- The number of DOT stakes has increased over the last seven days.

- Most of the market indicators were bearish, but CMF was bullish.

Polkadiot [DOT] has been in the limelight for several months now because of its development activity, which has had quite a lot of volatility in the past few weeks.

Apart from that, Polkadot governance has also been a key highlight. Now the question is- Can Polkadot’s strong governance propel growth in the token’s price action?

Read Polkadot’s [DOT] Price Prediction 2023-24

Polkadot governance in a nutshell

To begin with, Polkadot makes use of a governance mechanism that enables it to change over time in response to the demands of its stakeholders.

The stated objective is to make sure that the network can always be controlled by the majority of the stakes. In order to decide whether to update the network, Polkadot brings together the council and the active token holders.

Polkadot proposals and voting system

Referenda are simple, inclusive, stake-based voting schemes. The blockchain has four ways to start a referendum – publicly submitted proposals, proposals submitted by the council, proposals submitted as part of the enactment of a prior referendum, and emergency proposals submitted by the Technical Committee.

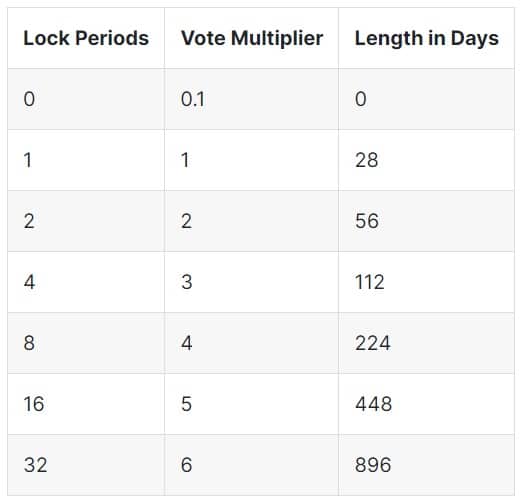

If there is at least one proposal in one of the queues, a new referendum will be put to a vote every 28 days. As per Polkadot’s official document, a voter needs to lock up their tokens for at least the enactment period after the referendum is over in order to cast a vote.

It is also possible to vote without locking, although considering their stake, casters’ votes are only worth a fraction of regular votes.

Source: Polakadot

Though Polkadot governance showed how it values the stakeholders, things from the investors’ point of view have not been great of late. The past month especially raised a concerning alarm as DOT’s price chart was red.

Is Polkadot adoption on the rise?

Polkadot Insider, a popular Twitter handle that posts updates related to the Polkadot ecosystem, revealed that DOT was only second to Ethereum [ETH] in terms of token incentives.

One of the positive signs of Token Incentives, when it goes high, is that it proves there were more participants in the network compared to others, leading to increased liquidity, usage, and adoption 🚀🧐

Below we listed the top 10 chains with the highest token incentives last… pic.twitter.com/iRmg8ep5Il

— Polkadot Insider (@PolkadotInsider) May 10, 2023

An increase in token incentives proves there are more participants in the network compared to other ecosystems, leading to increased liquidity, usage, and adoption.

Furthermore, Polkadot’s network stats also looked pretty healthy. According to Token Terminal, DOT’s fees and revenue generated over the last 30 days were stable, which was a positive signal.

Source: Token Terrminal

DOT staking witnesses growth

Meanwhile, Polkadot’s staking ecosystem grew over the last seven days. As per Staking Rewards’ data, the number of DOT stakers increased slightly last week.

At the time of writing, DOT had a staking ratio of over 41% and a staking market capitalization of nearly $3 billion.

Source: Staking Rewards

A quick look at DOT’s state in Q2 2023

It was surprising that, despite being known for its development efforts, Polkadot’s development activity actually dipped in the second quarter.

However, its social volume remained high, reflecting its popularity in the crypto space. But the popularity might not have been in a positive sense, and DOT’s weighted sentiments remained low for most of the time.

Source: Santiment

DOT’s Binance and DyDx funding rates remained relatively green. This was encouraging, as it suggested that DOT saw demand in the derivatives market.

Nonetheless, the token’s trading volume declined, which indicated that investors’ willingness to trade the token had taken a backseat.

Source: Santiment

While Polkadot governance and network stats looked promising, the token’s price action was not in favor of investors. According to CoinMarketCap, DOT’s price declined by more than 6% in the last seven days. At the time of writing, DOT was trading at $5.39 with a market cap of over $6.3 billion.

Realistic or not, here’s DOT market cap in BTC‘s terms

What about DOT’s future?

Polkadot’s anticipated performance shared a mixed signal, as a few market indicators were in the bulls’ favor while the rest suggested otherwise.

For instance, the Bollinger Bands data pointed out that DOT’s price was in a less volatile zone, which decreased the chances of a sudden northbound breakout. The MACD revealed that the bears were still controlling the market.

DOT’s Money Flow Index (MFI) also registered a downtick, which again was a development in the sellers’ favor. Nonetheless, DOT’s Chaikin Money Flow (CMF) went up. This gave rise to expectations for a trend reversal in the coming days.

Source: TradingView