Blockchain

Key Points:

The Layer 2 attack against ecosystems in general, and Ethereum in particular, is more intense than ever. Arbitrum has always been regarded as the top Layer 2 solution for Ethereum since its inception.

The project has aimed to give investors a network that is inexpensive, quick, and scalable, all of which Ethereum is currently suffering with despite its Merge update in September 2022.

As a result, developers have rushed to Arbitrum to create decentralized apps (dApps), and it is presently rated sixth in total value locked (TVL) by DeFi Llama.

There is currently anticipation that it will issue its own ARBI token, but users are waiting for the network confirmation.

Let’s look at Coincu and learn why it’s currently a Layer 2 stronghold that even Optimism can’t beat.

What is Arbitrum?

The Arbitrum network is a layer-2 feature created by the New York-based company Offchain Labs to alleviate the congestion on the Ethereum network by enhancing how smart contracts are verified.

The platform uses the Ethereum mainnet’s security but allows smart contracts to execute on a separate layer to alleviate network congestion.

This method is known as ‘transaction rollups,’ and it consists of batches of transactions and records that are validated on the lower layer before being sent to the mainnet of layer-1, in this case, the Ethereum mainnet.

Arbitrum intends to offer three scaling solutions: rollup (OPU), channels, and sidechains.

- State Channels: Users must transmit an Ethereum Snapshot into a Multi-sign Contract. This state will contain critical information such as the address’s balance. A system of this type enables free off-chain transactions with instant completion and greater privacy.

- Sidechains: Separate blockchains with their own independent consensus rules where Ethereum transactions may be routed and monitored to alleviate the load on the Ethereum mainnet.

- Rollups: like sophisticated non-custodial sidechains, can significantly increase the Ethereum mainnet’s throughput capacity. Optimistic Rollups, zkRollups, Plasma, and Validium are the four basic forms of rollups known so far in aggregation.

The Ethereum community is now focused on Arbitrum’s Rollup (OPU).

Arbitrum pays ETH to nodes who actively validate the chain’s smart contracts (known as aggregators), and they are in charge of adding blocks to the first tier – the Ethereum mainnet.

How does it work?

Arbtrium is a project that makes use of Optimistic Rollups technology.

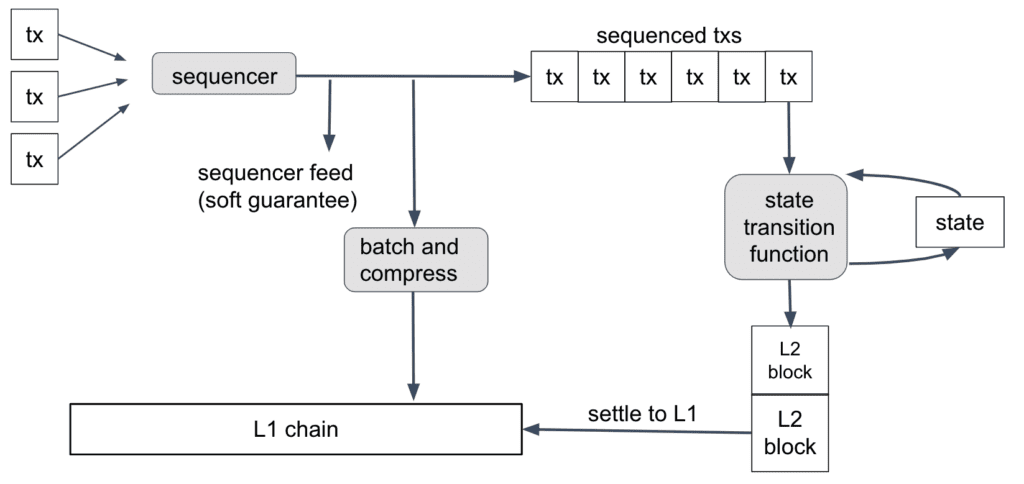

Rollups are a form of off-chain transaction processing that involves taking transactions produced on the main blockchain outside and processing them on a separate Rollups layer, after which the data and transactions are bundled or “rolled up” into a single block to transmit to Layer 2 for certification.

This solution enables Ethereum smart contracts to scale by exchanging messages between Ethereum smart contracts and layer 2 Arbitrum smart contracts. The bulk of transaction processing occurs on layer 2, with the results recorded on the main chain considerably enhancing speed and efficiency.

Arbitrum, like many other blockchains, allows independent nodes to participate. Validator nodes monitor the chain’s status, whereas full nodes aid in the aggregation of layer 1 transactions. When the rest of the user’s transaction fees are dispersed to other network participants, such as validators, aggregators that transmit transactions to layer 1 will get incentives paid in ETH.

Arbitrum adds a challenging stage for rollup blocks, allowing other validators to evaluate the accuracy of a block and issue a challenge if it is incorrect. If the block is proved to be erroneous or a challenge is proven to be unjustified, the dishonest validator’s stake will be taken, ensuring validators always play fairly or face the penalties.

The Arbitrum virtual machine (AVM) is the platform’s own unique virtual machine. This is the execution environment for Arbitrum smart contracts, and it is built on top of EthBridge, which is a collection of smart contracts that connect with Arbitrum. Smart contracts written in Ethereum are immediately translated to operate on the AVM.

Highlights of the project

Arbitrum’s “multi-round rollup” technique dramatically reduces the cost of Fraud Proofs. The project seeks a low-cost solution with a broad application (support for highly complex txns).

Completely compatible with the Ethereum virtual machine (EVM), expertise with smart contracts on L1, and compatibility with ETH tools. Arbitrum may also run EVM code directly, eliminating the need to recompile smart contracts.

