- One of the crypto analysts states that BTC will likely remain above $20,000

- Ordinals improve the state of BTC miners.

In the last few days, Bitcoin dominated headlines as it surged past the $24K barrier, which remains an important psychological level.

Along with BTC’s prices, the skepticism around the spike also increased, with many calling the uptick to be a bull trap.

However, new data from an analyst suggested that even though BTC prices may fall, the decline will not be too drastic.

Read BTC’s Price Prediction 2023-2024

According to analyst Timothy Peterson, the chances of Bitcoin dropping below the $20k mark is less than 1%. Timothy believes that most investors would quickly buy any dips below $20k.

One of the factors cited behind this reasoning was- 50% of all risk asset holders are waiting to buy dips.

In case, if the king coin goes back to the $20,000 level, it surely would impact the short-term holders. But this would be a good opportunity for the long-term holders.

Notably, the number of long-term HODLers of Bitcoin grew immensely in the past few days, according to data provided by glassnode.

📈 #Bitcoin $BTC Amount of HODLed or Lost Coins just reached a 5-year high of 7,617,132.238 BTC

View metric:https://t.co/dJK8rxCtsB pic.twitter.com/30Cxi6ULh1

— glassnode alerts (@glassnodealerts) February 18, 2023

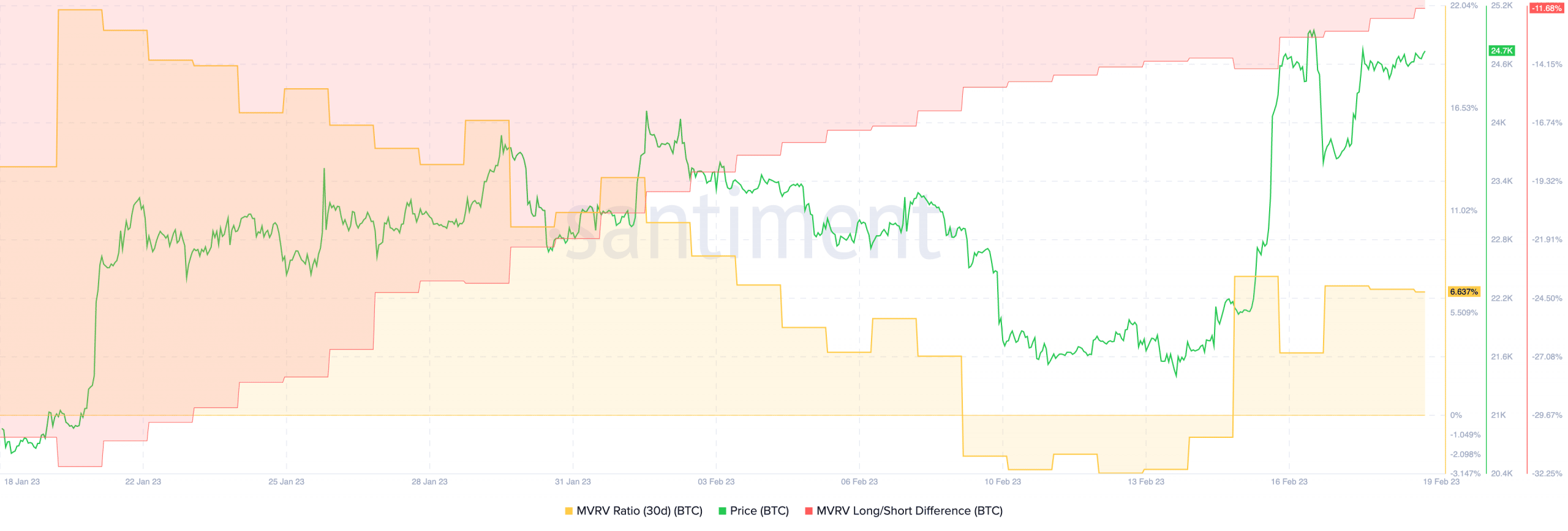

These long-term holders did not have a lot of incentives to sell. According to data provided by Santiment, Bitcoin’s MVRV ratio was positive but only by a small margin. It suggested that many Bitcoin holders would still have to wait before their holdings could turn highly profitable.

Surprisingly, the number of short-term holders also declined over the last week as indicated by the growing long/short difference.

Source: Santiment

One section of Bitcoin which was plagued by selling pressure was the mining sector. However, with the introduction of Ordinals, the state of BTC miners has improved considerably.

