- Bitcoin’s hashrate spiked at a time when miner revenue declined.

- Miners were selling BTC, but buying sentiment was dominant in the broader market.

With only a few months remaining until the fourth Bitcoin [BTC] halving, the mining ecosystem has been acting in an interesting manner.

On one hand, the blockchain’s hashrate spiked substantially, indicating an influx of miners. On the other hand, miners were continuing to sell their BTC holdings.

A look at Bitcoin’s mining sector

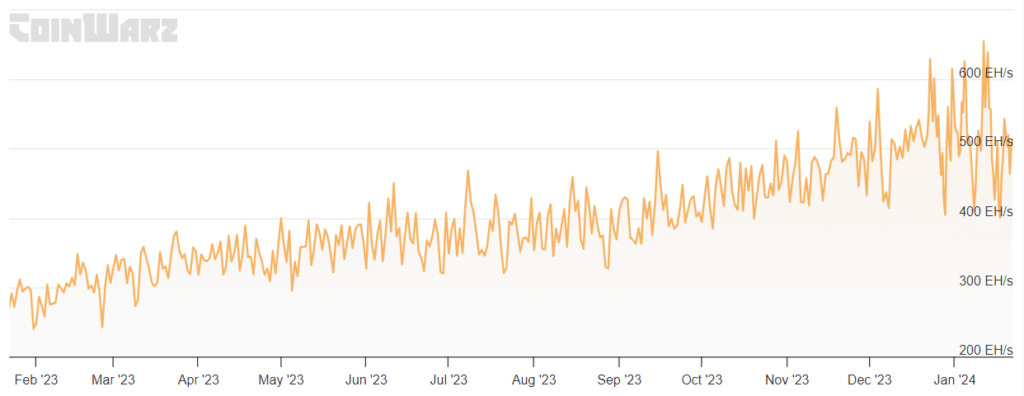

The latest data revealed that Bitcoin’s hashrate has gained upward momentum over the last few months. It also managed to reach an all-time high of over 655 exahashes in the recent past.

As per Coinwarz, at the time of writing, BTC’s hashrate stood at 529.99 EH/s.

Source: Coinwarz

Thanks to the rise in hashrate, the blockchain’s mining difficulty also increased during the same period. At press time, BTC had a mining difficulty of 70.34 T.

A possible reason behind the surge in these metrics could be the upcoming halving, which is scheduled to happen in April 2024.

Since the halving will reduce miners’ rewards to half, the miners might have been entering the market to earn more rewards before the event took place.

Another reason could be a rise in miners’ revenue, which could have lured more miners into the network. However, that did not seem to be the case.

AMBCrypto’s look at Glassnode’s data revealed that miners’ revenue was actually on a declining trend over the past few weeks.

Source: Glassnode

Are miners selling Bitcoin?

Though there has been an influx of new miners, it was surprising to see that they were selling their Bitcoin holdings.

Our analysis revealed that BTC’s miners’ net position change remained throughout the last month, indicating high sell-offs. An increase in selling pressure from miners could hurt the price of the king coin.

Source: Glassnode

Though miners continued to sell, it was not the dominant sentiment in the market. AMBCrypto’s look at Santiment’s chart pointed out that BTC’s Supply on Exchanges has fallen sharply.

This happened simultaneously with a rise in Bitcoin’s Supply outside of Exchanges, clearly indicating a rise in buying pressure.

An uptick in buying pressure usually means that investors were confident in BTC and expect its price to rally over the weeks to follow.

Source: Santiment

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, the derivatives market statistics paint a different picture. For example, BTC’s taker buy/sell ratio remained red. This suggested that selling sentiment was dominant in the futures market.

At the time of writing, BTC was trading at $41,076.50, with a market capitalization of over $805 billion.

Source: CryptoQuant