- Standard Chartered added another 20% increase to its previous Bitcoin prediction.

- On-chain data showed that BTC was closer to its bottom than the market top.

Like Clockwork, Bitcoin [BTC] has been subject to numerous price projections, with the latest coming from Standard Chartered, the prominent international financial institution. In a report shared by Reuters on 10 July, the bank declared a bullish forecast for Bitcoin, suggesting it could hit $50,000 by the end of 2023.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

However, the bone of contention, which had sparked debate around the crypto community, was the institution’s $120,000 prediction for 2024. Geoff Kendrick, Standard Chartered FX’s analyst, said that the decision to increase the projection by 20% was due to Bitcoin miners’ decisions.

BTC skyrockets and miners change

In defense of his opinion, Kendrick noted that BTC’s recent jump could force miners to hoard more of the Bitcoin supply. Usually, when this happens, the demand for Bitcoin increases, thereby leading to a rise in price.

Also, miners’ income will likely increase from transaction fees alone, rather than the combination of block rewards and transaction fees. Kendrick, who predicted a $100,000 hit in the same year earlier, said,

“Increased miner profitability per BTC (bitcoin) mined means they can sell less while maintaining cash inflows, reducing net BTC supply, and pushing BTC prices higher.”

In May, Bitcoin miners recorded a huge rise in fees generated. However, the condition at press time was not close to the hike mentioned. And according to Glassnode, miners’ fees have dropped to 1.66%.

This suggested that mining fees were going extinct because the king coin could reach its total supply of 21 million. And when this happens, as Kendrick pointed out, demand would soar, and the BTC price would skyrocket.

Close to the bottom

Kendrick also mentioned that miners’ approach to the market might change when the price hits $50,000. According to him, if the price hits the milestone, then miners, who have recently been selling 100% of their new coins, would reduce the rate of selling.

He said,

“If the price hits $50,000 though, they would probably only sell 20-30%.It is the equivalent of miners reducing the amount of bitcoins they sell per day to just 180-270 from 900 currently.Over a year, that would reduce miner selling from 328,500 to a range of 65,700-98,550 – a reduction in net BTC supply of roughly 250,000 bitcoins a year.”

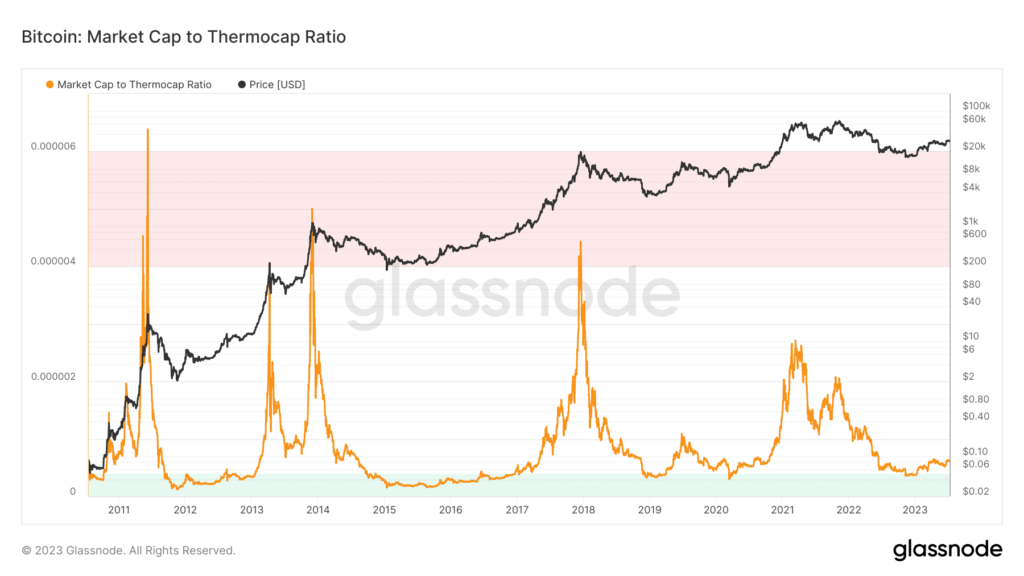

Perhaps it is necessary to evaluate the state of a few other metrics. In doing this, one of the go-to metrics is the Bitcoin Market Cap to Thermocap Ratio. Calculated as the ratio of adjusted supply to increasing supply, the Market Cap to Thermocap Ratio shows if BTC’s price is trading at a premium relative to the miners’ security spend.

At press time, the metric had mildly risen to 0.00000063. But it was still at a very low point. Historically, a high value of this metric hints at a BTC market top. So, the state at press time signals a local market bottom.

With whales continually accumulating, the Bitcoin Market Cap to Thermocap Ratio shows that the coin still has massive potential to rally. Nonetheless, this was no guarantee that the $50,000 or $120,000 prediction would be met.

Source: Glassnode

BTC price action

This year, BTC has shown signs of suppressing the expectation of bears. And on a Year-To-Date (YTD) basis, the coin has gained over 70%. On the technical side, BTC has experienced a significant amount of selling pressure lately.

Take, for instance, when the price hit $30,900 on 6 July, several participating used the opportunity to grab gains. This led to a plunge below $30,000. However, increased demand at $29,992 could neutralize sellers’ dominance and push the price back up.

Moreso, the Awesome Oscillator (AO) had increased was 218.85. This positive reading indicates that the fast moving average was much more than the slow-moving average. Hence, this indicates that the slight downtrend might not dominate for long.

![Bitcoin [BTC] Price Action](https://statics.ambcrypto.com/wp-content/uploads/2023/07/BTCUSD_2023-07-11_10-43-59.png)

Source: TradingView

Retail is also gearing up

In analyzing other on-chain data, Santiment showed that the supply distribution has been impressive. This was because whales were not the only ones involved in accumulation. Based on the balance of address of the 0 to 10 retail cohort, accumulation was also on the rise.

Usually, this suggests that market participants consider the BTC at $30,000 a good buying opportunity. So, the broader sentiment was that the coin price would not likely perform better than it was.

Source: Santiment

Additionally, the Market Value to Realized Value (MVRV) Z-Score was 0.70. Typically, the MVRV Z-Score evaluates if BTC is undervalued or overvalued. It does this by comparing the market value to realized value.

When it’s significantly higher, and in the red zone, the Z-Score indicates that a market top. But at the time of writing, the MVRV Z-Score was only a little above the green region.

Oftentimes, this suggests a significantly lower market value than the realized value. As such, Bitcoin’s value could be considered undervalued, and a significant rally could be possible in the long term.

Source: Glassnode

Realistic or not, here’s BTC’s market cap in ETH terms

In conclusion, the probability of Bitcoin hitting $120,000 in 2024 or $50,000 in 2023 is something that can be debated. But from the on-chain data analyzed, a rally remains visibly possible. But when exactly it’s going to happen cannot be determined.

Nonetheless, Standard Chartered’s prediction could have some historical backing. Apart from the miners’ action mentioned, BTC’s price usually skyrockets after each halving. So, this could be a point to look at.