- Establishing how the Russia-Ukraine war has impacted Bitcoin.

- Bitcoin bulls give way to the bears after critical support range.

Bitcoin [BTC] bulls have been called into question despite the rally they have delivered so far this year. There are multiple reasons why many analysts expect prices to remain suppressed, and one of them is the ongoing conflict between Russia and Ukraine.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Bitcoin was initially on a healthy uptick before the war started having a negative impact, especially in the form of inflation. This was because of unstable conditions caused by such conflicts discourage investment.

On the other hand, Bitcoin turned out to be more useful to those affected, whether in Ukraine or Russia, as it became one of the most accessible forms of money. However, the risk of another major retracement will remain.

Will an extended war trigger more pressure for Bitcoin?

The conflict in Ukraine does not have a direct correlation with Bitcoin. It is just one of the indirect factors that has contributed to inflation and disruption in the global economy. Meanwhile, the Federal Reserve is slowing its quantitative tightening measures which have been sucking the liquidity out of the markets. This is a major reason why Bitcoin fell in 2022, and why there has been some recovery with dropped interest rates.

What does this all mean for Bitcoin in the short run? Well, there is still room for the Fed to raise rates higher to hit its target rate by June. The next FOMC meeting is still a few weeks out, but there are some significant outflows.

📊 Daily On-Chain Exchange Flow#Bitcoin $BTC

➡️ $682.1M in

⬅️ $778.2M out

📉 Net flow: -$96.1M#Ethereum $ETH

➡️ $415.4M in

⬅️ $411.9M out

📈 Net flow: +$3.5M#Tether (ERC20) $USDT

➡️ $686.2M in

⬅️ $670.0M out

📈 Net flow: +$16.2Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) February 22, 2023

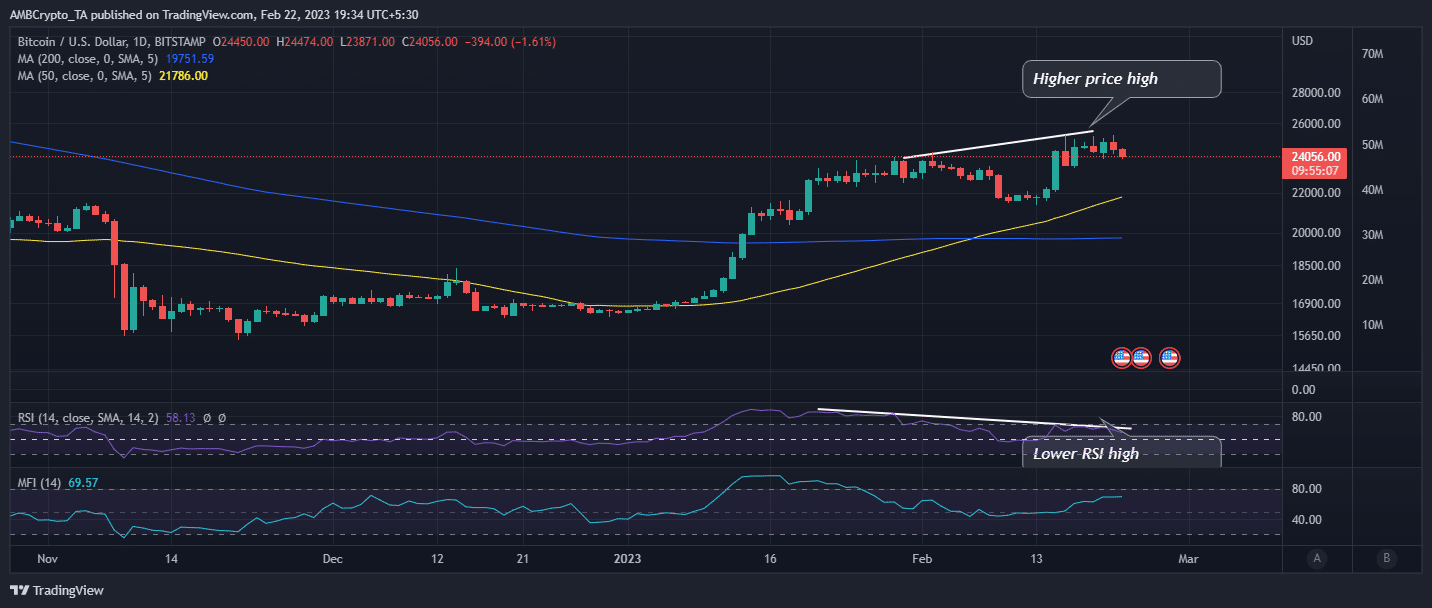

BTC recently tested a key resistance level at $25,000, triggering some sell pressure. This was exasperated by a price-RSI divergence. The events confirmed a trend weakness in the latest price rally and coincided with the expectation of sell pressure at the resistance level.

