- USDC regained its peg after Circle moved quickly with new banking partners.

- USDC demonstrated signs of demand and volume recovery.

Circle faced its toughest week so far this year after USD Coin [USDC] lost its dollar peg. It has since recovered, but the stablecoin issuer just released a new update regarding its USDC operations.

According to the update, Circle redeemed 2.9 billion USDC and minted 700 million USDC on 14 March. Those efforts were part of its action plan to aid the peg recovery. More importantly, Circle announced that it was securing new transaction banking partners. The company’s goal is to facilitate round-the-clock transactions that will not be limited by regular banking hours.

Circle announced that it had redeemed 2.9 billion USDC and minted 700 million USDC on March 13. That was down from an earlier estimate of $4 billion to $12 billion without a U.S. government’s help for banks. Circle says it will continue to add new transaction banking partners… https://t.co/OgxuEPTVVb

— Wu Blockchain (@WuBlockchain) March 15, 2023

Circle further revealed that it had limited funds held by its transaction banking partners to support redemption and minting. It also revealed that it held a cash position of its reserve at BNY Mellon. Thus, at press time, it had on-ramps for users looking to move their funds into the crypto segment.

The move by Circle underscored plans to bypass regulators’ efforts to prevent banks from working with crypto companies. It also came just days after multiple banks collapsed, adding more pressure to the fiat system. As a result, more people were losing their trust in the fiat system, and this was a key factor that fueled the rally in the last three days.

USDC volumes are recovering

The aforementioned factors and the fact that USDC has regained its test have restored some confidence back into the stablecoin. The supply of USDC in smart contracts recently bounced back to a new four-month high.

$USDC Percent Supply in Smart Contracts just reached a 4-month high of 37.979%

Previous 4-month high of 37.735% was observed on 13 March 2023

View metric:https://t.co/eCjboyzLH7 pic.twitter.com/YKXLRAOwTy

— glassnode alerts (@glassnodealerts) March 15, 2023

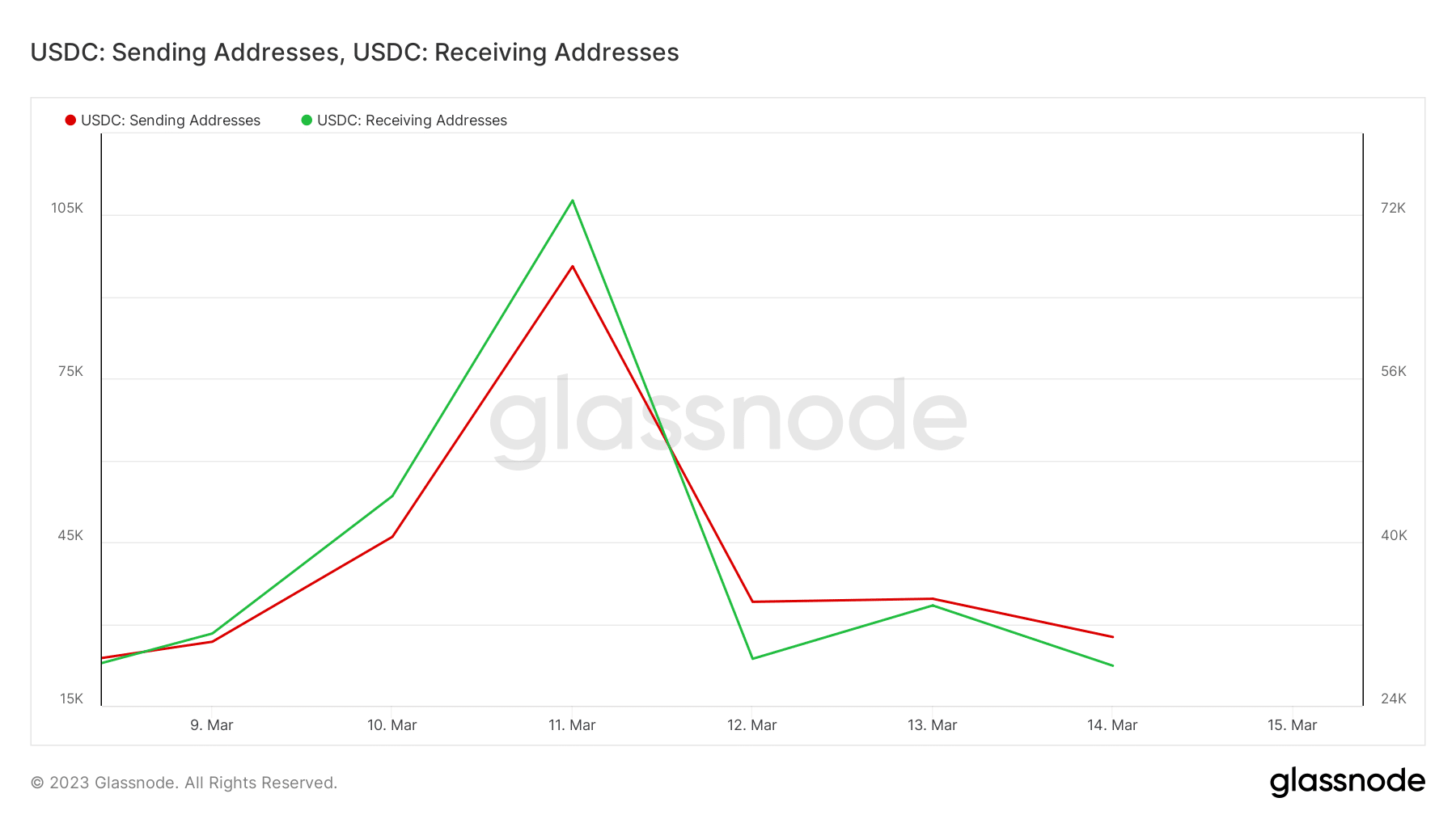

But what about actual market demand? Well, a look at address characteristics revealed that USDC receiving addresses were slightly higher than sending addresses. Another key observation is that both metrics dropped substantially since 11 March, as people moved to other stablecoins.

