NFT

Borrowing Bored Apes and Doodles is booming.

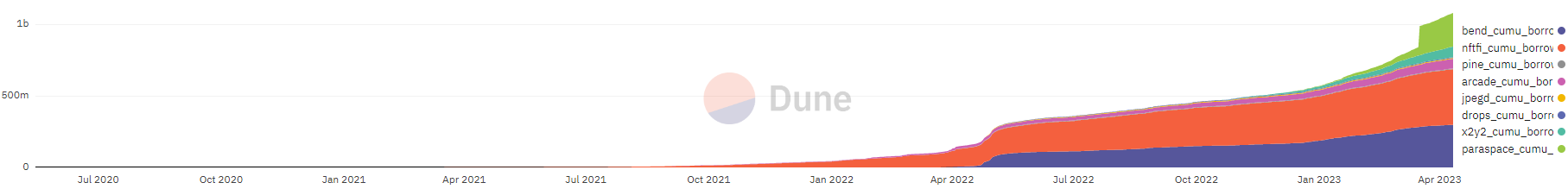

Per data pulled from Dune, the cumulative volume for borrowing against NFTs has just hit $1 billion.

This measures the dollar value of borrowing activity across several notable projects including market leading NFT liquidity providers NFTfi and BendDAO, but also newcomers like Paraspace.

As of April 6, NFTfi facilitated more than $390 million, BendDAO boasts nearly $298 million, and Paraspace has already hit $236 million. The number of cumulative users has also soared well above 40,000.

Cumulative borrow volume in dollars. Source: Dune.

Borrowing against your Bitcoin is one thing, but how has a market meant for borrowing jpegs found such traction?

“NFT holders are increasingly looking for ways to unlock the value of their assets without selling them, and lending and borrowing platforms like JPEG’d offer a solution to this need,” JPEG’d’s marketing and community lead Derrick Nguyen told Decrypt. “Additionally, decreased volatility has been another result of the NFT market maturing, which has made using NFTs as collateral more and more viable and attractive.”

Nguyen also cited the platform’s liquidation insurance, which lets users buy back their repo’d NFT from the JPEG’d DAO instead of being instantly resold on the secondary market.

Rival NFT liquidity provider NFTfi has its own unique liquidation mechanism that leverages its peer-to-peer design.

“The only way for borrowers to lose their collateral is failing to repay the loan upon loan maturity,” NFTfi’s CMO Andrej Skraba told Decrypt. “P2P lending allows for more tailored loan agreements between the borrower and the lender. This includes terms like interest rates, collateral, and loan duration, which can be negotiated (and renegotiated) on a case-by-case basis.”

BendDAO’s co-founder Crylipto called the business proposition “simple.”

“We just use lending and borrowing services to improve NFT asset liquidity,” they said. “When you hold an NFT, you don’t need to sell it, instead, you can use your NFT as collateral to borrow Ethereum for the liquidity demand.”

Borrowing Against a Bored Ape NFT—What Could Go Wrong?

How does NFT borrowing work?

The various NFT liquidity providers have minor differences in their respective offerings, but the basic premise is the same across the board: Squeezing liquidity out of illiquid jpegs.

JPEG’d, for example, lets users do precisely this, with a few extra bells and whistles.

For example, users who lock up an NFT in the platform’s vault can borrow up to 60% of the NFTs value in synthetic versions of Ethereum (pETH) or dollars (PUSd). These synthetic tokens can then be swapped out for bigger-brand stablecoins over on Curve, or continue to earn yield there too.

BendDAO lets users make down payments on specific blue-chip NFTs with a 40% minimum upfront and the rest is covered by a flash loan from Aave. In many ways, it resembles the financialization of the real estate market, with hopeful NFT owners taking out a digital mortgage to get their very own Bored Ape.

NFT Service JPEG’d Launching CryptoPunks Lending and Chainlink Integration

Likewise, Paraspace is building on the model but adding even more additional features, including letting users stake their APE tokens on the platform.

“With that collateral credit and capital expansion users are able to access even more liquidity, and we’re seeing a lot of of them actually leverage our Buy Now Pay Later feature on the platform to buy more NFTs,” a Paraspace representative told Decrypt.

Going beyond unicorn status

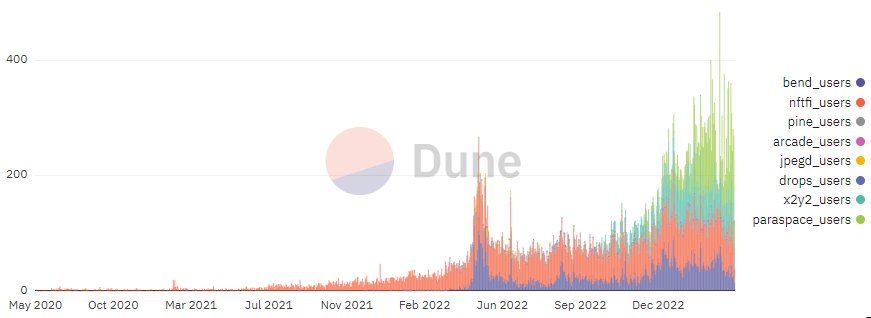

Cumulative volumes and users are all fine and dandy, but a closer look at the data shows it’s still fairly early days for borrowing against NFTs.

Per Dune data, the number of daily users across all platforms has only ever crossed 400 people twice. Daily borrow volumes are also quite low, with numbers rarely ever crossing more than $1 million per platform.

Daily users across NFT lending platforms. Image: Dune.

In terms of how the space will continue to grow, JPEG’d’s Nguyen said the “market must capitalize on the potential of NFTs as digitalized property rights and recognize that virtually anything can become an NFT.”

Others, like NFTfi’s Skraba, suggest that beyond building out the infrastructure needed to keep unlocking illiquid NFTs, the industry should also focus on “raising awareness” around these types of tools.

“At present, many digital asset holders are either unaware of the existence of credit markets or are unfamiliar with the various types of lending protocols available,” said the CMO. “As an industry, we still have much to accomplish in terms of educating the market and raising awareness. This increased understanding will pave the way for new NFT verticals and integration opportunities.”

OCTA: Things Are Melting Up Quietly

OCTA: Things Are Melting Up Quietly