- CHZ took on losses despite Chiliz not being directly exposed to events that triggered losses.

- CHZ bulls are looking to take over but the coast may not be clear yet.

Chiliz recently joined the list of crypto projects that have released statements regarding the state of exposure to recent market woes. An attempt at boosting investor confidence in a month that has so far seen an influx of FUD.

Realistic or not, here’s Chiliz market cap in BTC’s terms

Chiliz CEO Alexander Dreyfus recently noted that the network was not exposed to Silvergate, FTX, Celsius, SBV, or Signature.

His statement is on account of increased investor concerns regarding the state of most networks. A scenario that has led to liquidity outflows at least until things cool down. Dreyfus also added that Chiliz has instead focused on development.

For what it’s worth, @socios didn’t have any exposure on FTX, Celsius, 3AC, Silvergate, Signature, SVB, or any of the dramas of the last 12 months. We are a very conservative group of people, focusing on building @chiliz as an ecosystem. We are spectators of this clean-up.

— Alexandre Dreyfus 🇹🇷 (@alex_dreyfus) March 10, 2023

Unfortunately, Chiliz’s native crypto CHZ still experienced the impact of the market turmoil caused by those black swan events in the last 12 months. As a result, CHZ was unable to hold on to its January gains. Instead, it pulled back in the last three weeks, wiping out previous gains.

CHZ price recap

CHZ exchanged hands at $0.106 at press time after a 40% dip from its February highs. It also fell almost to its January low, followed by a slight bounce back just before it dipped into the RSI’s oversold zone.

Source: TradingView

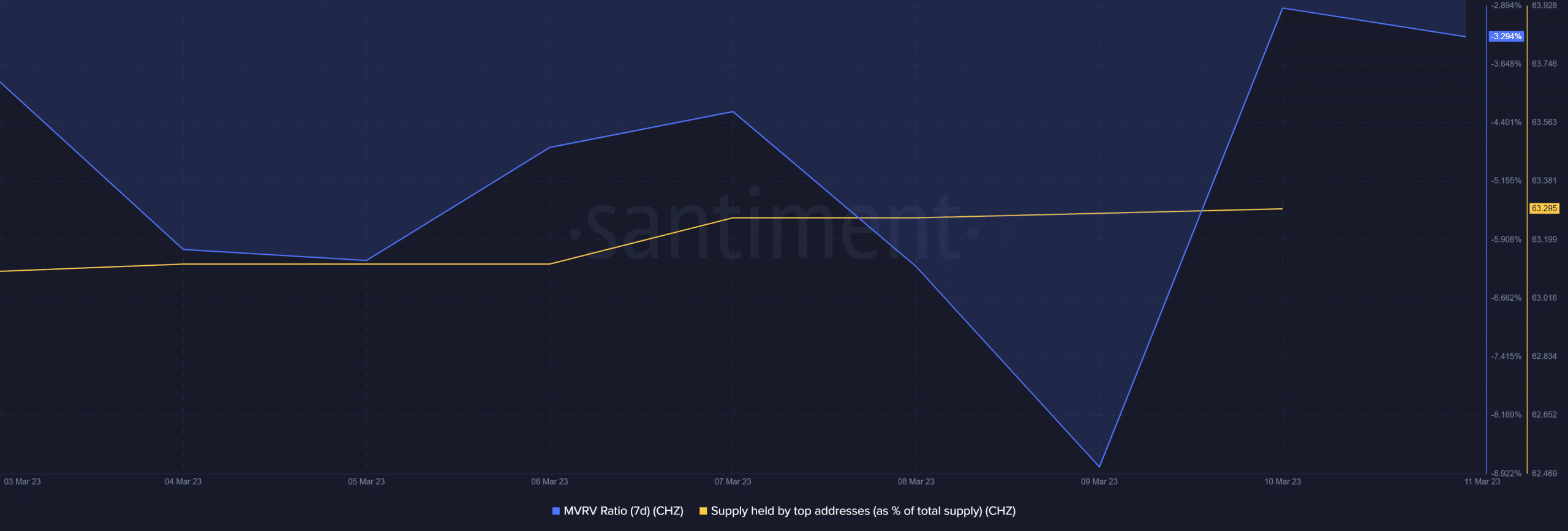

Can CHZ bounce back strong? Well, the MFI indicates that noteworthy accumulation has been taking place. One key indicator that supports this is the 7-day MVRV which bounced back on 9 March after falling to a weekly low.

