PEPE has observed an impressive 60% rally recently. Here’s what on-chain data says regarding whether this rise can continue.

PEPE Has Seen Some On-Chain Metrics Light Up Recently

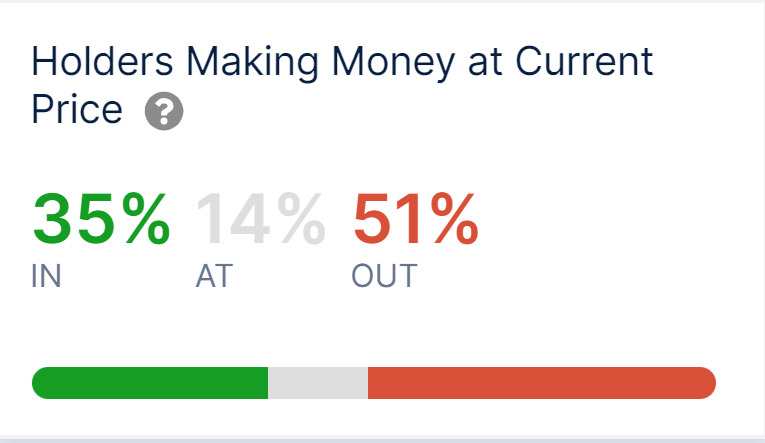

In a new post on X, the market intelligence platform IntoTheBlock has discussed how PEPE is looking in terms of its on-chain indicators currently. The first metric of interest here is the profit/loss breakdown of the memecoin’s user base.

The distribution of the PEPE holders based on whether they are in loss or profit | Source: IntoTheBlock on X

As displayed above, about 35% of the holders/addresses of the cryptocurrency are carrying their coins with some net unrealized profit right now. On the other hand, the loss investors amount to 51% of the network’s user base, meaning that the majority of the holders are in the red currently.

The remaining 14% of the addresses are breaking even at the current price levels of the asset. Generally, the investors carrying profits are more likely to sell their coins to harvest their gains, which means that if there are many holders in profit, significant selling pressure could arise in the market.

In the current scenario, however, more than 50% of the investors are still carrying their coins at a loss despite the recent 60% surge that PEPE has enjoyed. Thus, the potential selling pressure in the sector may not be too much yet. This could certainly be a positive sign for the rally’s sustainability.

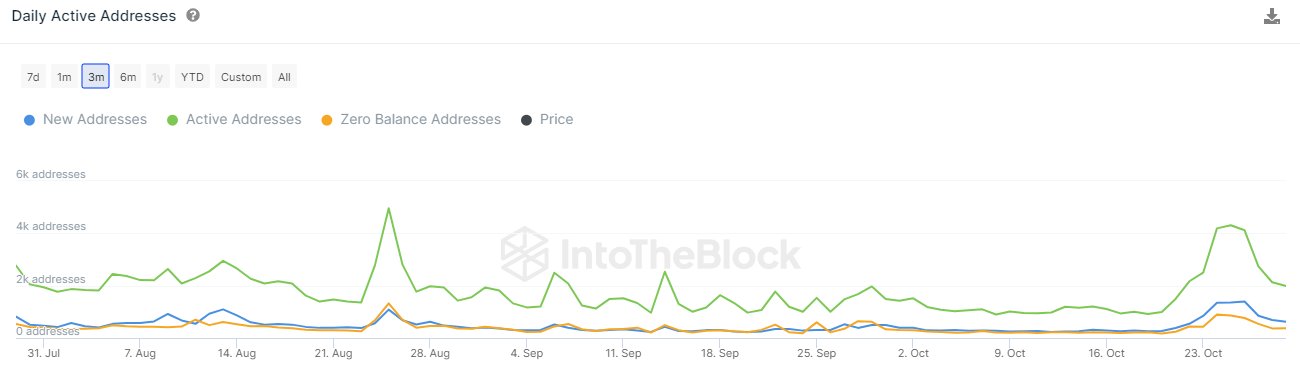

Next, IntoTheBlock has pointed out how the address activity related to PEPE has observed a significant boost recently.

Looks like the metrics have registered high values in recent days | Source: IntoTheBlock on X

According to the analytics firm, the active addresses jumped 372% between October 19th and 25th, while the new addresses increased by 440% in the same period.

The “active addresses” metric keeps track of the daily number of addresses participating in some transaction activity on the blockchain. In contrast, the new addresses indicator measures the daily number of wallets coming online on the network for the first time.

The sharp growth in these indicators would imply that network activity has been high recently, both in terms of usage and adoption. Historically, rallies have thrived in such conditions, as a large number of active traders is what such moves require to be sustainable.

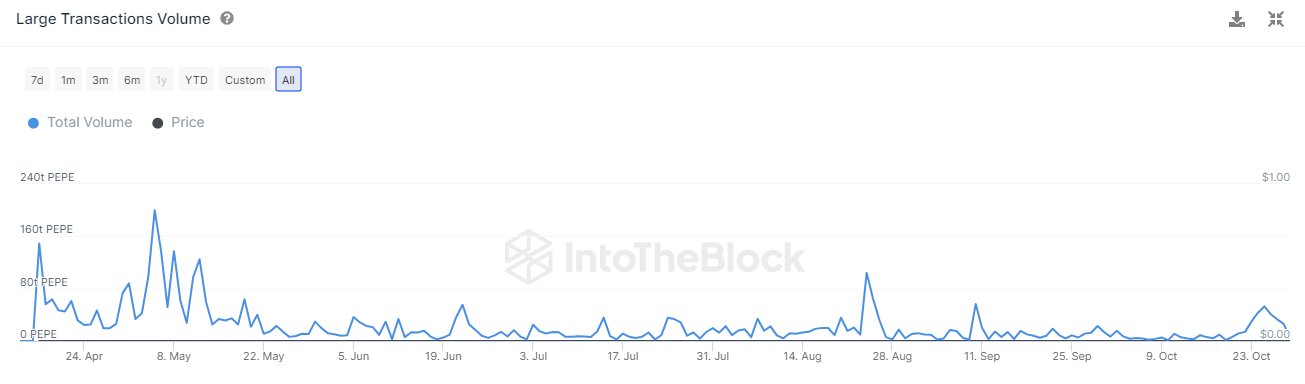

Lastly, IntoTheBlock has pointed out that while the PEPE whales haven’t shown concrete signs of accumulation yet, they have been potentially becoming active recently.

The metric has seen some uptick recently | Source: IntoTheBlock on X

From the chart, it’s visible that the “large transactions volume” has observed some rise recently. The large transactions refer to transactions worth at least $100,000 in value, usually made by the whales and institutional entities.

While the uptick in the activity of these humongous investors hasn’t been that much, it’s still an optimistic sign that these investors have been showing at least some interest in PEPE during this rally.

PEPE Price

Since its sharp rise, PEPE has gone stale in the last few days as its price continues to trade around $0.0000011672.

The memecoin has been trading sideways in the past week | Source: PEPEUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com