– BTC had formed a fulcrum bottom, and this could trigger a breakout

– Some traders still held short positions despite an on-chain signal supporting a bull return

Veteran digital asset trader Peter Brandt opined that Bitcoin [BTC] traders should go long as the coin hovers around $30,000. In the tweet where he suggested the same position for NASDAQ and Gold, the analyst explained his rationale for the stance. According to Brandt, BTC had formed walls around the fulcrum bottom.

Heading to MN for the summer. Current Factor LLC positions with trailing stops

Long Nasdaq $NQ_F

Long Gold vs. YPY $GC_F $G6J_F

Long Bitcoin $BTC

Long Gold $GC_F

Long London Cocoa (not shown) $LCC_F pic.twitter.com/FH2o0LxZEz— Peter Brandt (@PeterLBrandt) April 13, 2023

Is your portfolio green? Check the Bitcoin Profit Calculator

Is BTC about to explode?

A fulcrum bottom occurs when a market forms an H and S pattern. In this “congestion area”, there are repeated tests of consolidation and flat sideways activity. Although this is a usually rare event, it serves as a signal for a breakout or substantial high returns.

Irrespective of the aforementioned perspective, Bitcoin has been able to register a 10.71% increase in the last seven days. However, there have been suggestions that the coin might cease its bullish outlook despite the current positive sentiment.

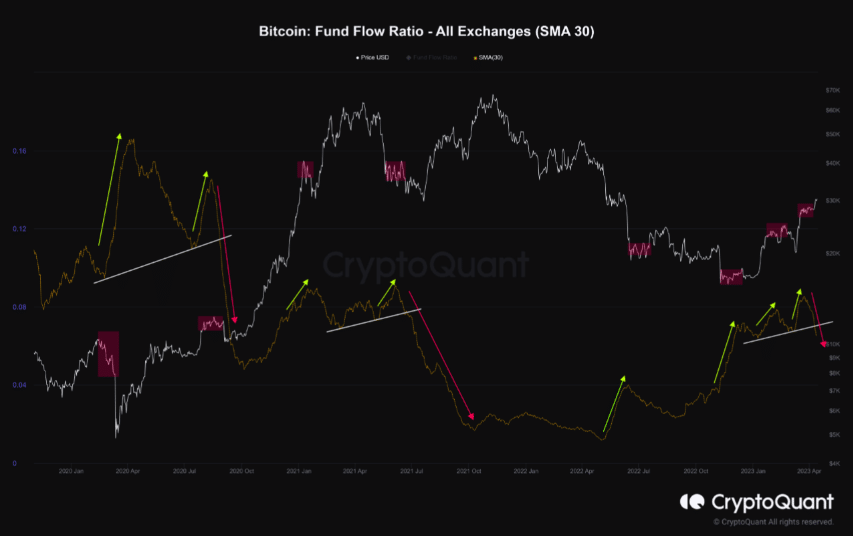

But CryptoQuant analyst JAYBOT mentioned that a noteworthy retracement might not arise soon. The analyst based his publication on happening in the on-chain arena. Using the fund flow ratio as a backing point, JAYBOTpointed out that there was a decrease in whale selling pressure.

![Bitcoin [BTC] fund flow ratio](https://statics.ambcrypto.com/wp-content/uploads/2023/04/Screenshot-2023-04-14-at-13.05.55.png)

Source: CryptoQuant

The fund flow ratio is the ratio of coins involving the exchange transfers to the overall transfer within the Bitcoin network. A high value of this metric indicated a lot of exchange activity. Low values, on the other hand, suggest a possible resolution to HODL.

At press time, the fund flow had decreased. The analyst also pointed out that the current circumstances were similar to the cycles when the bull market began when compared with the 30-day Moving Average (MA). JAYBOT wrote,

“In comparison to the past, when 30MA of the fund flow ratio breaks out of the uptrend, a bull market for Bitcoin has begun. The current section also looks like that.”

Taking on the long call

Despite the suggestion earlier started, traders have been torn between opening BTC shorts and longs. In actual fact, longs accounted for 50.19% while shorts went through with 49.81%. At the time of writing, the condition left the BTC long/short ratio at 1.01. The metric calculates the number of traders’ buying volume and selling volume.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

When the long/short ratio is high, it indicates a bullish sentiment as more long positions have been opened. In situations when it is low, it means that there are more short contracts than longs.

![Bitcoin [BTC] long/short ratio](https://statics.ambcrypto.com/wp-content/uploads/2023/04/bybt_chart-6-1.png)

Source: Coinglass

But since the ratio was slightly above 1, it suggested that more traders have positive expectations. For the time being, BTC was edging closer to $31,000.