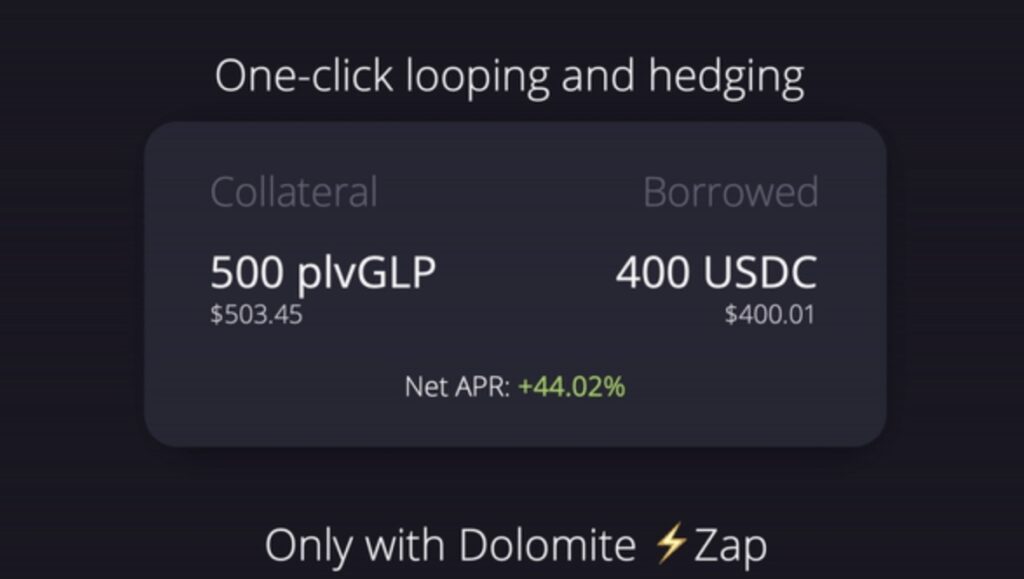

Dolomite, the lending and borrowing protocol operating on Arbitrum, has launched a new feature that can be filed under “Why didn’t anyone think of this sooner?”. Zap is a one-click collateral maximization solution, saving users from the chore of multiple depositing, borrowing, and re-depositing just to obtain leverage on their assets.

Dolomite Delivers a DeFi First

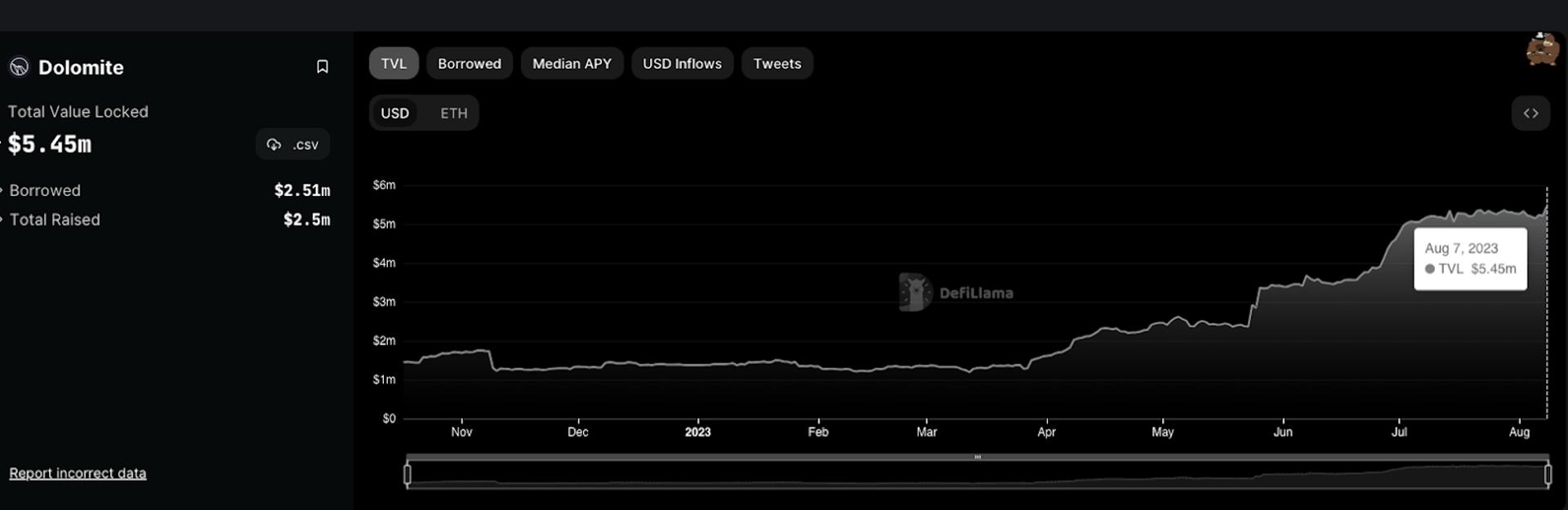

A top 50 protocol by total value locked (TVL), Dolomite is a DeFi primitive that’s very much on the up. This is demonstrated not simply by the rising value of its user deposits, but by the innovative products it’s been regularly releasing. While lending and borrowing protocols are plentiful within decentralized finance, Dolomite offers something different from the usual ETH-and-stables mix. For example, it enables margin trading on protocols like GMX using stablecoins and other DeFi assets, something that isn’t generally possible elsewhere.

Another problem that Dolomite solves is the yield dilemma. DeFi users are faced with a choice of competing protocols, each offering an ROI should they lock their capital into the smart contracts where it will be used to deepen total liquidity. Dolomite allows users to LP their assets in order to earn yield from AMMs and then to earn further interest from margin lending the same assets.

Zap, therefore, slots neatly into Dolomite’s product suite, extending the capabilities of the protocol’s existing offerings. Not only does Zap simplify the process of obtaining maximum capital, but it eliminates complexity, reducing the likelihood of users taking a wrong turn along the way. While experienced DeFi users are accustomed to looping their funds through numerous depositing-borrowing cycles, the process is cumbersome and confusing for new users.

Lending Dominates DeFi

Over the past 18 months, lending has grown to become the largest DeFi vertical, outsizing even DEX trading. This is partially due to the emergence of liquid staking derivatives (LSD) which have spawned an entirely new sector, LSDfi, in which staked assets can be used to secure other L2s and to earn yield elsewhere. In its H2 report for 2023, Binance Research notes that DeFi lending now boasts a TVL of $14.5 billion.

It goes on to add: “Another intriguing trend over the last few months has been the merging of lending platforms and stablecoin providers, showcasing a convergence that augments the utility and functionality of these DeFi categories…This development represents a key example of the increasing interoperability in the DeFi space, paving the way for future innovation and cross-functional solutions.”

Zap has the potential to play a modest role in supporting this trend; the ability to maximize borrowing power in a single click is a major boost for making lending simpler and safer. The ordinary looping process, while generally safe, does carry hazards for inexperienced users who risk being liquidated if they borrow too close to their liquidation threshold and prices change.

While Zap doesn’t eliminate the possibility of liquidation altogether, it allows users to borrow at a safe level in one go while giving them a clear overview of their health score. Should prices change, threatening their collateral, they can quickly top it up without needing to reverse the looping process as would ordinarily be the case. Zap is set to go live on Dolomite on August 8, ushering in a new era for lending on Arbitrum.