Arbitrum also has a faster asset withdrawal time than other Rollup alternatives.

By developing a layer 2 solution, the Arbitrum development team is aiming to lower entry barriers. As a result, they have prepared extensive development documentation for Arbitrum, and developers may begin utilizing the current Ethereum tool.

Ecosystem

Tools

Many tools known to Ethereum developers, most of which are accessible on Arbitrum, have been integrated with featured platform projects.

Wallet

dApps

Bridge

Project development

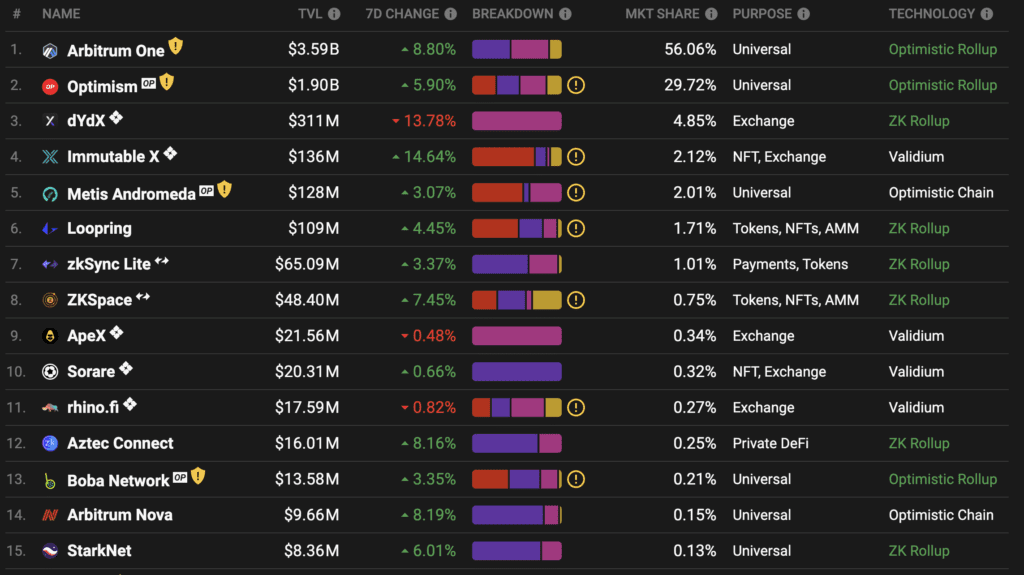

Arbitrum now ranks 1st among Ethereum’s layer-2s, with a total value of TVL keys in the protocol at roughly $3.6 billion. Significantly, TVL on Arbitrum outperforms Optimism, which is in second position.

The main reason for the large gap between the two projects might be due to retroactive. After the introduction of the token by Optimism, a flood of DeFi money returned to Arbitrum in quest of the next chance.

Apart from the reasons stated above, this ecosystem is also highly solid with a longer period to get into operation, and the pieces and items on Arbitrum are also quite diversified, assisting this layer-2 in attracting cash flow swiftly.

There are other exceptional Layer-2s scaling options for Ethereum, but at the time, Polygon is the only platform officially mainnet, and Ethereum’s severe congestion has placed Polygon in a stronger position than ever, which Polygon has also taken use of. But everything has changed now.

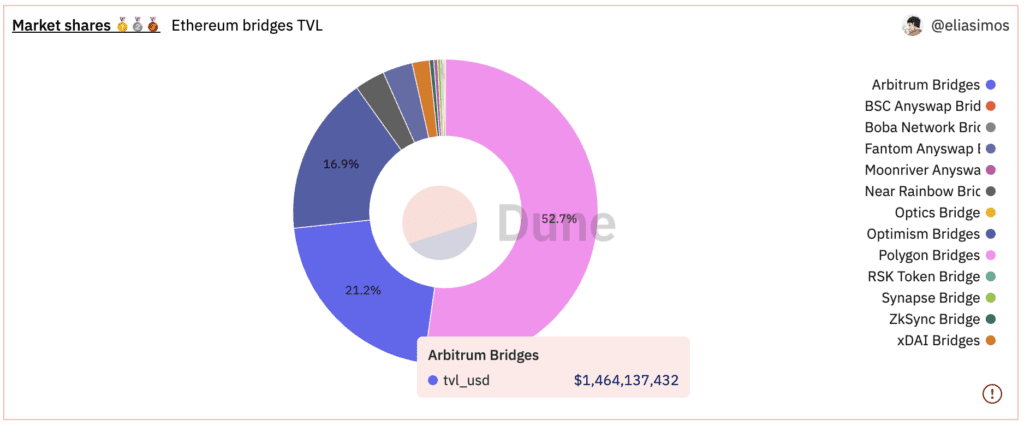

According to cash flow statistics between Ethereum and layer-2, Polygon now has the greatest market share with around 52.7%, followed by Arbitrum (21.2%) and Optimist (16.9%). As can be observed, the cash flow still favors Arbitrum above the other new Layer-2s.

Arbitrum’s backers include two industry leaders in venture capital: Coinbase Ventures and Pantera Capital. About the Ecosystem, the chain has a sufficient number of vital components. These are the factors driving its development.

Conclusion

Arbitrum is a promising proposal that might be realized in the near future. At the same time, the project has made its initial steps by collaborating with several significant industry partners to incorporate these projects into layer 2.

But, this project is currently a work in progress. The ecosystem has a number of fundamental components, however, they are merely folk versions with little investment in developing goods and consumers. Moreover, Arbitrum does not yet have its own project token. So it’s still new and has a lot of room to expand.