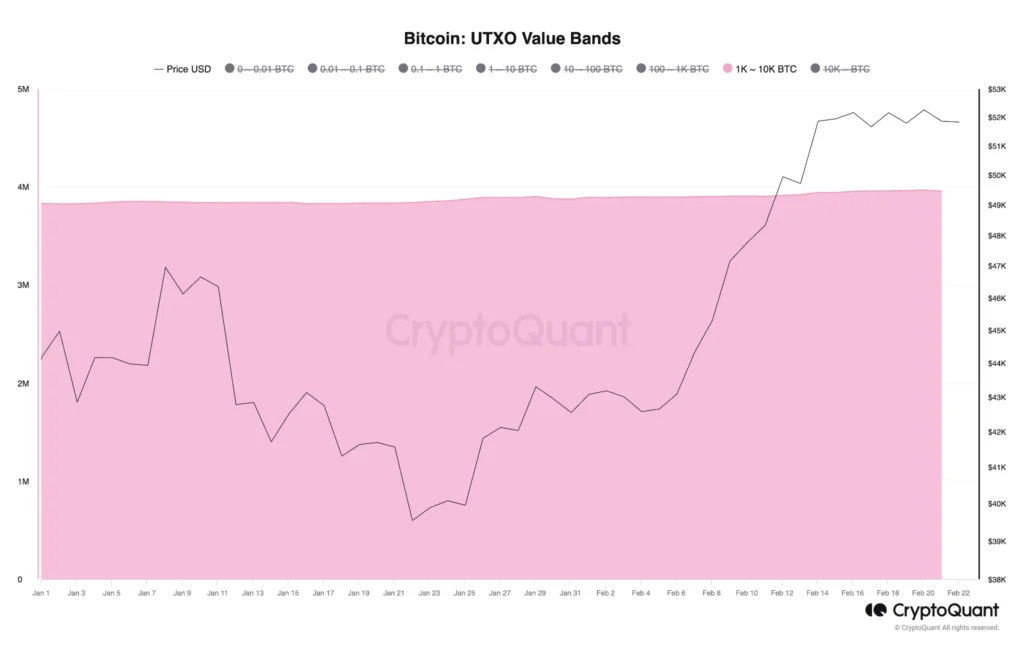

- The UTXO, which ranges from 1,000 to 10,000 Bitcoins, has grown since the beginning of February.

- Bitcoin’s Coinbase and Korean Premium Indexes have both increased during that period.

According to data from CryptoQuant, there has been a spike in the number of Unspent Transaction Outputs (UTXOs) ranging from 1,000 to 10,000 Bitcoins [BTC] since the beginning of February.

BTC UTXO is a metric that tracks the amount of the cryptocurrency in a wallet address left untouched after a transaction is completed.

According to the on-chain data provider, since the 1st of February, the UTXO of coin holders that hold between 1,000 to 10,000 BTC has climbed by 2%.

Source: CryptoQuant

Generally, when this UTXO spike occurs alongside a rally in price, it often suggests a surge in accumulation by institutional investors. It also implies that BTC whales may be acquiring large amounts of the leading coin and dividing them into smaller UTXOs for storage or further investment.

Commenting on the significance of the recent hike in UTXO ranging from 1,000 to 10,000 BTC, pseudonymous CryptoQuant analyst Crypto Dan said:

“These amounts are more likely to be related by whales or institutional investors rather than individuals, and particularly since the recent approval of Bitcoin spot ETFs, they have been increasing sharply.”

Institutional investors increase their presence

According to Dan, while the recent hike in UTXO for the BTC value band under consideration is “not yet as significant as the latter part of the bull market in 2021,” it still depicts an influx of institutional liquidity into the market.

AMBCrypto confirmed this by assessing the coin’s Coinbase Premium Index (CPI). This metric tracks the difference between BTC prices on Coinbase and Binance. When the asset’s CPI value is positive and in an uptrend, it indicates strong buying pressure among US-based institutional investors on Coinbase.

According to data from CryptoQuant, BTC’s CPI has rested above the zero line since the beginning of February. It even climbed to a year-to-date high of 0.122 on the 14th of February, signaling the hike in the presence of institutional investors in the market on that day.

Although approaching the center line at press time, BTC’s CPI maintained a positive value of 0.004.

Source: Cryptoquant

In comparison, while BTC’s CPI has trended downward since its 14th of February peak, the coin’s Korean Premium Index (KPI), which tracks the price gap between South Korean exchanges and other exchanges, has rallied significantly in the past few weeks.

When BTC’s KPI climbs in this manner, it indicates a surge in buying pressure among Korean retail investors.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

However, while this increased market participation has resulted in a 25% jump in BTC’s value in the last month, analyst Dan warns:

“Generally, in bull markets, after a significant influx of institutional investors, new individual investors enter the market, marking the end of the bull run.”