Tom Emmer, Republican Congressman for Minnesota, wrote a letter to the Chairman of the Federal Deposit Insurance Corporation (FDIC), Mark Gruenberg, on March 15 expressing his concerns about the recent closures of digital asset and tech-centered banks like Silvergate, Signature Bank, and Silicon Valley Bank.

FDIC weaponizing banks

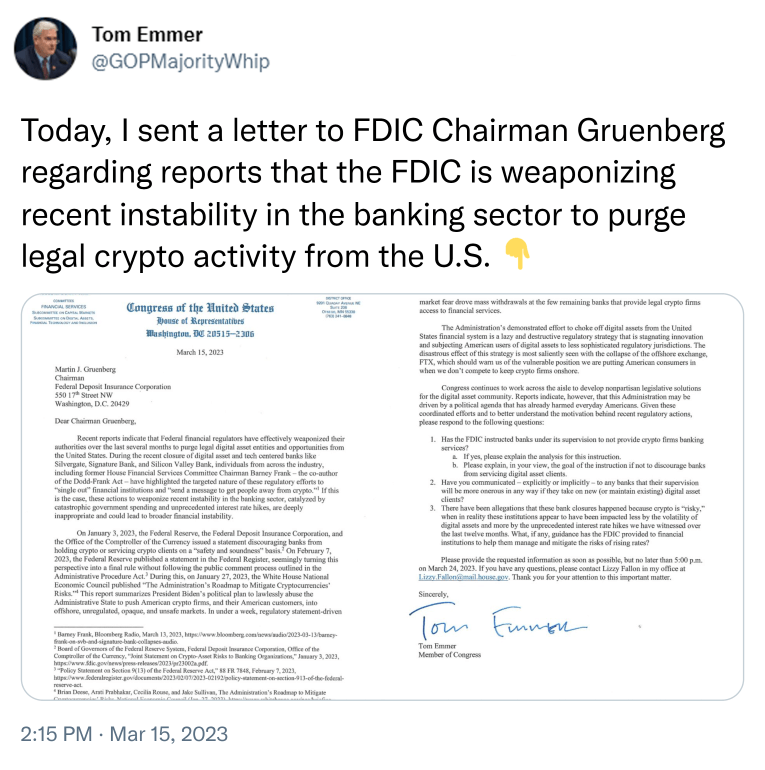

Emmer shared the letter on Twitter, declaring that “the FDIC is weaponizing recent instability in the banking sector to purge legal crypto activity from the U.S.” The Congressman believes federal financial regulators have weaponized their authority to purge legal digital asset entities and opportunities from the U.S., leading to broader economic instability.

In the letter, he also questioned the allegation that the FDIC instructed banks not to provide crypto firms with banking services and asked whether they have communicated to any banks that their supervision will be “more onerous” if they take on new or maintain existing digital assets clients.

He also asked what guidance the FDIC has provided to financial institutions to “help them manage and mitigate the risks of rising rates,” comparing the “risky” volatility in crypto with the current state of traditional assets.

Emmer is seeking answers to his questions by March 24, to understand the motivation behind recent regulatory actions better. The Congressman urged the FDIC to guide financial institutions to help them manage and mitigate the risks of rising interest rates instead of targeting digital asset entities.

Industry reaction

Both Gemini co-founders Cameron and Tyler Winklevoss shared the tweet as the twins continue to push for more precise and relevant crypto regulation within the U.S. In addition, Gemini stated on March 13 that “all Gemini customer U.S. dollars are held at JPMorgan, Goldman Sachs, and State Street Bank,” distancing itself from the contagion fallout from SVB, Signature, and Silivergate.

Others have followed in Emmer’s sentiment as Signature board member Barney Frank has also made multiple assertions indicating that the closure of Signature Bank is linked to cryptocurrency. For example, in a CNBC on March 13, Frank claimed that the bank’s shutdown sought to convey a forceful stance against crypto.

In addition, Messari founder, Ryan Selkis, stated on March 13 that Signature was still solvent.

“Signature was healthy. NYDFS went rogue in shutting them down, and surprised even the FDIC. It’s targeted.”

However, on March 14, the New York State Department of Financial Services (NYDFS) announced that the Signature Bank closure had nothing to do with cryptocurrency, directly contradicting Emmer’s claims. However, around 30% of Signature’s deposits were related to crypto companies, indicating significant exposure to crypto markets.

Further, other industry comments on the letter raised concerns that nothing tends to come of such tactics; as Mark Jeffrey from the Across the Chains podcast stated,

“It seems like you guys have no real power to actually DO anything about this — except write mean letters and scold people in ‘hearings’. Meanwhile, people like Gary Gensler and this guy run around vandalizing everything on a monster scale.”

In summary

The closure of digital asset and tech-centered banks has raised concerns among industry experts and lawmakers. In addition, Congressman Tom Emmer’s letter to the FDIC Chairman has shed light on the potential weaponization of regulators’ authorities to purge legal crypto activity from the United States.

While some industry insiders believe that the recent closures of banks like Signature are linked to cryptocurrency, others have contradicted these claims. It remains to be seen whether Emmer’s letter will result in any action from the authorities. However, it highlights the need for more transparent and more relevant crypto regulations in the U.S. as the industry looks for guidance from regulatory bodies to manage and mitigate risks while fostering innovation and growth.