Source: TradingView

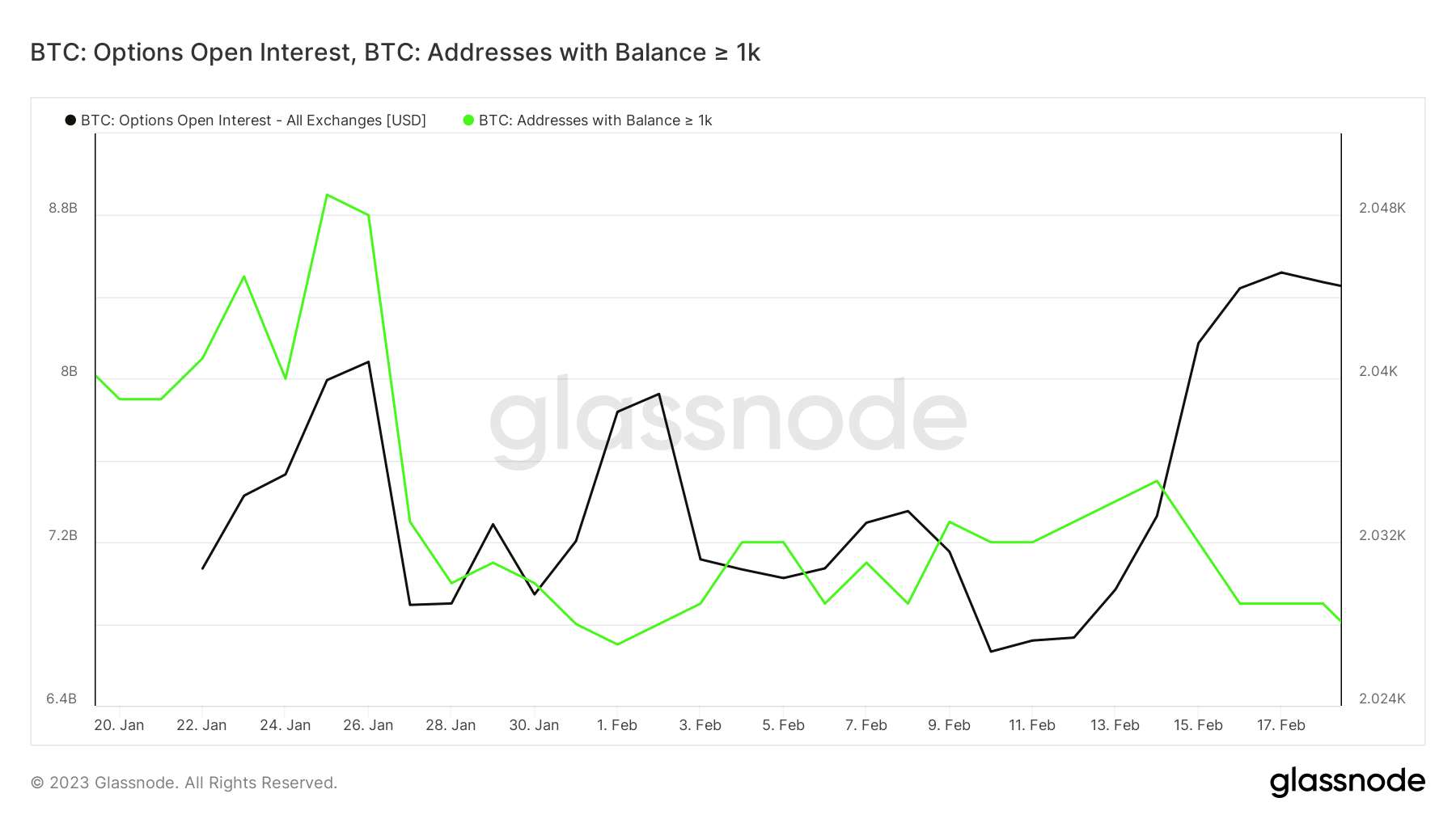

Despite this impact, the MFI indicated that there was little relative sell pressure taking place at press time. This explained why the prevailing sell pressure is limited. A brief look at whale activity confirmed an overall bearish sentiment in the market. Addresses holding over 1,000 BTC have been selling since mid-February.

Source: Glassnode

How much are 1,10,100 BTCs worth today?

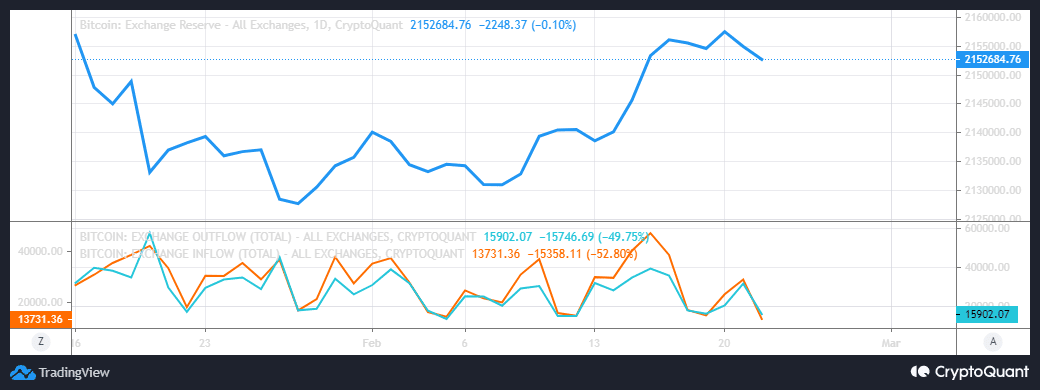

The derivatives segment aligned with this view, considering that options Open Interest plateaued. Bitcoin exchange reserves have increased significantly in the last two weeks as investors moved funds to exchanges. This also reflected in the slowing momentum in the recent bull run.

Source: CryptoQuant

Higher exchange reserves often underscore an increase in sell pressure. There has been a drop in both exchange outflows and inflows in the last 24 hours until press time. However, inflows remained slightly higher than outflows, hence the bearish outcome.

![Bitcoin’s [BTC] recovery in question as Russia-Ukraine conflict anniversary nears](https://cryptoinvestornewsnetwork.com/wp-content/uploads/2023/02/BTCUSD_2023-02-22_17-04-53-1024x435.png)