Miners see some hope

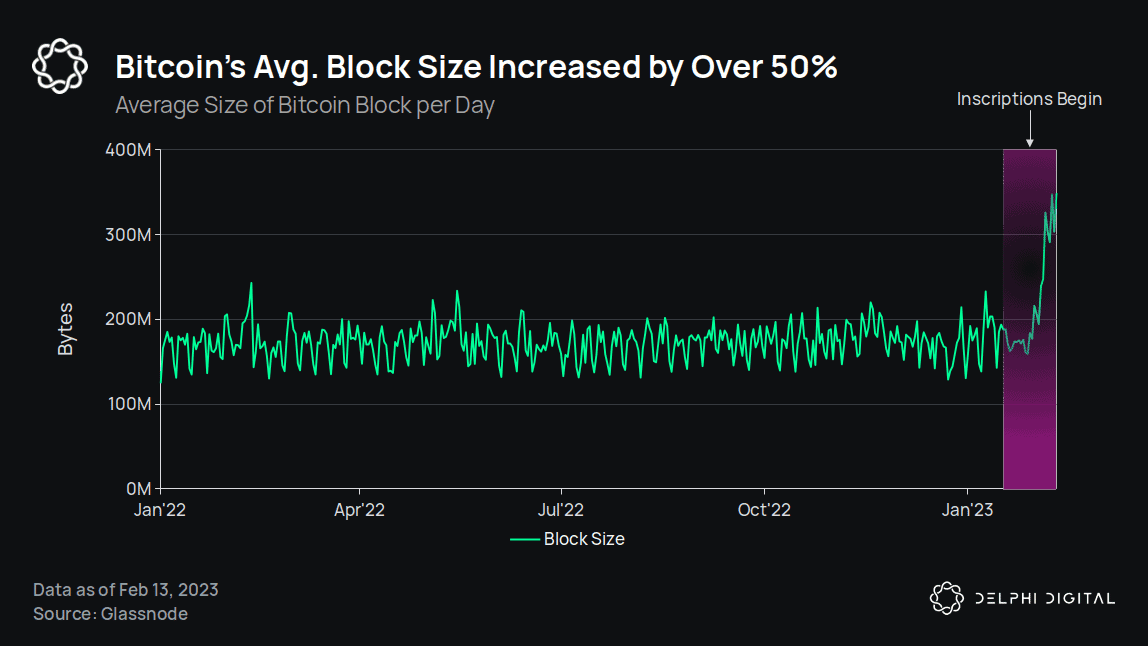

This was because miner profitability increased due to Ordinals. The reason for the growth in miner profitability was the increasing average block size of Bitcoin.

As the block size of Bitcoin increased, the number of fees earned by the miners grew. Thus, impacting the overall revenue generated.

According to Delphi Digitals data, Ordinals accounted for 12.5% of Bitcoin’s daily fees collected.

How much are 1,10,100 BTC worth today?

The growing block size not only helped miners but also aided the overall Bitcoin network by increasing the security of the blockchain.

Source: Delphi Digital

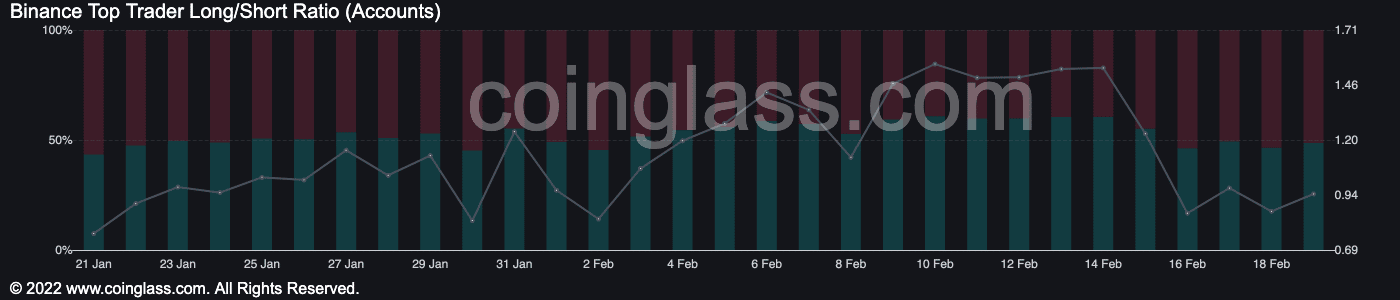

However, despite these improvements, traders remained skeptical of BTC’s growth. According to coinglass’s data, the number of short positions taken against BTC increased over the past few days.

Source: coinglass

Well, only time will tell how all these factors will impact Bitcoin in the long run.