A Bloomberg analyst is issuing a warning to traders, saying that Bitcoin (BTC) is winding up to make a big move.

Bloomberg Intelligence’s senior macro strategist Mike McGlone tells his 61,300 followers on the social media platform X that the king crypto is “coiled” up in between a narrow range and between major moving averages, suggesting volatility in the near future.

“Risks of short cleansing, the morning of Oct. 16.

Bitcoin’s narrowing $25,000-$29,000 cage; breakout ramifications –

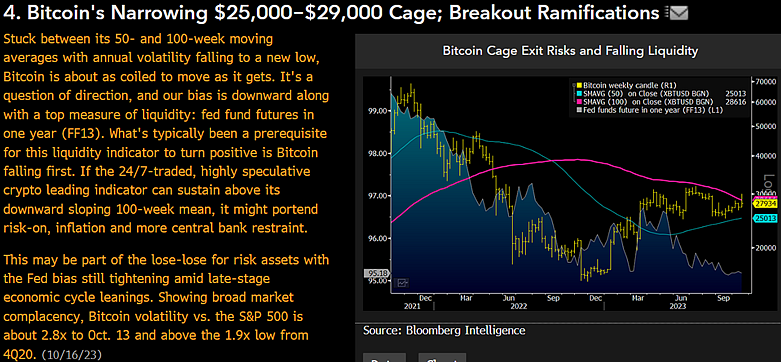

Stuck between its 50- and 100-week moving averages with annual volatility falling to a new low, Bitcoin is about as coiled to move as it gets.”

According to McGlone, BTC is bound for a major move – the only question is the direction. He says that BTC is more likely to collapse to the downside than to rally.

“It’s a question of direction, and my bias is downward along with a top measure of liquidity: Fed fund futures in one year…

What’s typically been a prerequisite for this liquidity indicator to turn positive is Bitcoin falling first. If the 24/7-traded, highly speculative crypto leading indicator can sustain above its downward sloping 100-week mean, it might portend risk-on, inflation and more central bank restraint.

This may be part of the lose-lose for risk assets with the Fed bias still tightening amid late-stage economic cycle leanings. Showing broad market complacency, Bitcoin volatility vs. the S&P 500 is about 2.8x to Oct. 13 and above the 1.9x low from Q4 2020.”

In a recent interview with crypto influencer Scott Melker, the strategist reiterates his position.

“Bitcoin goes up in the liquidity and does well when the stock market’s doing well and then it goes down the other way. So here’s what I think’s going to happen: they’re both going to go down.”

BTC is worth $28,475 at time of writing.

I

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney