikin argued that the SEC’s authorization of Coinbase’s S-1 carried more legal weight than the regulatory body claimed.

While the proceeding represents a small portion of the SEC’s lawsuit against the exchange, there have been few instances of judicial representatives either empathizing with the arguments presented by crypto exchanges or ruling in their favor. Some in the Web3 community are eager to see this as a sign that the position of Web3-native companies operating in the NFT and crypto sphere are less invalid than the SEC has made them out to be in its regulatory approach.

Editor’s note: This article was written by an nft now staff member in collaboration with OpenAI’s GPT-4.