Source: Santiment

The bounce back confirms a surge in CHZ accumulation in the last two days. It thus indicates that those who bought near the recent lows are now in profit after the slight price uptick that occurred on Friday.

More importantly, whales have been accumulating. The supply held by top addresses metric registered a marginal upside within the last seven days.

Is your portfolio green? Check out the Chiliz Profit Calculator

Whale accumulation is an important part because of the impact they have on price movements.

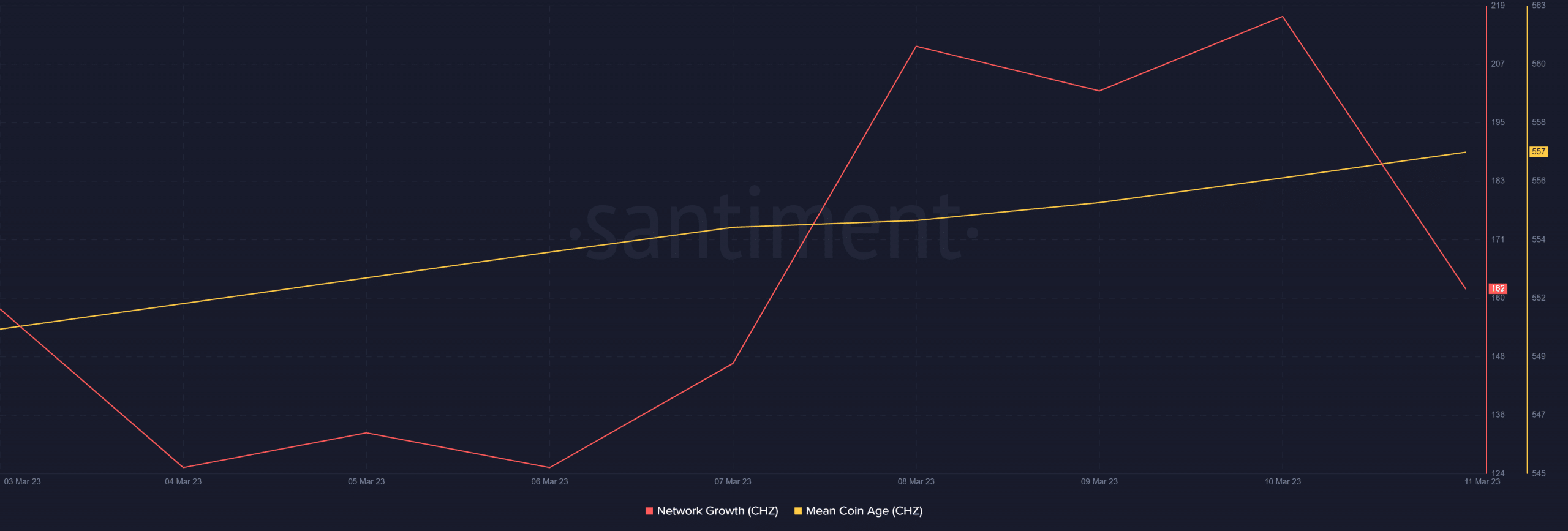

Meanwhile, the mean coin age achieved a steady incline in the last 7 days despite the price crash. A reflection of the aforementioned whale accumulation.

Source: Santiment

Network growth also improved during the same weekly period. However, it pivoted on Friday, but this pivot might just be an indicator that the selling pressure was dying down.

The observed whale accumulation may offer some relief against the downside. Nevertheless, it does not act as confirmation that prices will not continue falling.