Source: Glassnode

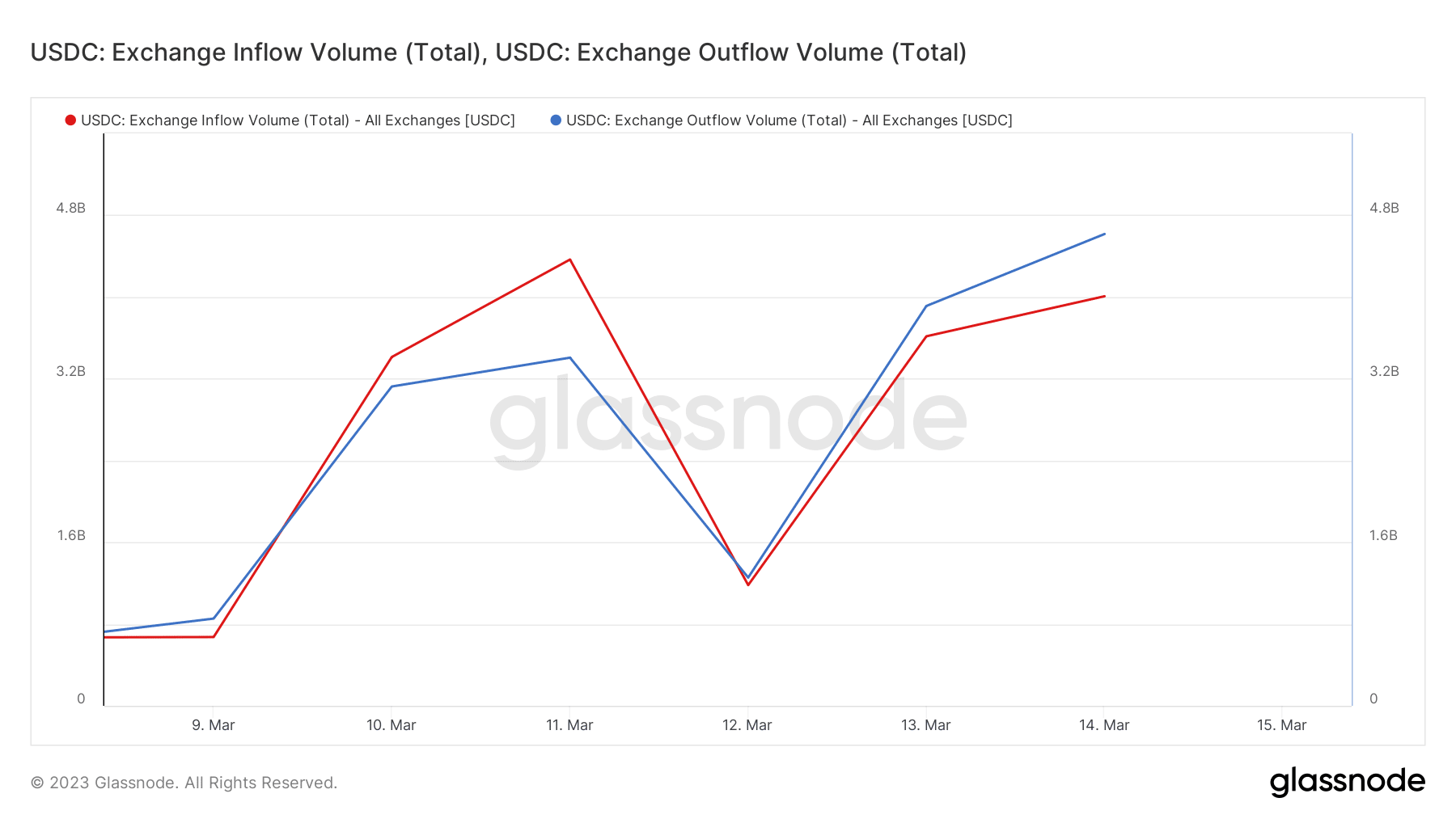

However, addresses began leveling out at press time, suggesting that USDC trading activity is recovering. This is evident in the stablecoin’s exchange flows. Both exchange inflows and outflows have been on the rise for the last three days after previously tanking because of the depeg.

Source: Glassnode

The exchange outflows remain higher than inflows, hence confirming that USDC is yet to regain full confidence. This may also be due to the recent crypto rally, which meant that investors have been buying crypto for stablecoins.

![Can Circle [USDC] turn things around with new plan? All you need to know](https://cryptoinvestornewsnetwork.com/wp-content/uploads/2023/03/glassnode-studio_usdc-sending-addresses-usdc-receiving-addresses-1024x576.png)