Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ADA formed a descending channel pattern since mid-February.

- ADA recorded significant whale activity.

Cardano [ADA] has depreciated since mid-February and formed a descending channel. But it rallied despite an overwhelming bearish sentiment as the market headed for the U.S. Jobs Report on Friday (March 10).

Read Cardano [ADA] Price Prediction 2023-24

The price action dropped below $0.3000 before a strong recovery on Friday that breached the descending channel. A pullback retest on the breached level could offer new buying opportunities if Bitcoin [BTC] defends the $20K support level.

Will the recovery continue?

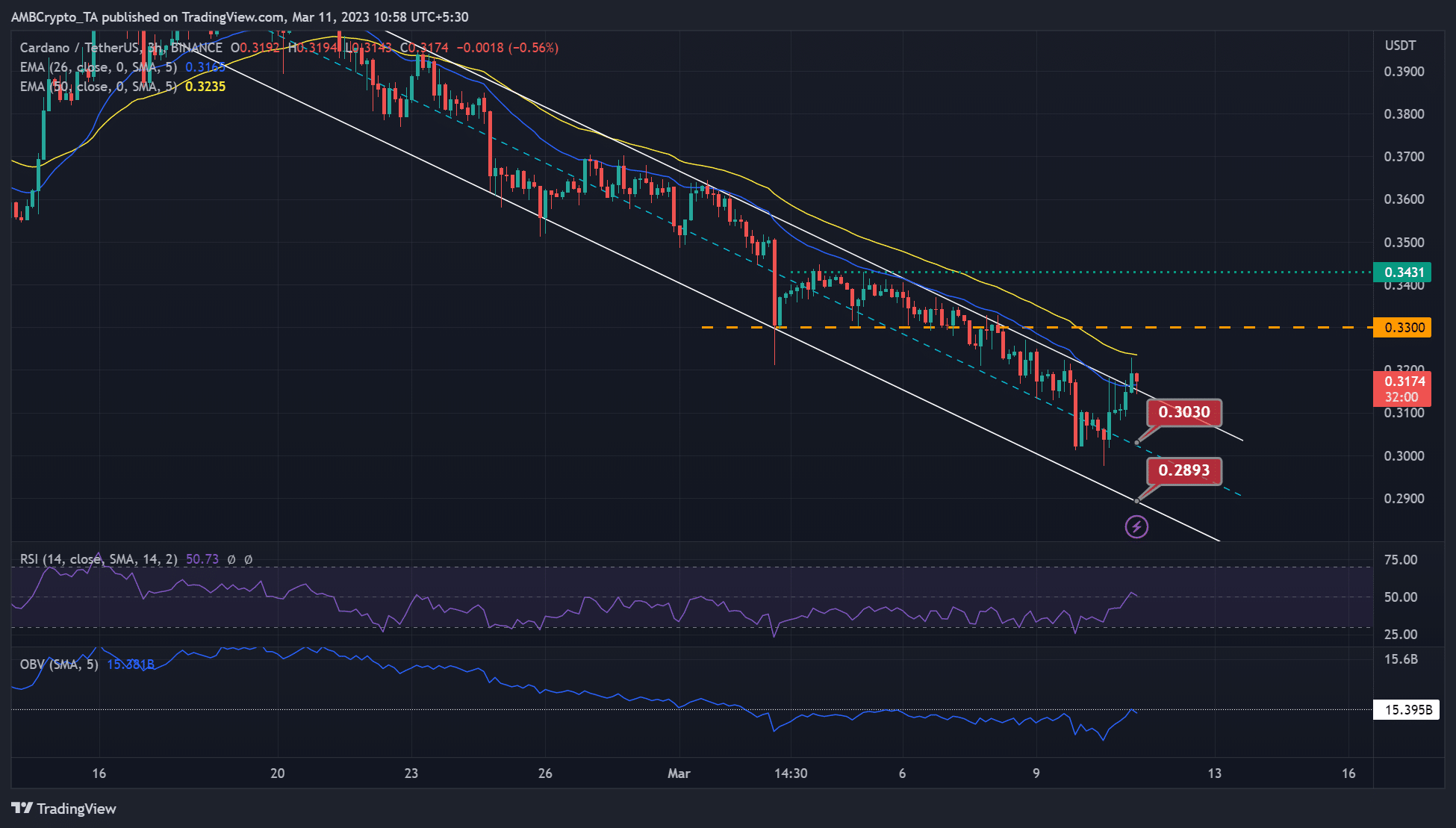

Source: ADA/USDT

ADA retested the channel’s upper boundary twice before inflicting a bullish breakout and clearing the 26-period EMA (exponential moving average) of $0.3165. But bulls’ efforts were stopped by the 50-period EMA of $0.3235.

