- Network activity suffered a decline on Cardano in Q2.

- Meanwhile, DeFi TVL and network revenue rallied.

Layer-1 smart contract network Cardano [ADA] saw a slight decline in network activity during the second quarter of 2023, according to a new report by Messari.

Read Cardano’s [ADA] Price Prediction 2023-24

However, other key ecosystem growth metrics rallied, including the number of daily on-chain transactions, the Total Value Locked (TVL) in Cardano DeFi protocols, and the chain’s revenue.

Cardano failed to attract new users in Q2 because…

Despite the growth in the number of decentralized finance (DeFi) protocols that launched on Cardano between 1 April and 30 June, the Proof-of-Stake (PoS) network experienced a decline in the count of daily active addresses and the number of new addresses created daily.

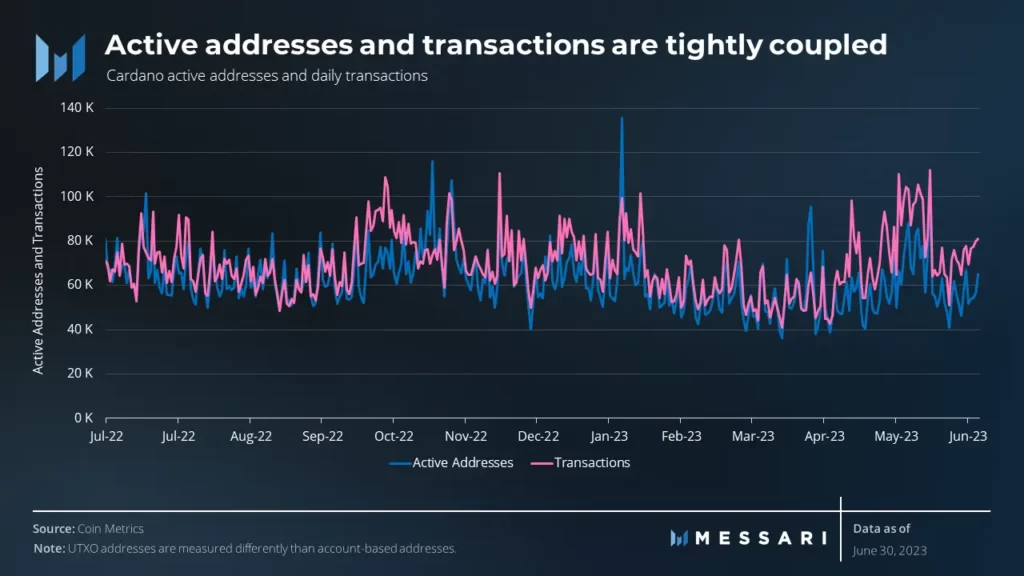

According to the report, in Q2, the average daily active address count on Cardano was 57,821. This represented a 4% decrease from the 60,208 recorded as the average daily active address count in Q1. Messari acknowledged:

“This marks the fourth QoQ decrease in address activity in the past five quarters.”

While many expected the new DeFi protocols to bring in new users to the Cardano blockchain, the reverse was the case. Per Messari, the average daily new addresses fell by 103% during the period under review.

However, in spite of all this, the number of transactions completed daily increased. As confirmed in the report:

“Transaction activity, on the other hand, did increase in Q2. Average daily transactions were up 1.9% QoQ from 67,500 to 68,800.”

Although a network’s transaction count and its active addresses count are typically correlated and often trend in the same direction, Messari found that for Cardano, they “have deviated slightly in recent quarters.” While many may naturally think this concerning, Messari added:

“The ratio of transactions to active addresses has been growing steadily over the past five quarters, suggesting that the average user is more active now than they previously were.”

This suggests that the decline in active addresses suffered in Q2 was not a result of a decrease in user activity but instead due to a reduction in the number of users who are simply holding ADA and not transacting with it.

Source: Messari

How much are 1,10,100 ADAs worth today?

Shout out to the stablecoins

In the quarter under review, the TVL held across the DeFi protocols housed with Cardano increased by 7%. The TVL growth occurred despite a persistent decline in ADA’s value in Q2.

According to Messari:

“Stablecoins, arguably the most important piece of infrastructure that is fueling this TVL run, also grew in both absolute and relative terms. The total stablecoin market cap grew 34.9% QoQ from $10.0 million to $13.5 million. Relative to other networks, Cardano’s stablecoin market cap moved up from 54th to 37th in 2023.”

Source: Messari

Regarding the chain’s revenue, Cardano’s quarterly revenue increased by double digits. In Q2, Cardano’s revenue totaled $788,290.

Source: Messari