A retest of the pullback and subsequent bounce from the channel’s upper boundary could confirm the continued recovery. As such, near-term bulls could make moves and target the 50-period EMA or $0.3300 if BTC doesn’t drop below $20K.

A drop back into the descending channel will invalidate the above move. Confirmation of further drop could offer shorting opportunities at the $0.3101 channel’s mid-level ($0.3030) or $0.2893 in an extreme scenario if BTC breaks below $20K.

The RSI retreated from oversold territory and reached equilibrium, showing strong buying pressure on March 10. However, it faced a few rejections at the mid-level in the past and could face another if the trend repeats.

On the other hand, the OBV also exhibited an uptick and could offer bulls leverage if it goes beyond the 15B level.

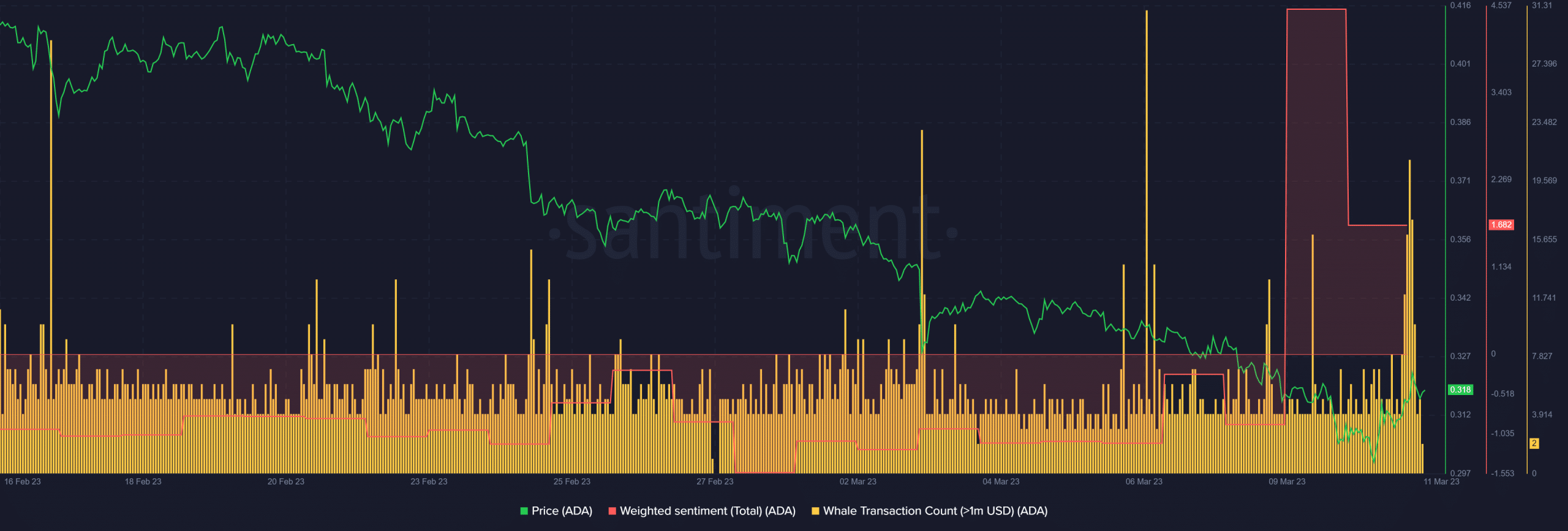

ADA recorded significant whale activity

Source: Santiment

ADA’s sentiment remained positive despite the bearish sentiment witnessed across the market on 10 March. Although the sentiment dropped slightly, it remained positive as significant whales accumulated ADA at discounted rates.

Is your portfolio green? Check ADA Profit Calculator

The supply distribution reveals two major whales accumulated on 10 March; 100M – 1B token holders and 1M – 10M token holders. However, the dominant category holding 10M – 100M tokens, distributed its holdings.

Therefore, the recovery could continue if the initial two whale categories continue to accumulate. But BTC’s break below $20K could undermine a strong recovery.

Source: Santiment

![Cardano [ADA] inflicted a bullish breakout- Are short-sellers subdued?](https://cryptoinvestornewsnetwork.com/wp-content/uploads/2023/03/pasted-image-0-57-1024x582.png)